Case Summary: United Site Services Chapter 11

United Site Services has filed for a prepackaged Chapter 11 bankruptcy to eliminate $2.4 billion in debt and hand control to its lenders, citing a severe downturn in the construction sector that undermined a previous out-of-court rescue attempt.

Business Description

Headquartered in Westborough, MA, United Site Services, Inc., along with its Debtor⁽¹⁾ affiliates (collectively, "USS" or the "Company"), is the largest provider of portable sanitation and related site services in the United States. USS serves over 70,000 customers nationwide, supported by a workforce of more than 3,000 employees.

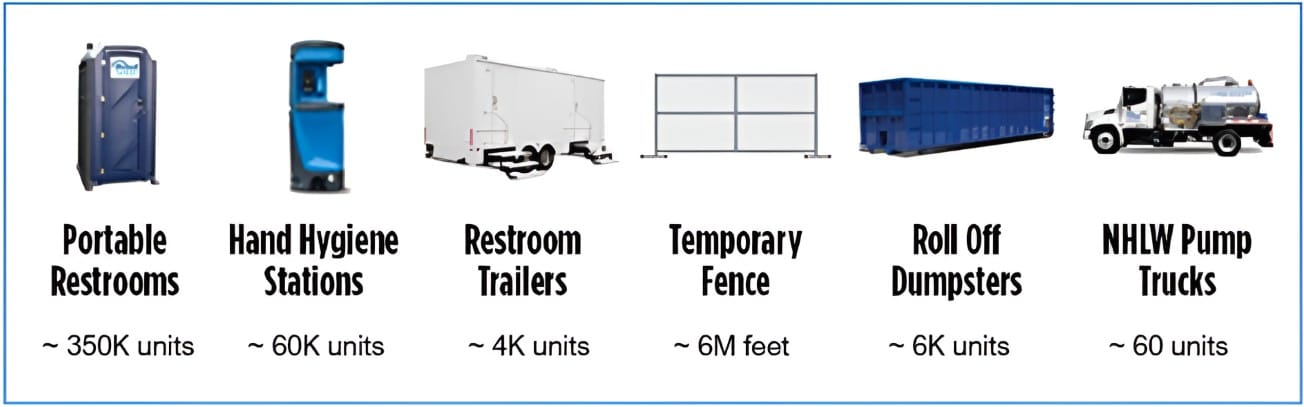

- The Company's core business revolves around the rental and servicing of portable restrooms and hand hygiene stations.

- USS owns a fleet of approximately 350,000 portable restroom units, ranging from standard single-user porta potties to upscale restroom trailers equipped with running water and electricity.

USS delivers regular cleaning, waste pumping, restocking, and maintenance services, emphasizing high standards of sanitation. The construction sector accounts for approximately 70% of USS's total revenue, with remaining revenue derived from special events (major sports games, concerts, festivals), industrial projects, agricultural work, and government sectors.

Complementary Site Services

Beyond its core sanitation offerings, USS functions as a one-stop shop by providing a broad suite of site services that complement temporary needs:

- Temporary Infrastructure: Installation of temporary fencing and barricades for perimeter security and crowd control.

- Waste and Storage: Provision of roll-off dumpsters and mobile storage containers for job site cleanup and material management.

- Power Solutions: Rental of temporary power equipment, including generators and portable lighting.

- Specialized Waste Removal: High-volume pumping and hauling of non-hazardous liquid waste, such as landfill leachate or grease trap waste, ensuring safe transport and disposal in compliance with environmental regulations.

This integrated service offering allows USS to respond at scale, often providing rapid-response sanitation, waste removal, and fencing to support relief efforts for natural disasters and emergencies (counting FEMA as a major customer).

United Site Services, Inc. and certain affiliates filed for Chapter 11 protection on December 29, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the District of New Jersey, reporting $1 billion to $10 billion in both assets and liabilities.

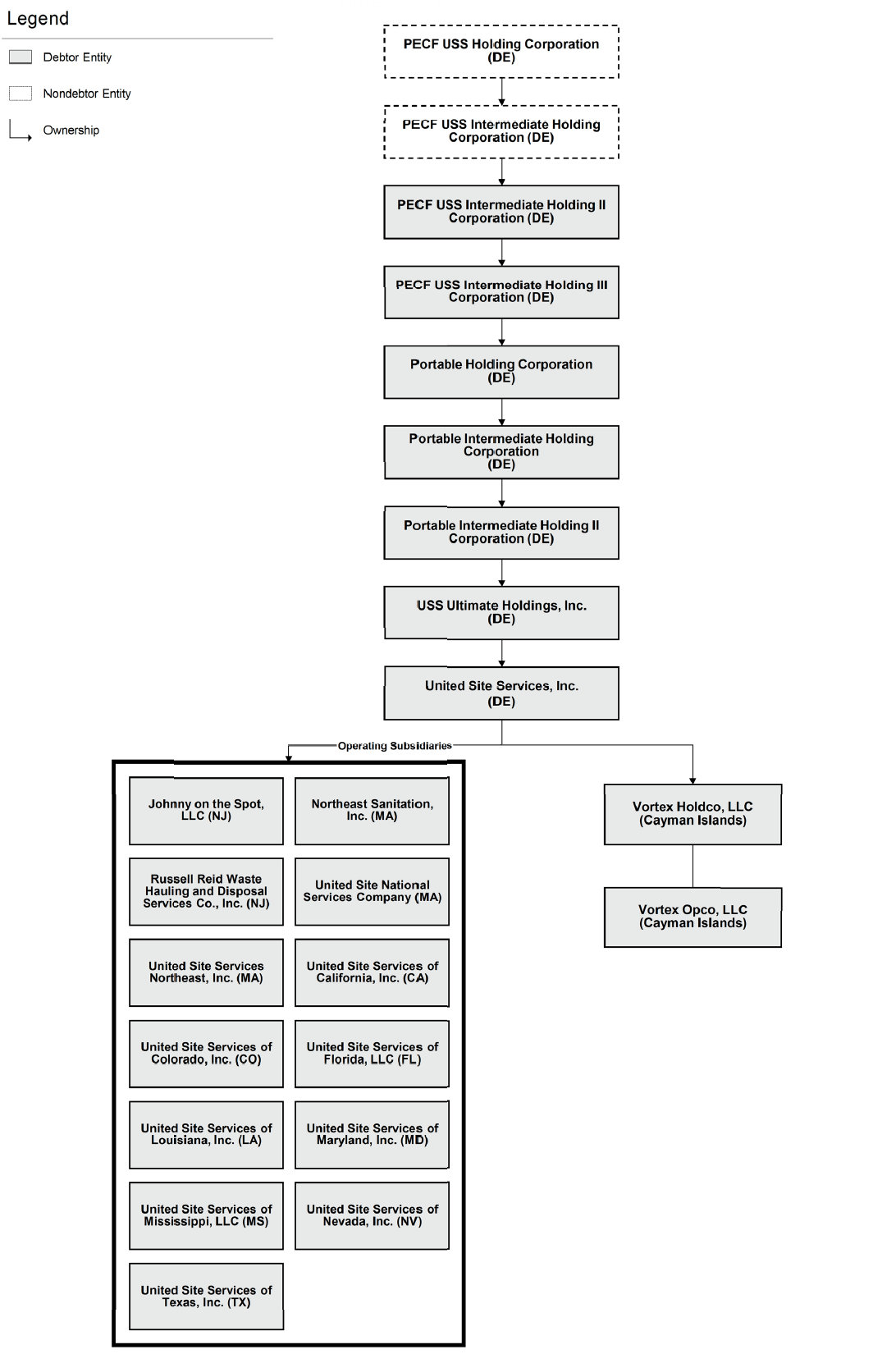

⁽¹⁾ For a complete list of Debtor entities, see organizational structure chart below.

Corporate History

USS began in 2000 as a regional portable sanitation business, initiated through the acquisition of a single Massachusetts provider (Handy House). The Company immediately pursued an aggressive "roll-up" growth strategy, consolidating the highly fragmented industry through M&A.

- By 2010, USS had completed approximately 80 acquisitions, expanding its offerings to include temporary fencing, roll-off dumpsters, and liquid waste services.

- By 2017, the Company’s acquisition count totaled 134, though many acquired branches still operated on disparate systems prior to major integration efforts.

Private Equity Sponsorship and Transformation

The Company’s ownership transitioned through several private equity firms as it scaled:

- Calera Capital (2014–2017): Calera acquired a majority stake, helping USS grow into a truly national platform with over 80 branch locations and the largest fleet of portable sanitation equipment in the country.

- Platinum Equity (Acquisition 2017): Platinum Equity purchased USS from Calera Capital in August 2017. Platinum launched a comprehensive transformation program focused on standardizing processes, investing in technology, and bolstering sales to large national accounts.

- Growth Under Platinum: Platinum oversaw 36 add-on acquisitions post-2017. This effort tripled USS’s EBITDA soon after the acquisition and resulted in doubling revenue and tripling EBITDA again by 2021. By 2019, the geographic footprint had expanded to over 100 branch locations nationwide.

Leadership and Capital Structure Evolution

In early 2019, Platinum installed new executive leadership at USS to guide growth, appointing Asterios Satrazemis as CEO and Scott Jamroz as CFO, succeeding long-time CEO Ron Carapezzi.

- USS operates with PECF USS Holding Corporation as the ultimate parent company, with various intermediate holding companies and regional operating subsidiaries organized below the main operating entity, United Site Services, Inc.

- In 2021, Platinum moved USS into a continuation fund—a single-asset secondary transaction—to extend its investment horizon. This initiative brought in new institutional minority equity holders, including funds managed by Fortress, Ares (via Landmark Partners), and Blackstone, alongside Platinum.

This decades-long corporate evolution established USS as the clear market leader, though characterized by a highly leveraged capital structure by the mid-2020s.

Corporate Organizational Structure

Operations Overview

USS operates a decentralized, hub-and-spoke branch model across the country, utilizing a network of over 100 local branch facilities in all key markets. Each branch facility includes a small office, maintenance bay, and fenced yard for equipment storage. Branch operations are managed by local teams, with frontline service technicians dispatched daily from their home branch.

- Neighboring branches are often grouped under regional managers to facilitate efficient resource sharing (equipment and personnel) to meet surges in demand.

Route-Based Service and Waste Management

The Company’s core sanitation service is managed through a specialized route-based model:

- Standard portable toilets and hand-wash stations are typically serviced at least twice per week.

- Service includes pumping out waste, cleaning and sanitizing units, restocking supplies, and performing necessary maintenance.

- All waste is transported and disposed of in compliance with environmental regulations, either offloaded directly into municipal sewage lines or hauled to approved treatment facilities.

The Company has invested in operational improvements, including centralized billing systems and better routing software, which led to lower incident rates and fewer service errors.

Customer Focus and Deployment Capabilities

USS leverages its dense network to maintain an edge in the construction sector, its largest segment (70%+ of revenue), where reliable, frequent service is essential due to heavy usage.

- Special Events: USS works closely with event organizers for music festivals, sporting events, and public gatherings to plan unit placement and ensure clean, accessible facilities, often supplementing with temporary fencing and portable power.

- Emergency Services: The operational footprint allows USS to mobilize nationwide rapidly. The Company is frequently contracted by government agencies or relief organizations (like FEMA) to provide sanitation and waste removal services in disaster-stricken areas.

Fleet Management and Critical Supply Chain

USS manages a substantial fleet of service trucks and vacuum tankers, relying on a small number of fleet management and leasing partners for hundreds of vehicles and maintenance support.

- The physical equipment (plastic toilet units, restroom trailer units, chemicals, paper products) is sourced from a minimal number of key suppliers.

- Concentrating volume with a few vendors helps control quality and cost. To preserve vital relationships, USS classified trade creditors for fuel, chemicals, and vehicle parts as operationally critical and planned to keep them unimpaired through the reorganization.

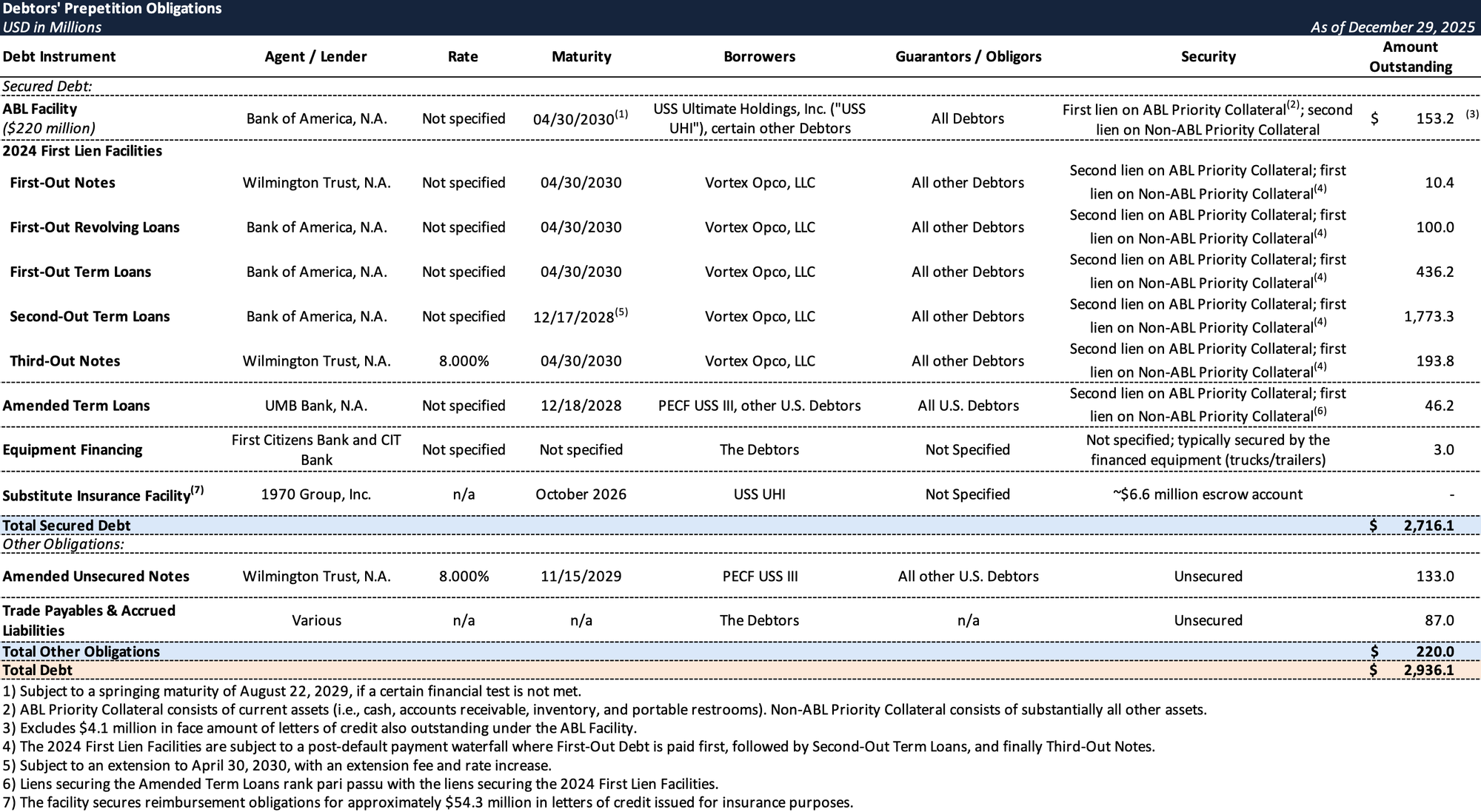

Prepetition Obligations

2024 Recapitalization

On August 22, 2024 (with a follow-on participation phase in September 2024), USS completed an out-of-court recapitalization that created the current secured debt stack.

- Existing Amended Term Loans and Amended Unsecured Notes were exchanged into the 2024 First Lien Facilities—including $300 million of new-money First-Out Term Loans, ~$1.795 billion of Second-Out Term Loans (with ~$46 million of legacy term loans remaining), and First-Out/Third-Out debt issued in exchange for ~$417 million of unsecured notes (with ~$133 million of unsecured notes remaining).

- The revolving facilities were also reset into the First-Out Revolver and the ABL Facility, and maturities were generally extended to 2030 (with the Second-Out maturing in December 2028).

Intercompany Credit Agreement Loans

In connection with the 2024 Recapitalization, Vortex Opco, LLC (the "Vortex Borrower") extended approximately $2.436 billion of intercompany term loans (the “Intercompany Credit Agreement Loans”) to PECF USS III under the credit agreement dated August 22, 2024, with Wilmington FSB acting as administrative and collateral agent. All Debtors (other than Vortex Borrower) are borrowers or guarantors under the Intercompany Credit Agreement Loans.

- As of the Petition Date, approximately $2.514 billion was outstanding, with a scheduled maturity of April 30, 2030.

- Under the RSA/Plan settlements, the Ad Hoc Group agreed that holders of claims under the 2024 First Lien Facilities will not receive Plan recoveries on account of their claims at Vortex Borrower to the extent such recoveries would be tied to distributions Vortex Borrower receives on account of the Intercompany Credit Agreement Loans.

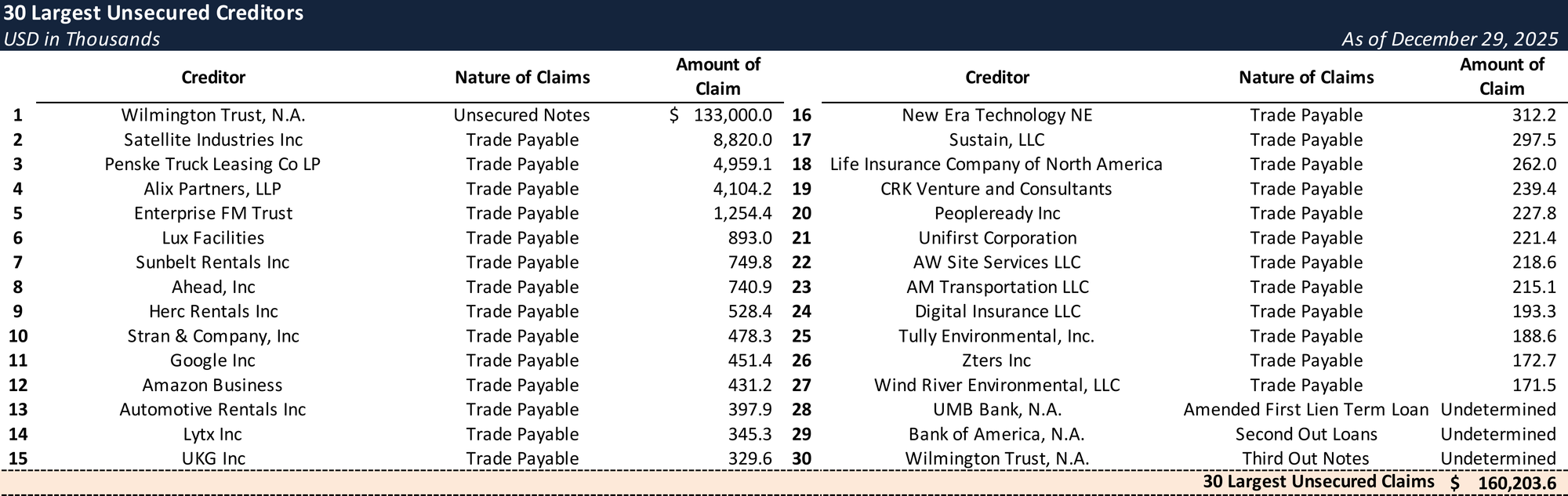

Top Unsecured Claims

Events Leading to Bankruptcy

After years of debt-fueled expansion and growth, USS began facing severe financial and commercial challenges starting in 2022, primarily driven by a highly leveraged capital structure, macroeconomic headwinds, and a construction sector downturn.

Macroeconomic Headwinds and Operational Deterioration (2022–2023)

- Cost Inflation: Inflationary pressures and supply chain disruptions drove up operating costs (fuel, vehicle maintenance, labor), severely squeezing profit margins.

- Interest Expense Surge: The sharp increase in floating interest rates significantly raised the debt service costs on USS’s massive debt load (approximately $2.8 billion).

- Market Softness: The construction sector downturn in key regions—including the San Francisco Bay Area, which saw housing construction permits drop by 50% in 2022—directly impacted top-line revenue. Stagnant demand reduced route density, causing fixed costs to weigh heavily on the balance sheet.

- Credit Deterioration: By late 2023, the Company’s financial performance and liquidity had declined markedly, prompting S&P Global Ratings to downgrade USS’s issuer credit rating one notch to “CCC,” citing expectations that credit metrics would remain unsustainably weak.

- S&P attributed the pressure to lower earnings and the full-year impact of higher interest expense, which it expected would drive moderately negative free cash flow in 2023, while noting it believed USS’s liquidity remained sufficient to make interest payments.

The Failed 2024 Out-of-Court Recapitalization

Facing tight cash flow and the danger of default, the Company engaged restructuring advisors (PJT Partners and Milbank LLP) in early 2024 to explore alternatives. Management also engaged Alvarez & Marsal to assist with cash forecasting and turnaround efforts.

- Bridge Financing: To address a projected near-term liquidity need ahead of finalizing the 2024 Recapitalization, Sponsor Platinum Equity provided a $50 million bridge facility on borrower-favorable terms (11% interest, no OID/fees, no covenant tightening), secured by a ring-fenced collateral package consisting of USS’s plastic toilet units held in a newly formed subsidiary and leased back to USS.

- The bridge facility was initially structured as a $30 million funded term loan plus a $20 million delayed-draw tranche, and was later amended to increase the delayed-draw to $30 million and extend the maturity from three months to four months (to end of August 2024). The upsized delayed-draw tranche was drawn on July 25, 2024.

- Consensual Exchange: By July 2024, USS and the 2024 Ad Hoc Group agreed to the recapitalization on a largely consensual basis, with support from holders of over 97% of the pre-transaction Amended Term Loans, over 75% of the Amended Unsecured Notes, and 100% of the ABL and pre-transaction revolver. The transaction closed in two phases in August 2024 and September 2024.

- Recap Outcomes: The transaction delivered a $300 million new-money injection via First-Out Term Loans, captured over $200 million of discount on exchanged debt, and extended maturities into 2030 (with certain tranches subject to conditions / extension mechanics). Platinum’s bridge facility was repaid in full at the first-phase close.

- Holdout Creditor: The only notable holdout from the 2024 Recapitalization was CastleKnight Management LP, which declined to exchange its pre-transaction holdings.

- According to the Debtors, CastleKnight holds both secured and unsecured debt and is understood to be the largest holder of the Amended Term Loans, Third-Out Notes, and Amended Unsecured Notes.

Continued Deterioration and Need for Deeper Deleveraging

The market failed to rebound in late 2024 and worsened in 2025, undercutting the gains of the recapitalization.

- Construction activity stalled and declined; multi-family housing completions in major markets fell approximately 29% year-over-year through 2025, and non-residential construction also softened.

- Revenues remained under pressure, never reaching levels assumed in the 2024 business plan. High interest costs continued to drain cash.

- USS concluded by mid-2025 that the Company remained fundamentally over-leveraged and required a more dramatic balance sheet restructuring, specifically a debt-for-equity swap, necessitating an in-court process.

Forbearance and Prepackaged Filing

In the second half of 2025, an Ad Hoc Group (representing the vast majority of USS’s secured debt) engaged Akin Gump and Centerview Partners for restructuring negotiations.

- Forbearance: On September 30, 2025, requisite lenders under the First-Out/Second-Out and ABL facilities entered into forbearance agreements tied to certain defaults, including missed Second-Out principal and First-Out/Second-Out interest payments due that day; the forbearance was extended while negotiations continued.

- Negotiations with Holdout: USS engaged CastleKnight under confidentiality starting October 17, 2025, and the parties exchanged eight restructuring proposals, but ultimately could not reach agreement on acceptable terms.

- RSA and Chapter 11: The RSA was executed on December 28, 2025, and USS commenced solicitation of votes on the Plan that same day, prior to filing the prepackaged Chapter 11 cases on December 29, 2025.

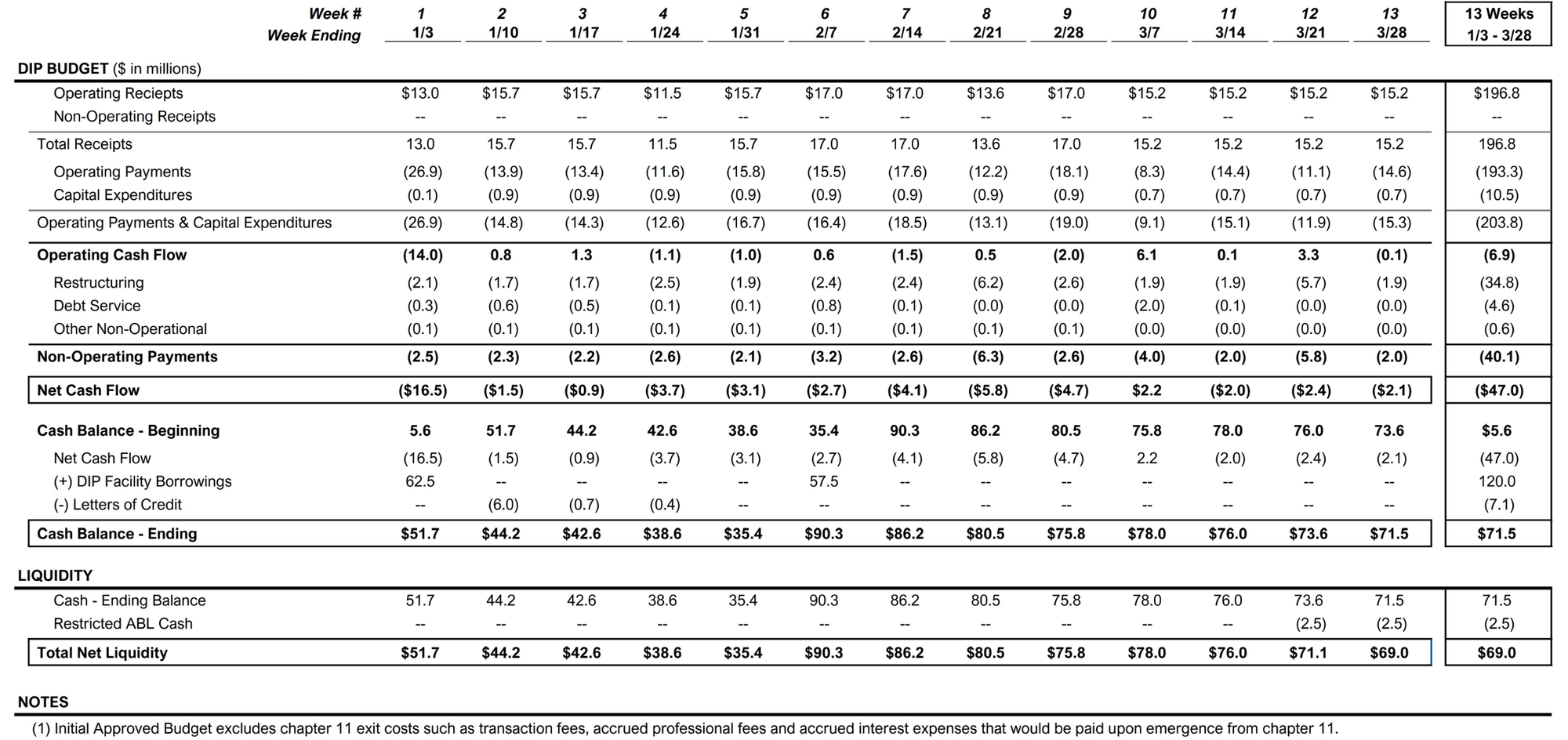

Restructuring Plan and Exit Financing

The prepackaged Plan provides for a $2.4 billion deleveraging, supported by $1.075 billion in total exit capital including $780 million in new-money commitments from the Ad Hoc Group. The cases are funded by a $120 million DIP facility, fully backstopped by the Ad Hoc Group.

- Plan Treatment & Recoveries:

- First-Out Debt: First-out term loans, notes, and revolving loans receive a 100% recovery via payment in full in cash.

- Second-Out Term Loans ($1.77B): Equitized for 98.22% of New Common Shares and Subscription Rights.

- Amended Term Loans ($46.2M): In a neutralizing treatment for legacy holdouts (primarily CastleKnight), holders receive $10.5 million in cash plus 1.78% of the new equity and subscription rights.

- Unsecured Funded Debt: Third-out and amended unsecured notes receive a pro rata share of a recovery pool (est. 0.3% recovery).

- GUCs: Unimpaired; paid in full in the ordinary course.

- Exit Capital Structure & Sponsor Settlement:

- New Money: $480 million Equity Rights Offering (ERO) and $300 million Exit Term Loan facility, both fully backstopped by the Ad Hoc Group.

- Asset-Based Facilities: A new $195 million Exit ABL and $100 million Exit Revolver will replace existing facilities.

- Sponsor Settlement: The Ad Hoc Group will pay $5.5 million to acquire 100% of the non-Debtor parent (PECF USS Holding Corp.) to preserve federal income tax group consolidation and prevent significant cash tax liabilities for the reorganized company.

Initial DIP Budget

Key Parties

- Cole Schotz P.C. (local bankruptcy counsel); Milbank LLP (general bankruptcy counsel); PJT Partners LP (investment banker); Alvarez & Marsal North America, LLC (financial advisor); Kurtzman Carson Consultants, LLC dba Verita Global (claims agent).

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.