Case Summary: Valves and Controls US (Weir Group) Chapter 11

Valves and Controls US Inc., a non-operating Weir Group subsidiary, filed for Chapter 11 to implement a liquidation trust after insurance exhaustion left it directly liable for asbestos-related claims.

Business Description

Valves and Controls US, Inc. (“Valves” or the “Debtor”), a non-operational Delaware corporation, is an indirect subsidiary of The Weir Group PLC (“Weir”), a global mining and engineering company. Since 2019, the Debtor's sole function has been to manage and resolve legacy product liability claims arising from its historical use of third-party asbestos-containing components in its industrial valve products.

- Although the Debtor never manufactured raw asbestos, it allegedly incorporated asbestos-containing gaskets and packing into certain valves until 1985, a practice that predates its acquisition by Weir.

- Valves faces a rapidly escalating number of asbestos-related lawsuits, which surged from 373 new filings in 2011 to 892 in 2024. As of the Petition Date, approximately 2,632 asbestos claims remained unresolved.

- The corresponding costs of defending and settling these claims have ballooned from approximately $2.9 million in 2011 to $12.8 million in 2024.

The Debtor’s financial position became untenable after its applicable insurance coverage was completely exhausted by May 2025, leaving it solely responsible for all defense and settlement expenses. To halt the deluge of litigation and preserve its remaining assets, Valves sought Chapter 11 protection with the primary objective of negotiating and implementing a global settlement of all current and future asbestos claims through a court-approved trust.

Valves and Controls US, Inc. filed for Chapter 11 protection on July 25, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the District of Delaware, reporting $50 million to $100 million in assets and $100 million to $500 million in liabilities.

Corporate History

The Debtor traces its origins to 1900 with the founding of Atwood & Morrill Co., Inc. (“A&M”) in Salem, MA. A&M grew into a prominent engineering firm and manufacturer of high-technology valves for the power generation, oil and gas, and petrochemical industries. Its products, including specialized valves for the U.S. Navy and the nascent nuclear power sector, were critical in high-pressure and high-temperature environments. In line with common industrial practice at the time, A&M incorporated third-party asbestos-containing components into some of its products, ceasing this practice in 1985.

Weir Acquisition and Asbestos Liability Emergence

- In 1990, The Weir Group PLC, a Scotland-based engineering conglomerate, acquired A&M as part of a global expansion strategy. A&M was subsequently rebranded, eventually becoming known as Weir Valves & Controls USA.

- Weir reportedly was not aware of any latent asbestos liability at the time of the acquisition. The first asbestos-related lawsuits against the valve business did not surface until around 2000, a decade after the transaction.

The 2019 First Reserve Sale and Liability Carve-Out

- In 2019, Weir strategically divested its Flow Control division, which included the valves business, to private equity firm First Reserve for an enterprise value of £275 million (approx. $343 million). The sale allowed Weir to focus on its core mining and oil and gas markets.

- Crucially, First Reserve was unwilling to assume the legacy asbestos liabilities. To facilitate the transaction, Weir “carved out” all asbestos-related claims and associated insurance policies, leaving them behind with the Debtor, which became a non-operating shell entity. The operating business was transferred to First Reserve free and clear of these liabilities and now operates as Trillium Flow Technologies.

- As part of the sale, $45 million of the purchase price was allocated to Valves to fund the anticipated liabilities. These proceeds were structured as a loan to a Weir affiliate, WHW Group, Inc., to be drawn down as needed to cover asbestos-related costs.

- To further protect the buyer, Valves and another Weir subsidiary, ESCO Group LLC, provided First Reserve with a joint and several indemnification of up to $75 million for any asbestos-related liabilities asserted against the sold assets.

Corporate Structure and Governance

- Valves is a wholly-owned subsidiary of TWG Investments (No. 8) Limited, which is an indirect subsidiary of The Weir Group PLC.

- In anticipation of a restructuring and to manage potential conflicts of interest, the Debtor’s board appointed Paul Aronzon as an independent director in April 2024. A Special Committee, with Mr. Aronzon as its sole member, was formed to oversee strategic alternatives and investigate material intercompany transactions with Weir.

Operations Overview

Since the 2019 divestiture of its operating assets to First Reserve, Valves has had no active business operations, revenue, products, or employees. The Debtor exists solely as a legal vehicle to manage and resolve the asbestos liabilities retained in the carve-out transaction.

Management and Funding

- The Debtor’s day-to-day affairs, including litigation and insurance oversight, are handled by personnel from Weir and outside professionals. Its officers are dual-hatted Weir employees, and a Chief Restructuring Officer, Scott M. Tandberg, was engaged to manage the bankruptcy process.

- From 2019 until mid-2025, Valves funded its asbestos defense and settlement costs through a cash management arrangement with the Weir affiliate WHW Group, Inc. WHW made periodic repayments on the $45 million intercompany loan as the Debtor required funds.

- On July 8, 2025, shortly before the bankruptcy filing, WHW fully repaid the remaining principal and interest on the loan. This transaction provided the Debtor with its current cash position of approximately $48 million.

Assets

- The Debtor’s primary assets consist of its $48 million in cash and its rights under historical insurance policies.

- Valves is actively seeking to monetize any remaining insurance value. This includes negotiations with Travelers for a potential policy buyback settlement related to certain "missing" policies from 1968–1970, with any proceeds intended to benefit the estate.

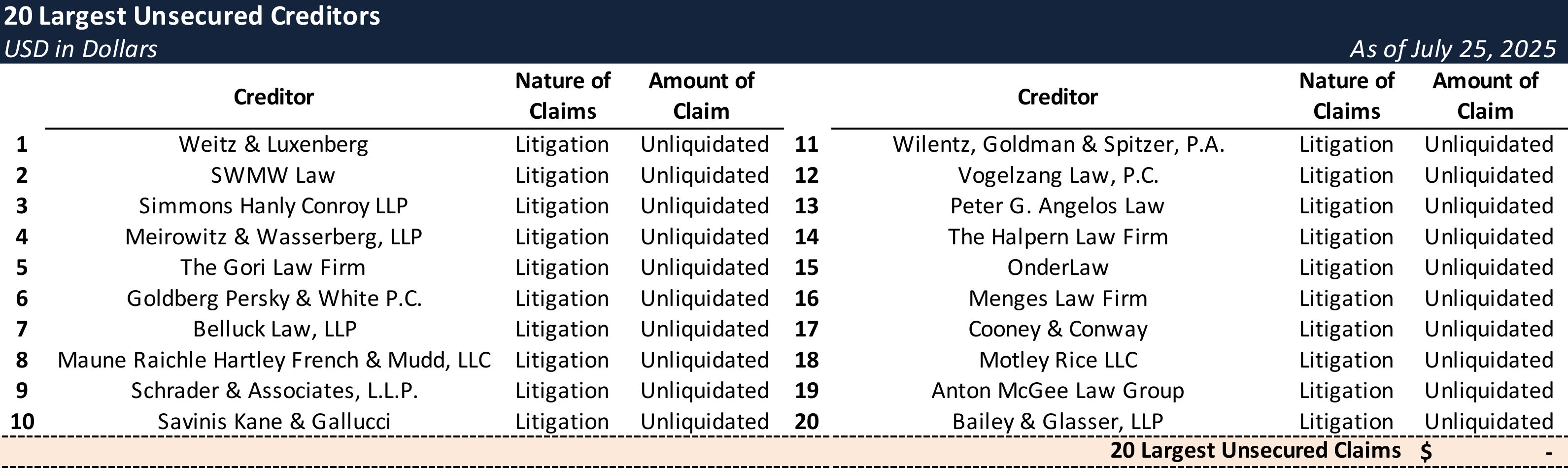

Top Unsecured Claims

Events Leading to Bankruptcy

The Debtor’s Chapter 11 filing is the direct result of unsustainable legacy asbestos liabilities, which were exacerbated by the recent and complete exhaustion of its historical insurance coverage.

Legacy Liabilities and Escalating Litigation Costs

- Over the last decade, Valves experienced a dramatic increase in asbestos litigation.

- The volume of new claims surged from a few hundred annually in the early 2010s to nearly 900 in 2024, with over 2,600 claims pending as of the Petition Date.

- This onslaught of litigation caused annual defense and settlement costs to climb from $2.9 million in 2011 to $12.8 million in 2024. By late 2023, it was clear that defending these cases in the tort system would eventually deplete the Debtor’s limited resources.

Exhaustion of Insurance Coverage

- A critical precipitating event was the depletion of the Debtor’s insurance coverage. For years, historical general liability policies covered the majority of asbestos-related costs, but these finite resources gradually eroded.

- On April 15, 2025, Travelers, a key insurer, notified Valves that its remaining policy limits would be fully exhausted by May 1, 2025, and that it would cease covering defense costs after May 31, 2025.

- This development left Valves completely self-insured and facing significant out-of-pocket defense and settlement costs, threatening to quickly drain its ~$48 million in cash reserves and rendering its financial situation untenable.

Prepetition Restructuring Efforts

- Recognizing the impending crisis, Valves began evaluating strategic alternatives in August 2023. After concluding that a Chapter 11 filing was the only viable path to a comprehensive resolution, the Debtor initiated extensive prepetition negotiations with key stakeholders.

- Engagement with Asbestos Claimants: In October 2024, Valves began discussions with an ad hoc committee of plaintiffs' law firms (the “ACC”) representing approximately 65% of the pending asbestos claims. The objective was to negotiate the framework of a consensual plan that would include the formation of a trust to resolve asbestos liabilities.

- Discussions with Weir: In parallel, the Debtor, under the oversight of its Special Committee, engaged in negotiations with its parent, Weir. These talks focused on securing a substantial cash contribution from Weir to the proposed trust in exchange for a full release from any derivative asbestos liability.

Decision to File Chapter 11 and Proposed Path Forward

- By July 2025, with its insurance safety net gone and negotiations with the ACC and Weir substantially advanced but not yet finalized, Valves filed for Chapter 11 protection. The filing provides the "breathing spell" of the automatic stay, preserving the Debtor’s cash while it works to finalize and implement its proposed restructuring.

- The Debtor intends to pursue a Chapter 11 plan designed to comprehensively resolve asbestos-related liabilities. Key anticipated plan features include:

- Asbestos Trust Establishment: The plan contemplates the formation of a liquidation trust to assume and resolve present and future asbestos claims, with funding provided by the Debtor and parent entity Weir.

- Channeling Injunction: The Debtor will seek a court order enjoining further litigation against the Debtor, Weir, and related parties, with all asbestos claims to be administered exclusively through the trust.

- Trust Funding Sources: Trust funding is expected to include approximately $48 million in Debtor cash, any recoveries from outstanding insurance settlements, and a cash contribution from Weir in exchange for a release of estate claims.

- Wind-Down of Debtor: Upon effectiveness of the plan and funding of the trust, the Debtor will commence an orderly wind-down and dissolution process.

Key Parties

- Cole Schotz P.C. and Weil, Gotshal & Manges LLP (co-counsel); AP Services, LLC (financial advisor); Paul Hastings LLP (special counsel); Scott M. Tandberg (chief restructuring officer); Kroll Restructuring Administration LLC (claims agent).

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.