Filing Alert: Weir Group Subsidiary Valves Files Chapter 11

Valves and Controls US Files Chapter 11 in District of Delaware

Valves and Controls US, Inc. ("Valves" or the "Company"), a non-operational subsidiary of global mining technology company Weir Group PLC ("Weir")⁽¹⁾, filed for Chapter 11 protection on Jul. 25 in the U.S. Bankruptcy Court for the District of Delaware. The Company’s sole purpose is to manage legacy liabilities stemming from its historical industrial valve manufacturing operations, which ceased using asbestos components in 1985.⁽²⁾

The filing was precipitated by the complete exhaustion of its insurance coverage in May 2025, leaving it exposed to surging litigation costs from approximately 2,632 unresolved asbestos claims. With annual defense and settlement expenses rising to $12.8 million in 2024, the bankruptcy seeks to halt litigation and preserve Valves’ approximately $48 million in cash for a global settlement.

The Company is using the Chapter 11 process to finalize negotiations on a consensual plan with an ad hoc committee of asbestos claimants and its parent, Weir. The proposed plan centers on creating a liquidation trust, funded by Valves' cash and a contribution from Weir, to resolve all current and future claims.

Valves reports $50 million to $100 million in assets and $100 million to $500 million in liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-11403.

⁽¹⁾ Weir acquired the Company, then known as Atwood & Morrill, in 1990. ⁽²⁾ In 2019, parent Weir sold Valves’ operating assets to First Reserve. To facilitate the sale, the legacy asbestos liabilities were carved out and remained with the Valves corporate entity, which then ceased all operations to focus solely on managing these claims.

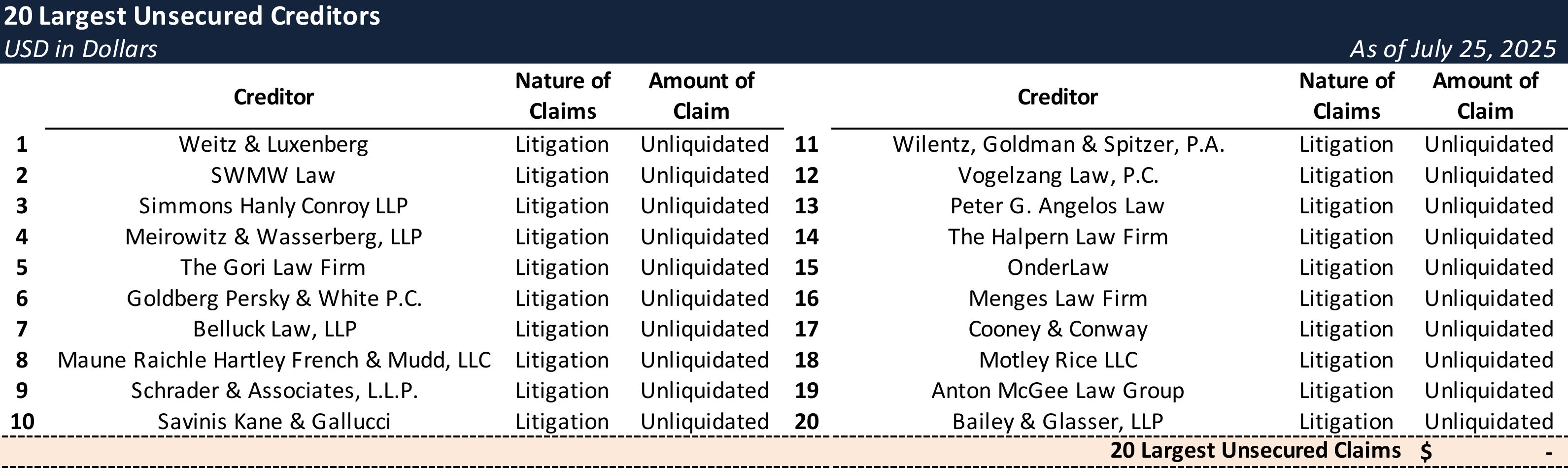

Top Unsecured Claims

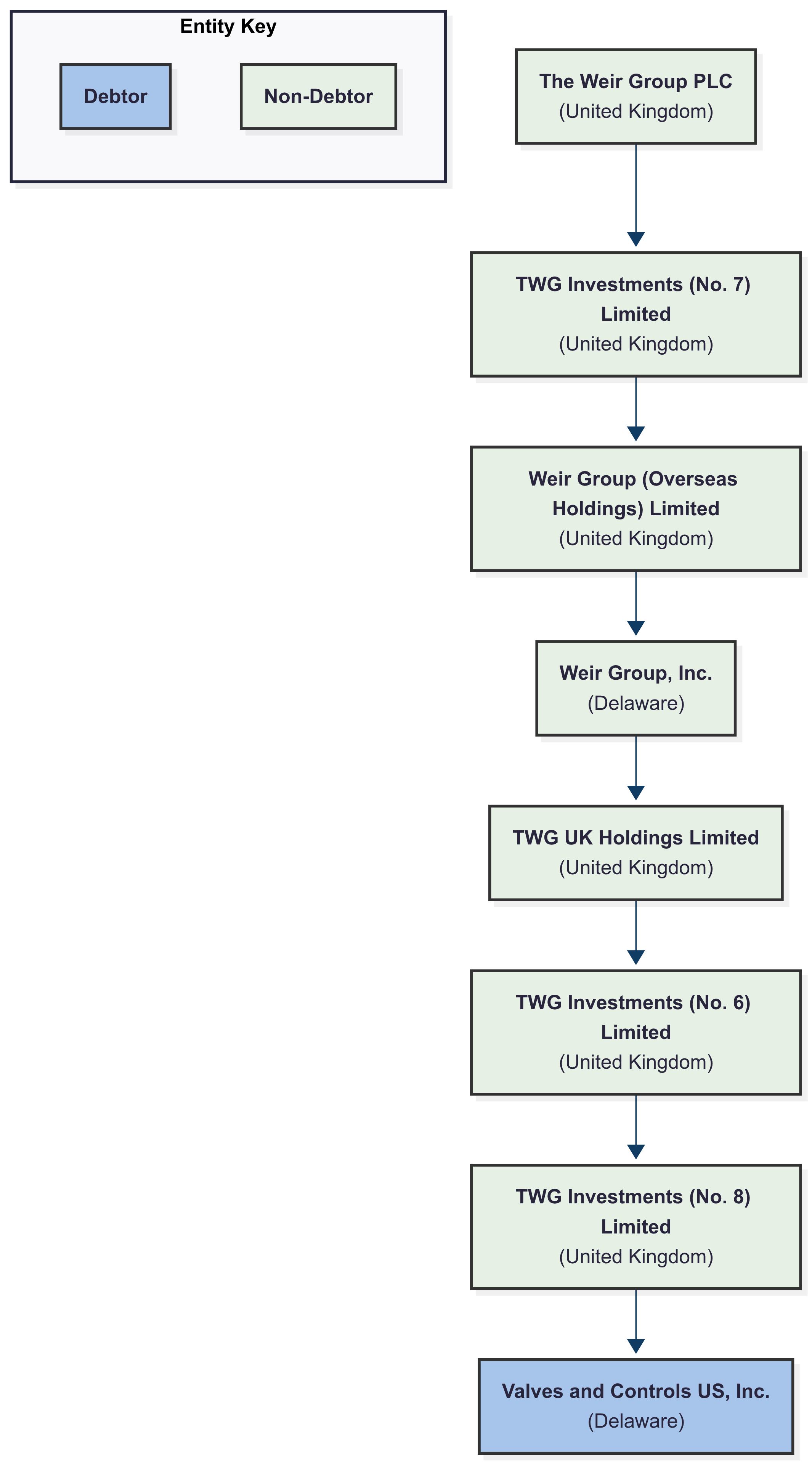

Corporate Organizational Structure

Key Parties

Co-Counsel:

- Patrick J. Reilley

- Cole Schotz P.C.

- Email: [email protected]

Co-Counsel:

- Matthew S. Barr

- Weil, Gotshal & Manges LLP

- Email: [email protected]

Financial advisor:

- AP Services, LLC

Special Counsel:

- Paul Hastings LLP

Signatories:

- Scott M. Tandberg – Chief Restructuring Officer

Claims Agent:

Equity Security Holders:

- TWG Investments (No. 8) Limited – 100% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.