Case Summary: Vanderbilt Minerals Chapter 11

Vanderbilt Minerals has filed for Chapter 11 bankruptcy to sell its assets to stalking horse bidder Commodore Materials for $50 million, driven by over $117 million in legacy talc-related litigation liabilities and recent adverse jury verdicts, supported by $15 million in DIP financing.

Business Description

Headquartered in Norwalk, CT, Vanderbilt Minerals, LLC ("Vanderbilt Minerals" or the "Debtor"), a wholly owned subsidiary of R.T. Vanderbilt Holding Company, Inc. ("Holdings"), is an industrial minerals company engaged in the mining, processing, and global distribution of various clays and mineral products used across pharmaceutical, agriculture, personal care, coatings, adhesives, construction, and industrial end markets.

- The Debtor operates mines and processing facilities in New York, North Carolina, South Carolina, and Nevada, with additional mines in Arizona and California, and employs approximately 125 full-time employees.

- The Debtor serves over 800 customers in approximately 60 countries, owns more than 70 unique brands, and utilizes a global distribution network of approximately 50 distributors alongside an internal sales force. Export sales accounted for 42.3% of revenue in 2025.

In 2025, the Debtor reported annual revenues of $64.3 million. The Debtor operates six distinct business lines under a single legal entity: (i) the VEEGUM® family of products (30.3% of 2025 revenue), magnesium aluminum silicate rheology modifiers used as industry standards in pharmaceutical, personal care, and agricultural applications; (ii) the Standard Minerals Division (21.4%), mining pyrophyllite under the PYRAX® brand; (iii) Resale Products (17.9%), DARVAN® dispersing agents and VANZAN® xanthan gum; (iv) the Gouverneur Minerals Division (17.3%), producing VANSIL® wollastonite; (v) the Dixie Clay Division (10.8%), mining and processing kaolin clay; and (vi) the Western Division, mining bentonite in California and Nevada.

- The Debtor's largest customer and largest supplier is affiliated entity Vanderbilt Chemicals, LLC ("VC"), which accounted for 8.7% of 2025 annual revenues and manufactures the VEEGUM® product line at a dedicated facility in Murray, Kentucky. Nearly all of the Debtor's projected growth is attributable to the VEEGUM® family of products.

Vanderbilt Minerals, LLC filed for Chapter 11 protection on February 16, 2026 (the "Petition Date") in the U.S. Bankruptcy Court for the Northern District of New York, reporting $100 million to $500 million in both assets and liabilities.

Corporate History

The Debtor traces its origins to 1916, when Robert T. Vanderbilt founded R.T. Vanderbilt Company, Inc. ("RTVC") in New York City, initially focused on mining clay for use in paper manufacturing. By the 1920s, RTVC had shifted to producing mineral fillers for the rubber industry and established Vanderbilt Research Laboratories in Norwalk, Connecticut, where the company eventually relocated its headquarters.

- In 1920, RTVC organized its Specialties Department, dedicated to research and development of new uses for clay and pyrophyllite minerals. By 1922, the company had expanded into ceramics through contracts with manufacturers producing ceramic plumbing fixtures, laying the foundation for the diversified product portfolio the Debtor maintains today.

Entry into Talc and Wollastonite

- In 1947, RTVC entered into a 99-year lease and royalty agreement for talc deposits in Gouverneur, New York, forming the Gouverneur Talc Company and commencing production of NYTAL® talc by October 1948. The talc was sold primarily to the ceramic and paint industries.

- In 1974, RTVC acquired the assets of International Talc Company, adding additional talc reserves and mining operations in the Gouverneur district. RTVC discontinued certain acquired talc grades in 1977 and ceased all talc mining and sales in 2008, citing increased litigation, rising production costs, and declining demand.

- In 1976, RTVC acquired significant deposits of high-purity wollastonite ore near its Gouverneur operations and began mining wollastonite in 1977. The Debtor remains one of only two continuous domestic wollastonite producers in the United States.

2012 Corporate Restructuring

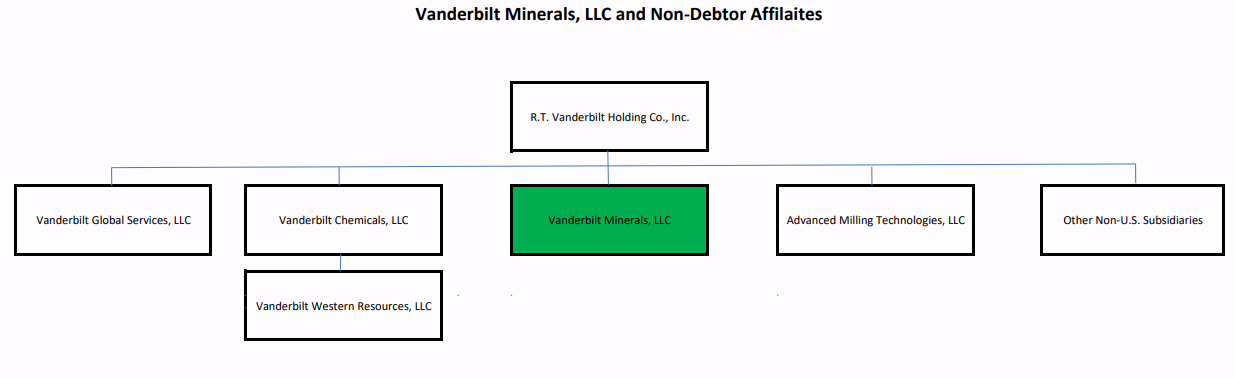

- As of 2012, RTVC operated two discrete businesses—chemicals and mining. To modernize its corporate structure, RTVC undertook a series of restructuring transactions that separated the two businesses into distinct legal entities:

- Vanderbilt Minerals, LLC was established as the legal successor to RTVC's historic mining business, a wholly owned subsidiary of the newly incorporated R.T. Vanderbilt Holding Company, Inc.

- Vanderbilt Chemicals, LLC assumed the chemical manufacturing operations, including the VEEGUM® processing plant in Murray, Kentucky—which remained with VC because it is part of a larger chemical processing facility operated by a single, unionized workforce.

- Vanderbilt Global Services, LLC ("VGS") provides shared administrative services, including accounting, HR, IT, and treasury functions, to the Debtor.

- Advanced Milling Technologies, LLC ("AMT") owns specialized milling equipment leased to the Debtor for use in its Gouverneur operations.

- The Debtor has no subsidiaries of its own. Its offices are separate from, and across the street from, Holdings' main offices. The Debtor maintains its own bank accounts, books and records, and management structure.

Organizational Structure and Key Relationships

The Debtor's operations are deeply intertwined with its non-debtor affiliates through a series of intercompany agreements governing supply, services, and support functions. VC is both the Debtor's largest customer and largest supplier: it purchases raw minerals from the Debtor and uses them to manufacture VEEGUM® products at its Murray, Kentucky facility, which are then sold exclusively back to the Debtor for third-party resale. Purchases of VEEGUM® products from VC exceeded $15 million in 2025.

- The Debtor and Holdings are also party to an Intercompany Promissory Note with an outstanding principal balance of approximately $27.9 million as of the Petition Date, bearing interest at 4% per annum and maturing on January 1, 2037.

- Holdings maintains responsibility for the Debtor's insurance policies and certain operating and capital leases important to the Debtor's operations.

Operations Overview

Vanderbilt Minerals operates through six distinct divisions, each with its own mining or sourcing operations, processing capabilities, and branded product portfolio.

VEEGUM® Family of Products (30.3% of 2025 Revenue)

- The VEEGUM® family represents the Debtor's largest and most strategically important revenue segment, with approximately two-thirds of sales exported internationally. The product line encompasses three subfamilies:

- VEEGUM®: Approximately a dozen variants of magnesium aluminum silicate rheology modifiers, irradiated by a third-party supplier to meet pharmaceutical, cosmetic, and personal care standards. Applications include dental formulations (VEEGUM® D) and pharmaceutical suspensions and topical products (VEEGUM® K).

- VAN GEL®: An industrial-grade product family (non-irradiated) used in household and institutional cleaners, polishes, and caustic formulations.

- VANNATURAL®: A bentonite clay positioned as a "pure and natural" stabilizer and rheology modifier for ecological and organic skincare products and cosmetics.

- VEEGUM® products are manufactured by VC at an approximately 50,000-square-foot, single-purpose, highly automated facility within VC's chemical plant campus in Murray, Kentucky. The raw mineral inputs are sourced exclusively from the Debtor's Western Division mines, shipped through a crushing facility in Beatty, Nevada, and then transported to Murray for processing.

Standard Minerals Division (21.4% of 2025 Revenue; ~36 Employees)

- Located on 1,500 acres in Robbins, North Carolina, SMD operates two pyrophyllite mines:

- Glendon Mine: Produces uniquely high-grade refractory pyrophyllite, with significant usage in the European automotive market.

- Robbins Mine: Produces filler-grade pyrophyllite primarily used in drywall joint compounds.

- Products are marketed under the PYRAX® brand, with ore stockpiled, crushed, blended, dry-ground, and air-classified at a mill in Robbins.

Resale Products (17.9% of 2025 Revenue)

- The Debtor purchases products from third-party suppliers and resells them under its own brands:

- DARVAN®: Approximately a dozen dispersing agent brands, each designed for specific end-market applications.

- VANZAN®: Approximately five xanthan gum brands used in applications such as reconstitutable powders, dry powder formulations, and tablet coatings. Customers frequently pair VANZAN® products with the VEEGUM® family.

- ACTIVE-8®: A drier accelerator for solvent-borne paints and coatings, accounting for a small share of revenues and likely to be discontinued in 2026.

Gouverneur Minerals Division (17.3% of 2025 Revenue; ~40 Employees)

- GMD owns more than 2,300 acres in Gouverneur, New York, where it operates an underground wollastonite mine and milling operation. Products are marketed under the VANSIL® brand in two forms:

- Acicular wollastonite: A high-aspect-ratio "needle-like" product produced using a specialized Netzsch Mill owned by non-debtor affiliate AMT and leased to the Debtor. This product is valued in coating applications.

- Wollastonite powder: Produced to varying particle sizes for ceramics, paints, plastics, and horticulture applications.

- Approximately 11% of VANSIL® sales are to affiliated VC.

Dixie Clay Division (10.8% of 2025 Revenue; ~27 Employees)

- Dixie operates two open-pit kaolin clay mines (hard and soft clay) and a processing facility on more than 3,000 acres in Bath Township, South Carolina. Clay is mined intermittently by a third party, generating six-to-twelve-month stockpiles, then dried and air-floated to remove impurities before packaging in bags, supersacks, or bulk.

- Over half of Dixie's output is sold to VC, which uses the kaolin in rubber and plastics products.

Western Division (~7 Employees)

- The Western Division mines bentonite deposits across California and Nevada, with each deposit exhibiting unique characteristics (color, pH) suited to different end products. The division also produces saponite/hectorite from the Lyles Mine in Arizona, a mineral critical to the formulation of several VEEGUM® products.

- All minerals mined by the Western Division are used exclusively in VEEGUM® production and are not sold to third parties.

Workforce

As of the Petition Date, the Debtor employs approximately 125 full-time and part-time employees, including one independent contractor. Two unions represent approximately 50 hourly workers: the United Steelworkers Local 4979 (approximately 29 employees at Gouverneur, New York) and United Steelworkers Local 00478 (approximately 21 employees at Beech Island, South Carolina).

Competitive Landscape

Vanderbilt Minerals is a niche specialty player in an industry dominated by substantially larger competitors, including Imerys SA (~€3.6 billion of 2024 revenue), Minerals Technologies Inc. (~$2.1 billion of 2024 revenue), and Sibelco NV, among others. In wollastonite, Vanderbilt and Imerys/NYCO Minerals are the only two U.S. producers.

Prepetition Obligations

As of the Petition Date, the Debtor had no secured funded debt and approximately $1 million in trade debt, but had accrued approximately $117.2 million in talc-related indemnity and defense costs stemming from legacy litigation tied to industrial talc operations discontinued in 2008.

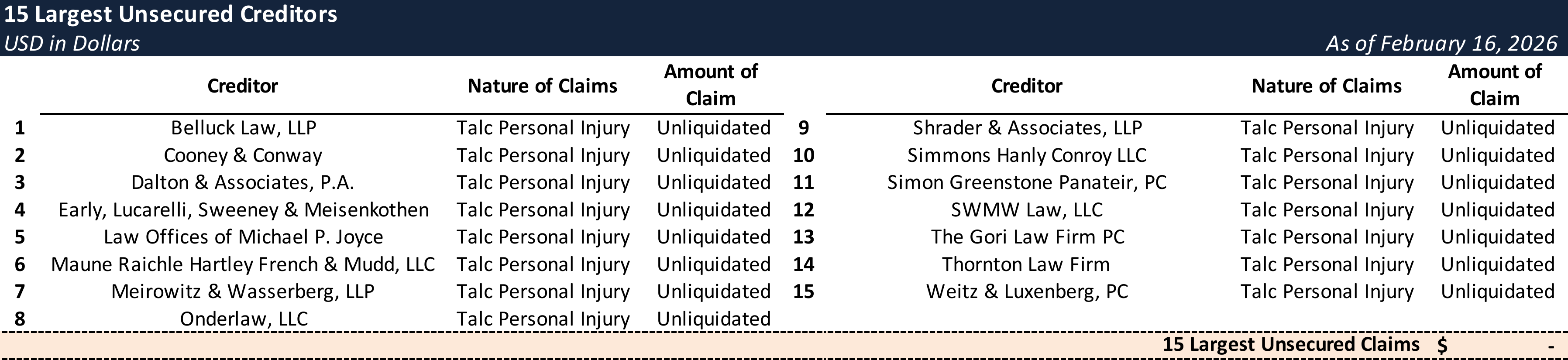

Top Unsecured Claims

Events Leading to Bankruptcy

Legacy Talc Litigation and Regulatory History

- The Debtor's distress stems from legacy talc mining operations conducted by its predecessor, RTVC, from 1948 through 2008. The talc deposits in New York's Gouverneur district naturally co-occur with tremolite and anthophyllite, minerals that exist in both asbestiform (fibrous) and non-asbestiform varieties—a geological reality that placed the Debtor at the center of a decades-long scientific and legal debate.

- In 1972, OSHA adopted a regulation classifying tremolite and anthophyllite as asbestos without distinguishing between asbestiform and non-asbestiform growth habits, creating confusion that persisted for years. OSHA confirmed in 1974 that the standard regulated only asbestiform varieties, but RTVC's customers continued to face citations.

- RTVC successfully challenged the 1986 OSHA standard, ultimately obtaining a June 1992 final ruling that excluded non-asbestiform tremolite and anthophyllite from the asbestos standard. Since that time, OSHA's position has remained that the non-asbestiform minerals found in RTVC's industrial talc are not regulated as asbestos.

- RTVC's talc mines were also regulated by the Mine Safety and Health Administration ("MSHA"), which routinely conducted air and product sampling and, since 1985, reported finding no detectable asbestos in the air or in talc from the Gouverneur mine.

Escalating Litigation and Adverse Verdicts

- Beginning in the 1980s, RTVC was named as a defendant in asbestos exposure litigation related to its talc production. Following OSHA's 1992 clarification, case volume initially declined, and lawsuits filed through the 1990s were generally dismissed or settled for relatively small sums. Starting in the mid-2000s, however, both claim counts and settlement amounts began to materially increase.

- The Debtor finished 2019 with 307 pending cases. As of the Petition Date, more than 1,400 cases were pending, while the Debtor and RTVC had settled more than 1,250 cases and more than 4,500 had been dismissed.

- Defense and indemnity costs escalated significantly—from approximately $2.9 million in 2019 to $8.0 million in 2025—placing increasing strain on the Debtor's liquidity.

- Beginning in the 2020s, juries began returning increasingly adverse verdicts in talc cases against the Debtor:

- 2023 (Peckham v. DAP Inc. and Vanderbilt Minerals): A Connecticut jury returned a $20 million compensatory verdict, with liability apportioned 50% to the Debtor. The case was settled while the trial judge was considering punitive damages—the largest asbestos verdict in Connecticut history at the time.

- 2024 (Barone v. Blue M): A Connecticut jury awarded $15 million, with the trial judge subsequently adding $7.5 million in punitive damages, for a total of $22.5 million. The Debtor posted an approximately $3.8 million appeal bond, which had a significant negative impact on its financial strength.

- 2025 (Bishop v. Vanderbilt Minerals): A St. Lawrence County, New York jury awarded $12.25 million ($4.5 million compensatory plus $7.75 million punitive), in what was believed to be the first successful verdict in the United States alleging environmental (non-occupational) exposure to asbestos from mining operations. Two additional adverse verdicts were returned in 2025, further straining liquidity.

Insurance Coverage

- From 1956 to 1986, RTVC purchased hundreds of millions of dollars of product liability insurance. Claims-made coverage has been exhausted, but remaining occurrence-based policies—which did not contain asbestos exclusions—continue to provide defense and indemnity coverage. As primary layers exhausted, excess insurers stepped in, and the Debtor asserts that a significant amount of coverage remains available for both the Debtor and non-debtor Holdings.

- Notwithstanding available coverage, the cumulative financial impact of adverse verdicts, the obligation to fund appeal bonds and trial costs, and increased defense costs associated with the growing case count eroded liquidity to unsustainable levels.

Prepetition Governance and Intercompany Investigation

- In May 2025, the Debtor appointed Dean Vomero of Applied Business Strategy LLC as Chief Restructuring Officer to assess strategic alternatives and oversee restructuring efforts.

- On September 15, 2025, the Debtor's Board of Managers appointed Ben Pickering as Independent Manager and sole member of an Independent Special Committee, tasked with investigating intercompany transactions and potential claims against related parties.

- Pickering retained Katten Muchin Rosenman LLP as independent counsel and the committee conducted an extensive factual and legal investigation.

- The investigation concluded that the Debtor held viable claims to recover: (i) amounts owed under the approximately $27.9 million Intercompany Note, (ii) approximately $7.6 million in net intercompany balances owed by Holdings from the centralized cash management system, and (iii) approximately $6.4 million in receivables owed by Vanderbilt Worldwide, Ltd.

Prepetition Marketing Process

- In August 2025, the Debtor retained Greenhill & Co., LLC ("Greenhill") as its investment banker to solicit interest in financing and/or a sale transaction for all or the majority of the Debtor's assets.

- Greenhill launched the sale process in November 2025, reaching out to 120 potential buyers (37 strategics and 83 sponsors). Thirty parties executed NDAs and were given access to an online data room. By late December, Greenhill had received four indications of interest for substantially all assets plus certain non-debtor affiliate assets, and three additional indications for subsets of assets.

- In parallel, Greenhill launched a DIP financing marketing process in October 2025, contacting 70 potential lenders. Twenty-two executed NDAs, and three submitted non-binding indications of interest—two from parties also interested in acquiring the assets and one from a standalone DIP provider. No party was willing to provide unsecured financing.

- Out-of-court alternatives quickly proved unviable given the magnitude of the $117.2 million in accrued talc liabilities against a business with no secured funded debt.

Global Settlement with Affiliates

- A central element of the Debtor's restructuring strategy is a Global Settlement Agreement with Holdings and its subsidiaries, negotiated at arm's length by the Independent Special Committee following a day-long settlement conference on February 5, 2026, with agreement reached on February 12, 2026.

- Throughout the marketing process, it became clear that no going-concern buyer would submit a standalone bid for the Debtor's assets without inclusion of certain non-debtor affiliate assets—specifically the VEEGUM® plant in Murray, Kentucky, the Lyles mine in Arizona, and the Netzsch Mill and other equipment (collectively, the "Settlement Assets"). The Settlement Agreement provides for the transfer of these assets to the Debtor's estate in exchange for, among other things, the release of claims under the Intercompany Note and resolution of intercompany balances.

- The Independent Manager valued the Debtor's claims against Holdings at between $19.6 million (litigation scenario) and $27.2 million (discounted repayment scenario) and concluded the Global Settlement exceeded the minimum value threshold for the estate.

Stalking Horse Agreement and DIP Financing

- Following a competitive bidding process that included a "mini-auction" among two finalists in the week preceding the filing, the Debtor entered into a Stalking Horse Agreement with Commodore Materials, LLC for the purchase of substantially all of the Debtor's assets—including the Settlement Assets—for an aggregate purchase price of approximately $50 million.

- The Stalking Horse Bidder has agreed to continue operating the business as a going concern and to offer employment to substantially all of the Debtor's employees. The agreement also requires assumption of the Debtor's collective bargaining agreements.

- Bidding protections include a $2.0 million break-up fee and up to $1.0 million in expense reimbursement (6.0% of the purchase price in the aggregate).

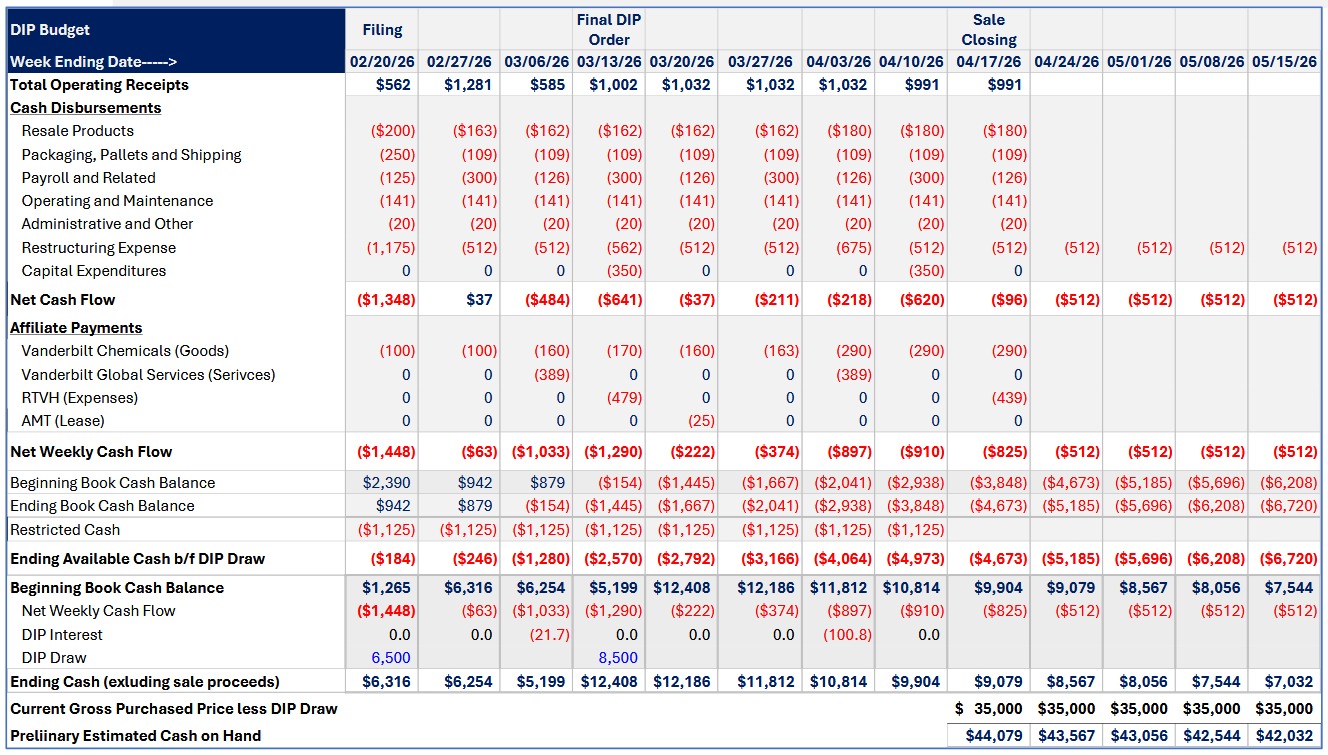

- The Debtor simultaneously obtained a senior secured superpriority DIP term-loan facility of up to $15.0 million ($6.5 million available on an interim basis) from Commodore Material Funding, LLC, an affiliate of the Stalking Horse Bidder. The DIP facility, coupled with operational cash flow, will fund the Debtor's operations through the sale process.

- Key Terms:

- DIP Interest: 7.5%

- Default Rate: 2.0%

- Commitment Fee: 0.5%

- Exit Fee: 1.0%

- Maturity: June 16, 2026

- As of February 15, 2026, the Debtor had approximately $1.3 million of liquidity and projected a $4.7 million deficit by mid-April absent DIP financing.

- Key Terms:

- The proposed sale timeline is compressed: an auction is scheduled for April 2, 2026, a sale hearing for April 7, 2026, and a sale closing deadline of April 17, 2026.

Broader Talc Bankruptcy Context

- The filing joins a growing roster of talc-related bankruptcies that has reshaped the industrial minerals sector, including Imerys Talc America (2019; $862 million asbestos trust), Avon Products (2024), and Presperse/Sumitomo (2024). Johnson & Johnson's three failed attempts to resolve talc liabilities through subsidiary bankruptcies—and more than $2.5 billion in adverse jury verdicts in 2025 alone—underscore the broader trajectory of talc litigation.

- For Vanderbilt, the parallels to Imerys are closest: both companies mined industrial (not cosmetic) talc, both faced mesothelioma claims among downstream industrial users, and both ultimately determined that the litigation trajectory was incompatible with ongoing business operations. The key distinction is scale—Vanderbilt's accrued liabilities of $117.2 million represent nearly twice its annual revenue.

DIP Budget

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.