Filing Alert: Vanderbilt Minerals Chapter 11

Vanderbilt Minerals Files Chapter 11 in Northern District of New York

Update (Feb. 16, 2026): A comprehensive case summary is now available for the Chapter 11 bankruptcy filing of Vanderbilt Minerals, LLC.

Vanderbilt Minerals, LLC, a Norwalk, CT-based miner and supplier of industrial minerals and clays, filed for Chapter 11 protection on Feb. 16 in the U.S. Bankruptcy Court for the Northern District of New York.

The filing is driven by mass tort liabilities stemming from the debtor's historic industrial talc production, which ceased in 2008. Pending asbestos-related cases have grown from 307 in 2019 to more than 1,400 as of the petition date, with defense and indemnity costs reaching $8.0 million in 2025. A $15 million jury verdict in 2024, coupled with $7.5 million in punitive damages and a $3.8 million appeal bond, further strained liquidity. As of the petition date, the debtor had accrued approximately $117.2 million in talc-related liabilities and carries no secured funded debt.

The debtor intends to sell substantially all of its assets through a court-supervised process following a prepetition marketing effort led by Greenhill & Co. that determined an out-of-court transaction was not viable. Proposed stalking horse bidder Commodore Materials, LLC, through affiliate Commodore Material Funding, LLC, is providing a $15 million senior secured superpriority DIP term loan, with $6.5 million available on an interim basis. Concurrently, the debtor is seeking approval of a settlement with parent R.T. Vanderbilt Holding Co. resolving potential claims arising from prepetition intercompany transactions following an independent investigation by a special committee.

Vanderbilt Minerals, LLC reports $100 million to $500 million in both assets and liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 26-60110.

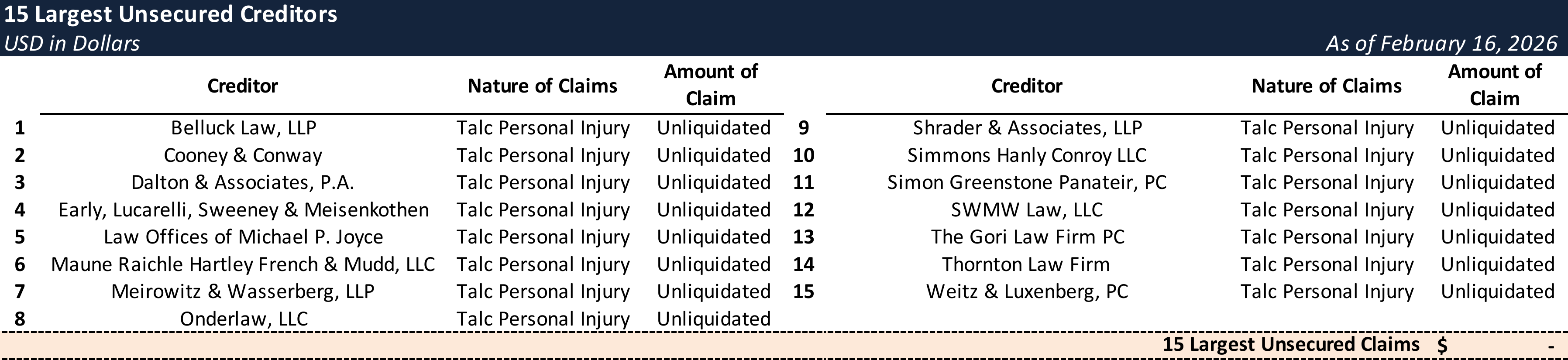

Top Unsecured Claims

Key Parties

Counsel:

- Charles J. Sullivan

Bond, Schoeneck & King PLLC

Email: [email protected]

Signatories:

- Dean Vomero – Chief Restructuring Officer

Claims Agent:

- Kurtzman Carson Consultants, LLC d/b/a Verita Global, LLC

Equity Security Holders:

- R.T. Vanderbilt Holding Company, Inc. – 100% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.