Case Summary: Village Roadshow Chapter 11

Village Roadshow has filed for Chapter 11 protection amid Warner Bros. disputes and a failed push into independent production, with a $365M stalking horse bid for its film library.

Business Description

Village Roadshow Entertainment Group USA Inc., along with its Debtor affiliates⁽¹⁾ (collectively, “VREG” or the “Company”), is a prominent independent producer and financier of major Hollywood motion pictures.

- Established in 1997, VREG has produced over 100 films, including globally acclaimed blockbusters such as Joker, The Great Gatsby, the Ocean’s series, Sully, The LEGO Movie, and the Matrix trilogy.

- The Company’s films have collectively generated over $19 billion in global box office revenue, featuring 34 films debuting at #1 in the U.S., securing 19 Academy Awards and six Golden Globe awards.

Despite navigating industry volatility, intensified by the COVID-19 pandemic and recent Hollywood labor disputes, VREG maintained steady financial performance for over two decades, anchored by a IP-centric business model emphasizing intellectual property and contractual rights.

VREG filed for Chapter 11 protection on Mar. 17 in the U.S. Bankruptcy Court for the District of Delaware. As of the Petition Date, the Debtors reported $100 million to $500 million in assets and $500 million to $1 billion in liabilities.

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table.

Corporate History

Prior to 2017, VREG notably specialized in co-production and co-financing ventures with major studios, primarily through a successful partnership with Warner Bros. Entertainment Inc. (“WB”).

- Of the 91 films produced during this period, the majority were in partnership with WB, along with collaborations involving Sony and Paramount.

In 2013, Debtors Village Roadshow Films (BVI) Limited and Village Roadshow Distribution (BVI) Limited executed the Magnum Transaction, selling partial financial interests in select film revenues to Magnum Films SPC, while retaining critical IP ownership and control rights.

Shift in Business Strategy

- Post-2017, VREG shifted towards independent film and television production under its Studio Business division, committing substantial resources to original content creation, project development, and workforce expansion.

- Since 2018, the Studio Business has launched development on 99 feature films, 67 unscripted television series, and 166 scripted television series.

- However, these initiatives failed to replicate prior successes achieved through studio partnerships, most notably the 2022 WB Arbitration (detailed below).

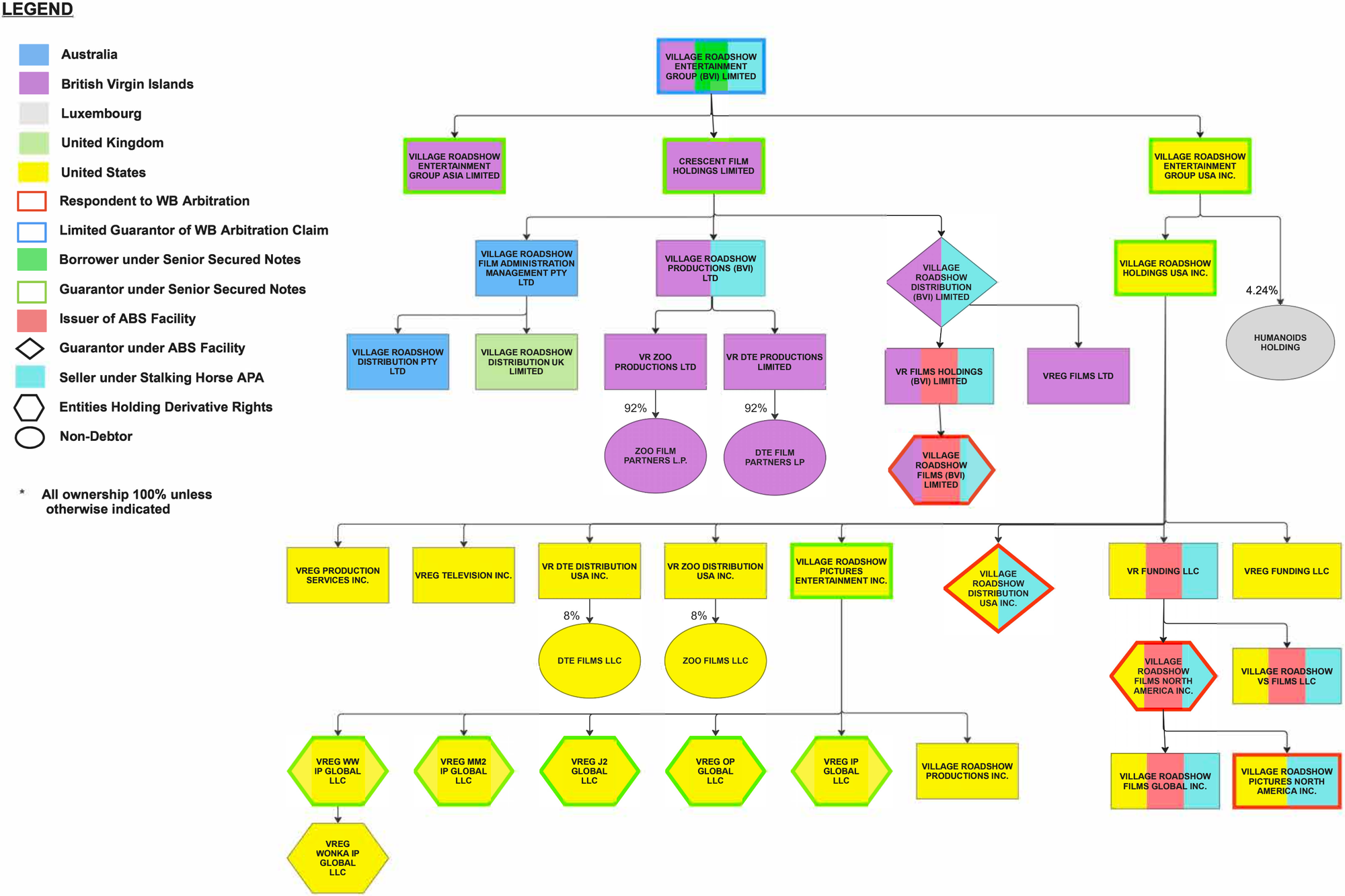

Organizational Structure

- Debtor Village Roadshow Entertainment Group (BVI) Limited ("VREG BVI") functions as the parent holding entity. Its equity security holders include:

- Vine Media Opportunities - Fund III-A, LP (47.1%)

- 1397225 Ontario Limited (15.2%)

- Vine Media Opportunities - Fund III, LP (13.5%)

- Falcon Strategic Partners IV, LP (12.8%)

- Vine Media Opportunities - Fund III-B, LP (7.1%)

- Village Roadshow Pictures International Pty Ltd (2.5%)

- Vine WestCon SPV, LP (1.8%)

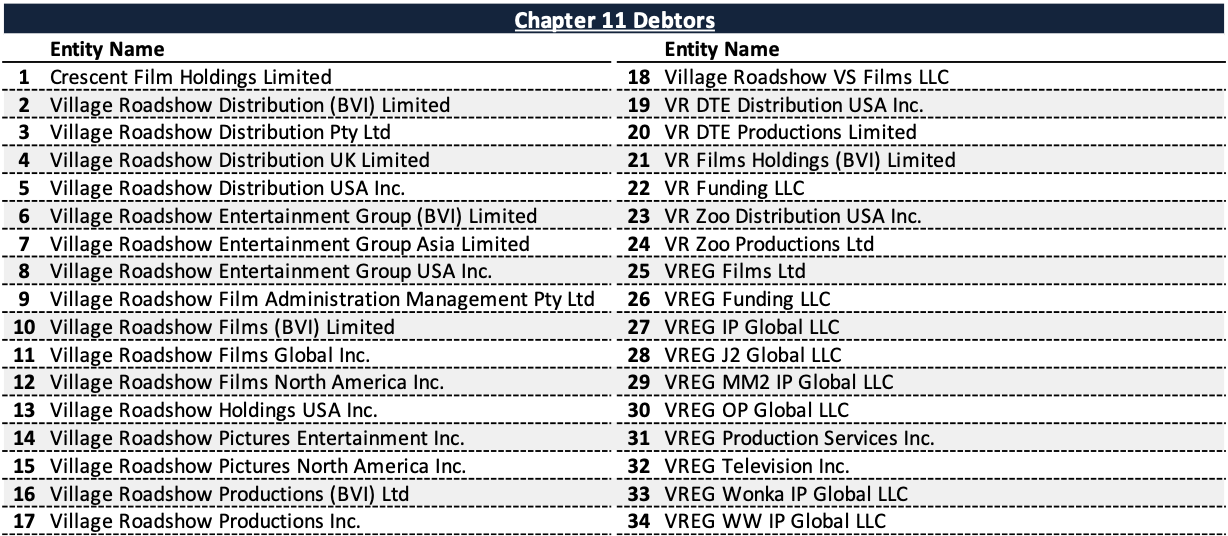

Chapter 11 Debtors

Operations Overview

VREG's core operational assets consist primarily of its valuable IP library, encompassing film ownership rights, intellectual property, domestic distribution, and derivative rights tied to its significant catalog.

Library Assets

- Generate approximately $50 million annually, offering steady revenues from historic content.

Derivative Rights

- Lucrative co-ownership agreements, notably with WB, grant rights to produce sequels, prequels, and related projects, underpinning strategic industry relationships.

Studio Business Initiatives

- Independent development of scripted and unscripted television series and feature films, though many have not achieved profitability or even production stages.

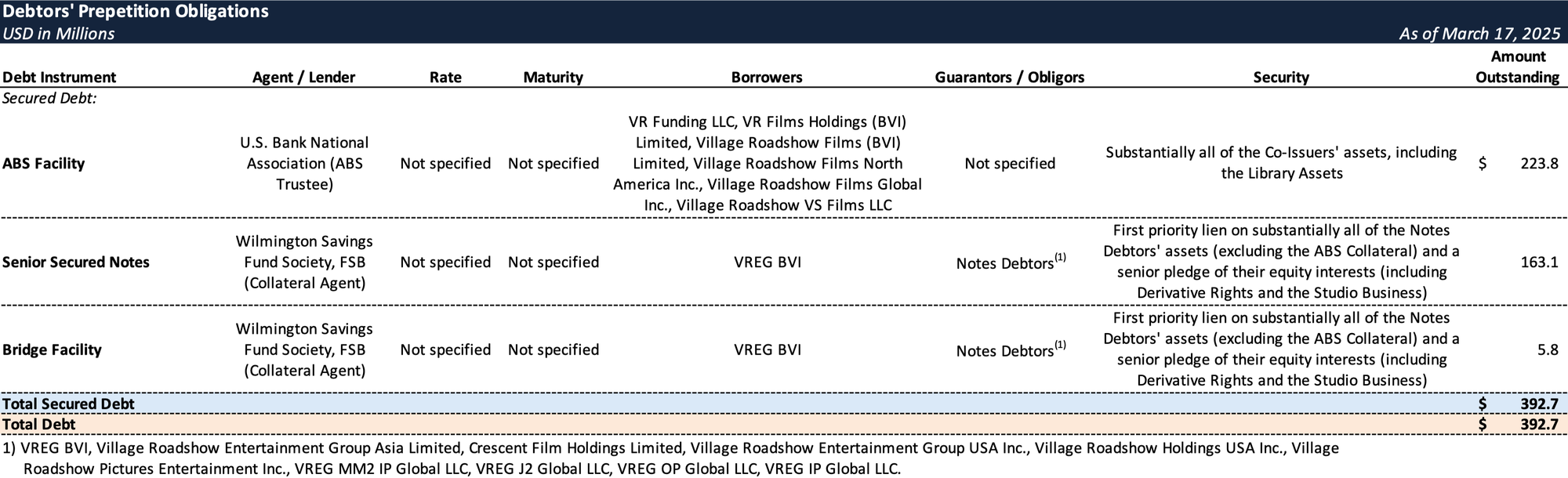

Prepetition Obligations

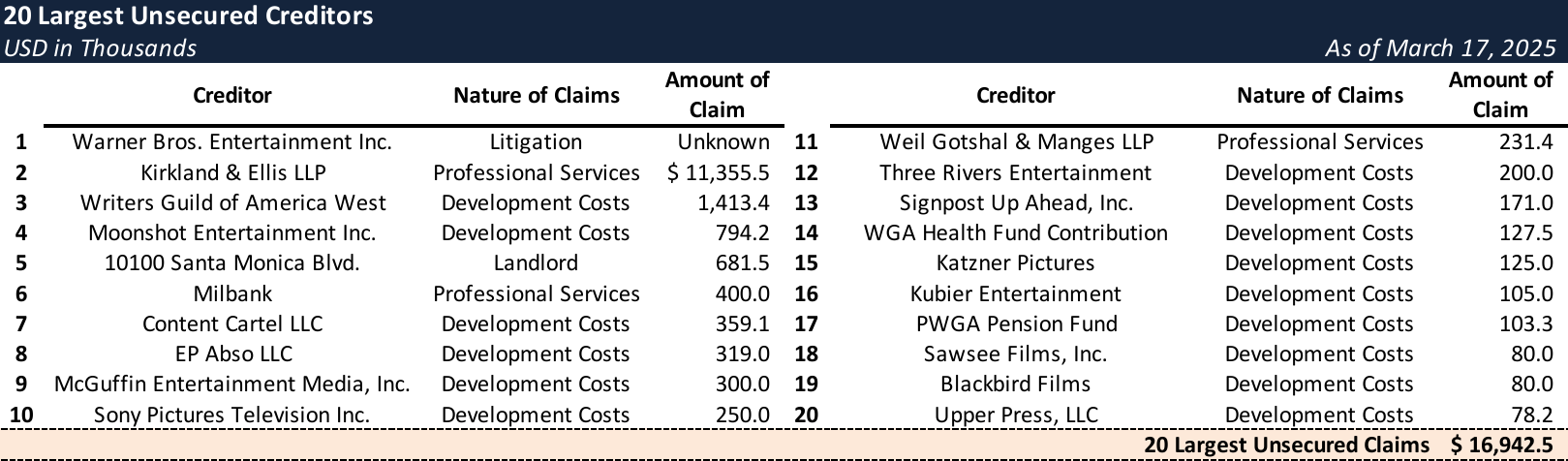

Top Unsecured Claims

Events Leading to Bankruptcy

Critical Financial Challenges

- Two significant factors drove VREG’s financial deterioration:

- Warner Bros. Arbitration: Initiated in February 2022, the dispute with WB critically disrupted VREG’s lucrative derivative rights, particularly related to the Matrix franchise. The arbitration has already incurred over $18 million in legal fees, threatens substantial financial liabilities, and jeopardizes future revenue streams from joint projects with WB.

- Independent Studio Venture: The Company’s strategic pivot into independent productions incurred approximately $47.5 million in development expenses, failing to generate profitable projects, creating substantial unpaid liabilities, and impeding access to additional capital.

Impact of Industry Disruptions

- VREG’s liquidity crisis was intensified by broader industry disruptions, including:

- COVID-19’s widespread industry shutdown;

- The 2023 Hollywood writers' and actors' strikes, causing significant delays and elevated production costs;

- Heightened competition from streaming services, altering traditional entertainment consumption and profitability.

Pre-Bankruptcy Strategic Efforts

- The Company initially retained Goldman Sachs for an out-of-court asset sale, but unresolved WB arbitration and restrictive asset clauses impeded buyer interest.

- Subsequent cost-saving measures led by financial advisory firm Accordion included halting new investments, cutting discretionary expenses, downsizing from 45 employees in early 2024 to 11 staff across the U.S. and Australia, and relocating to cost-efficient premises.

- Despite these efforts, liquidity constraints persisted, shifting the focus toward asset divestiture.

Strategic Repositioning and Chapter 11 Filing

- In December 2024, VREG engaged Sheppard Mullin and subsequently Solic to explore restructuring alternatives, securing bridge financing in January 2025 to extend liquidity.

- On March 14, 2025, the Debtors executed a $365 million stalking horse APA with CP Ventura LLC for the Library Assets, setting the stage for a Section 363 sale.

- VREG secured DIP financing totaling approximately $12.8 million, comprising a roll-up of existing bridge financing and $7 million in additional liquidity.

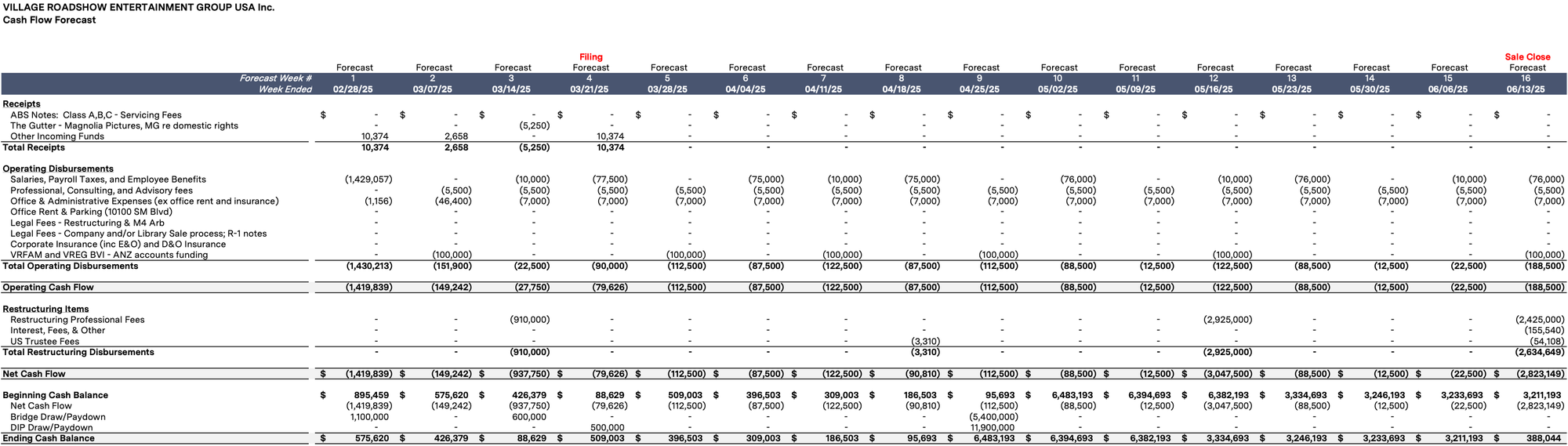

Initial DIP Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.