Filing Alert: Village Roadshow Entertainment Group USA Chapter 11

Village Roadshow Entertainment Group USA Files Chapter 11 in District of Delaware

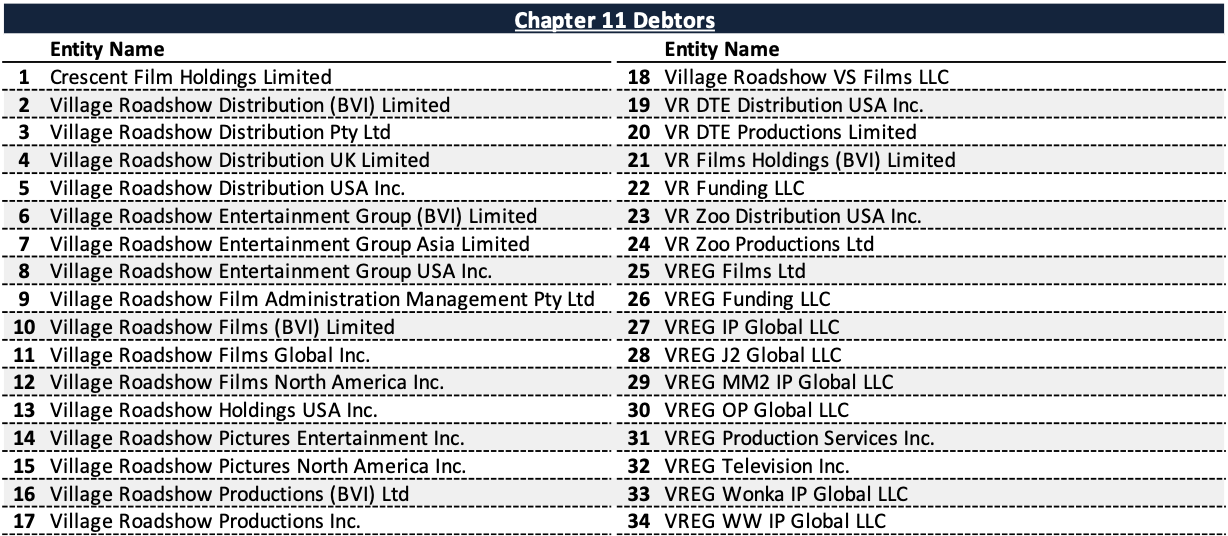

Village Roadshow Entertainment Group USA Inc. and its debtor affiliates⁽¹⁾, a West Hollywood, CA-based independent producer and financier of major Hollywood motion pictures, filed for Chapter 11 protection on Mar. 17 in the U.S. Bankruptcy Court for the District of Delaware.

The company reports $100 million to $500 million in assets and $500 million to $1 billion in liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-10475.

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table.

Chapter 11 Debtors

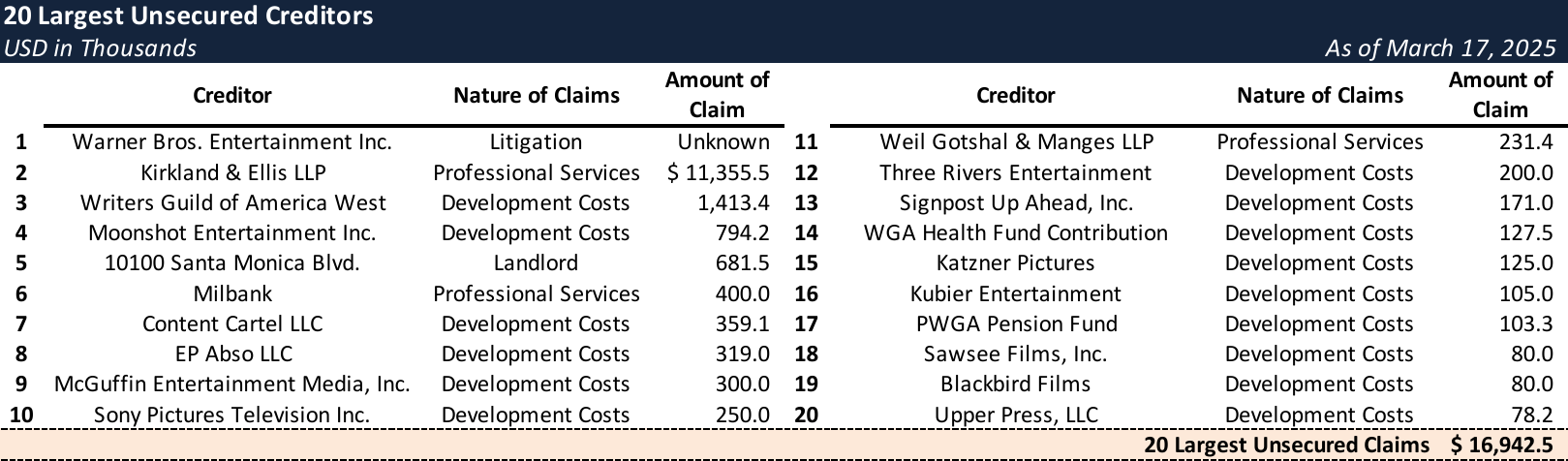

Top Unsecured Claims

Key Parties

Local Bankruptcy Counsel:

- Joseph M. Mulvihill

- Young Conaway Stargatt & Taylor, LLP

- Email: [email protected]

General Bankruptcy Counsel:

- Sheppard Mullin, Richter & Hampton LLP

Special Litigation Counsel:

- Kirkland & Ellis LLP

Financial and Restructuring Advisor:

- Accordion Partners, LLC

Investment Banker:

- SOLIC Capital Advisors, LLC

Signatories:

- Keith Maib – Chief Restructuring Officer

Claims Agent:

- Kurtzman Carson Consultants, LLC dba Verita Global

Equity Security Holders:

- Village Roadshow Entertainment Group (BVI) Limited ("VREG BVI") – 100% Membership Interest

- VREG BVI Equity Security Holders:

- Vine Media Opportunities - Fund III-A, LP – 47.1% Equity Interest

- 1397225 Ontario Limited – 15.2% Equity Interest

- Vine Media Opportunities - Fund III, LP – 13.5% Equity Interest

- Falcon Strategic Partners IV, LP – 12.8% Equity Interest

- Vine Media Opportunities - Fund III-B, LP – 7.1% Equity Interest

- Village Roadshow Pictures International Pty Ltd – 2.5% Equity Interest

- Vine WestCon SPV, LP – 1.8% Equity Interest

- VREG BVI Equity Security Holders:

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.