Case Summary: Wag! Chapter 11

Wag! has filed for Chapter 11 bankruptcy to implement a prepackaged plan equitizing $16.3 million in secured debt and transferring control to its sole secured lender, following failed sale and refinancing efforts.

Business Description

Headquartered in San Francisco, CA, Wag! Group Co., along with its Debtor⁽¹⁾ affiliates (collectively, "Wag!" or the "Company"), operates a proprietary technology platform serving as a one-stop digital marketplace for pet care services and products. The Company’s core offering, the Wag! Platform, connects over 1 million pet owners (“Pet Parents”) with a network of more than 500,000 independent pet caregivers (“Pet Caregivers”) across approximately 5,300 U.S. cities.

- Through the platform, Pet Parents can book a range of services, including on-demand dog walking, pet sitting, boarding, and training.

- As of the Petition Date, over 12 million pet services had been completed via the platform.

Beyond its foundational service marketplace, Wag! has expanded into a comprehensive pet care ecosystem that includes wellness offerings, pet food guidance, and direct-to-consumer product sales. The Company operates a portfolio of online properties, including pet insurance comparison sites (Petted.com, PetInsurer.com), pet food review platforms (DogFoodAdvisor.com, CatFoodAdvisor.com), and a premium pet products e-commerce store (Maxbone.com).

For the year ended December 31, 2024, Wag! reported approximately $70.5 million in revenue, a 16% decline from the previous year. Three customers in the Wag! Wellness division accounted for about 38% of this total.

Wag! Group Co. and its affiliates filed for Chapter 11 protection on July 21, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the District of Delaware, reporting $29.4 million in assets and $29.9 million in liabilities (as of December 31, 2024).

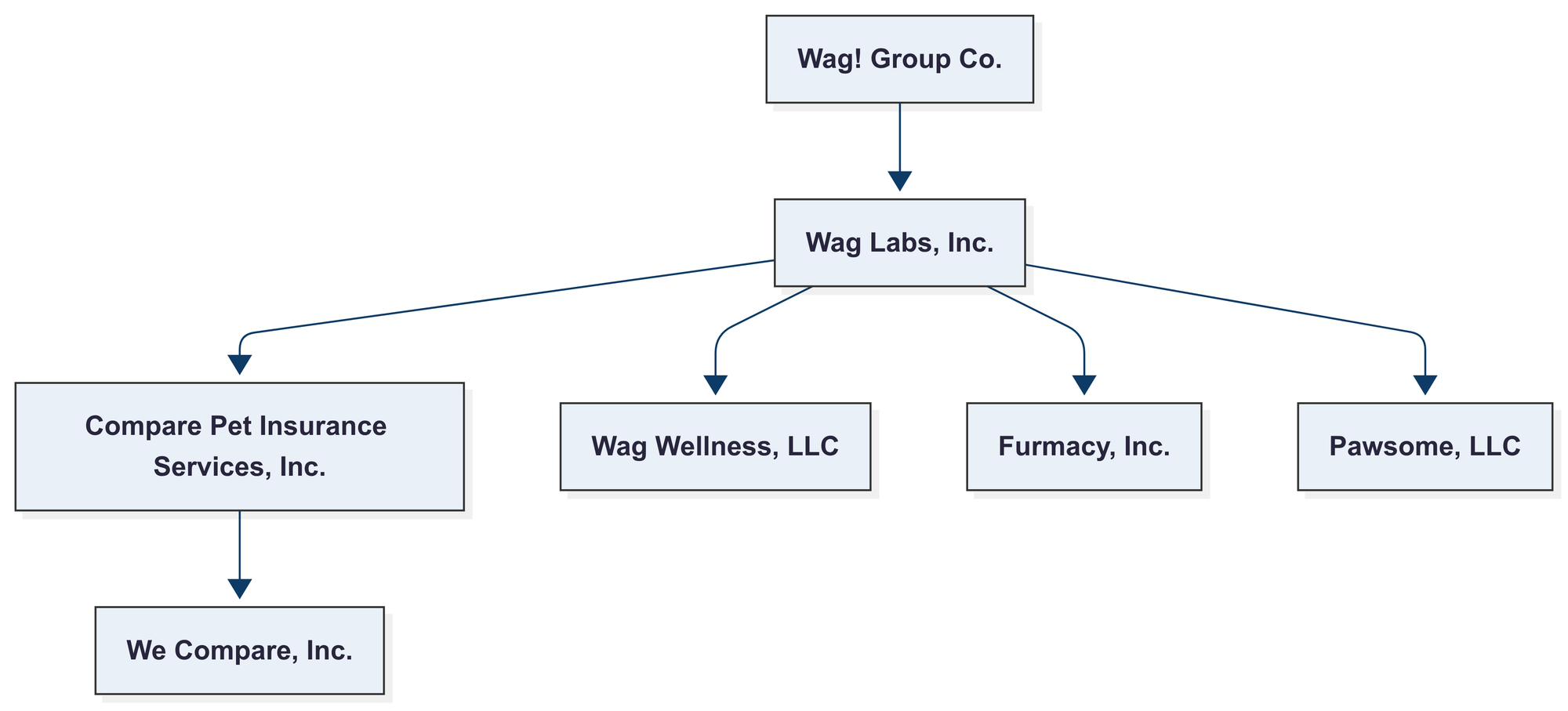

⁽¹⁾ For a complete list of debtor entities, see the organizational structure chart below.

Corporate History

Wag Labs, Inc. ("Wag Labs") was founded in 2014 to simplify pet care logistics, launching its on-demand dog walking app in 2015. Between 2014 and 2017, the Company raised approximately $68 million in venture funding to fuel its early growth. In January 2018, Wag Labs secured a significant $300 million investment from SoftBank’s Vision Fund in exchange for a 45% equity stake. However, by December 2019, this stake was sold back to the Company as it sought to "right-size" its capital base amid a leadership transition.

Public Listing and Expansion

- On August 9, 2022, Wag Labs consummated a de-SPAC business combination with CHW Acquisition Corp., a special-purpose acquisition company, in a deal valued at $350 million. Upon closing, the combined entity was renamed Wag! Group Co. and began trading on the Nasdaq Global Market under the ticker symbol "PET".

- Following its public listing, the Company executed a series of strategic acquisitions to broaden its offerings:

- 2021: Acquired Compare Pet Insurance Services, Inc. ("CPIS") to enter the pet insurance comparison market and formed Wag Wellness, Inc. to develop its subscription wellness services.

- 2022: Acquired the assets of Dog Food Advisor to expand into pet food and treat reviews and acquired Furmacy, Inc. to offer prescription management software for veterinarians.

- 2023: Acquired premium pet apparel and accessories brand Maxbone, Inc., integrating its e-commerce platform.

- 2024: Acquired Rowlo Woof Ltd., the creator of the social media content channel WoofWoofTV, marking its entry into pet media.

Corporate Organizational Structure

Operations Overview

Wag! operates a multi-sided marketplace connecting Pet Parents, Pet Caregivers, and third-party service providers across four primary business segments:

Wag! Wellness Services ($42.7M in 2024 Revenue)

- The Company’s largest segment focuses on pet wellness and insurance-related products.

- Pet Insurance Comparison: Through its licensed broker, CPIS, Wag! enables users to compare and purchase pet insurance plans from third-party providers via its platform and dedicated sites like Petted.com and WeCompare.com. Revenue is generated from referral fees and commissions from insurance partners such as ASPCA Pet Health Insurance, Fetch, and Pets Best.

- Wag! Wellness Plans: A subscription-based preventative care program that reimburses Pet Parents for routine veterinary expenses not typically covered by insurance, such as annual exams, vaccines, and diagnostic tests.

- Vet Chat: A 24/7 telehealth feature connecting Pet Parents with licensed veterinary professionals for on-demand advice.

Pet Care Services ($19.4M in 2024 Revenue)

- The Company’s foundational segment facilitates on-demand and scheduled pet care through the Wag! Platform, including dog walking, pet sitting, and boarding.

- Wag! Premium: A subscription membership ($5.99/month or $59.99/year) that offers Pet Parents discounts on services, waived booking fees, and complimentary access to Vet Chat.

Pet Food & Treats ($6.2M in 2024 Revenue)

- Wag! generates affiliate and advertising revenue by directing pet owners to pet food and treat products through its review platforms, DogFoodAdvisor.com and CatFoodAdvisor.com.

- The Company partners with major retailers and brands like Chewy, Petco, and The Farmer’s Dog, earning referral fees for customer purchases.

Pet Apparel & Products ($2.2M in 2024 Revenue)

- This segment consists of direct-to-consumer retail sales of premium pet apparel and accessories through Maxbone.com. Fulfillment is managed by a third-party logistics partner.

Marketplace Participants

- Pet Caregivers: Wag! maintains a nationwide network of approximately 500,000 vetted, independent Pet Caregivers. The Company charges Caregivers an upfront application fee and retains a recurring percentage commission from each service transaction, which is processed through Stripe. A premium program, Wag! Pro, offers Caregivers enhanced profile visibility and priority access to bookings for a one-time fee.

- Pet Parents: Over 1 million Pet Parents have used the Wag! platform for pet care needs. Revenue is generated through service fees, Wag! Premium subscriptions, product sales, and referral commissions from third-party partners.

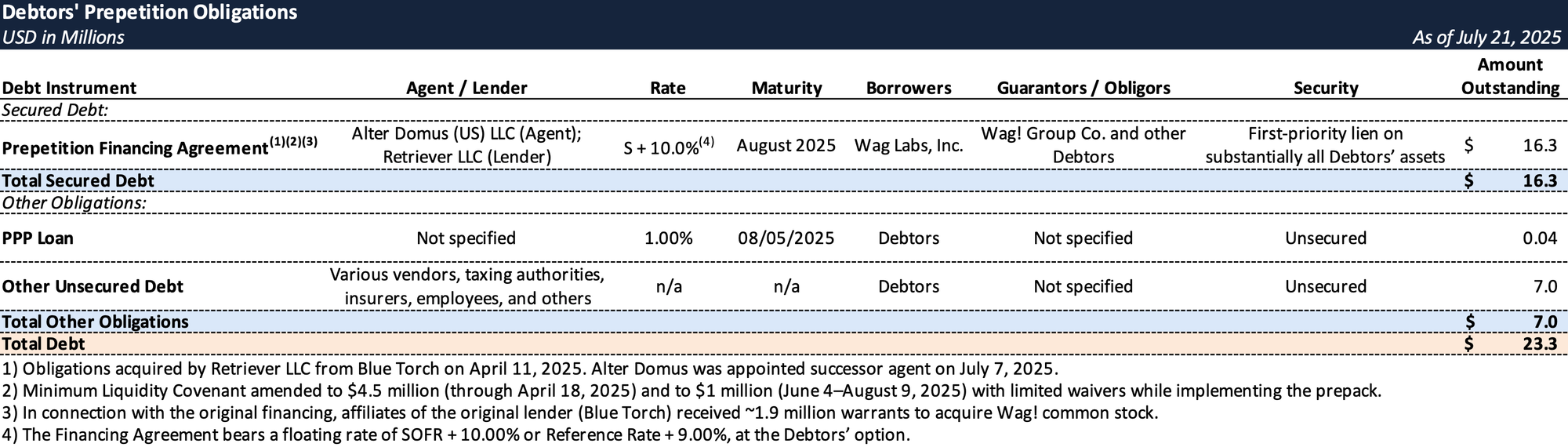

Prepetition Obligations

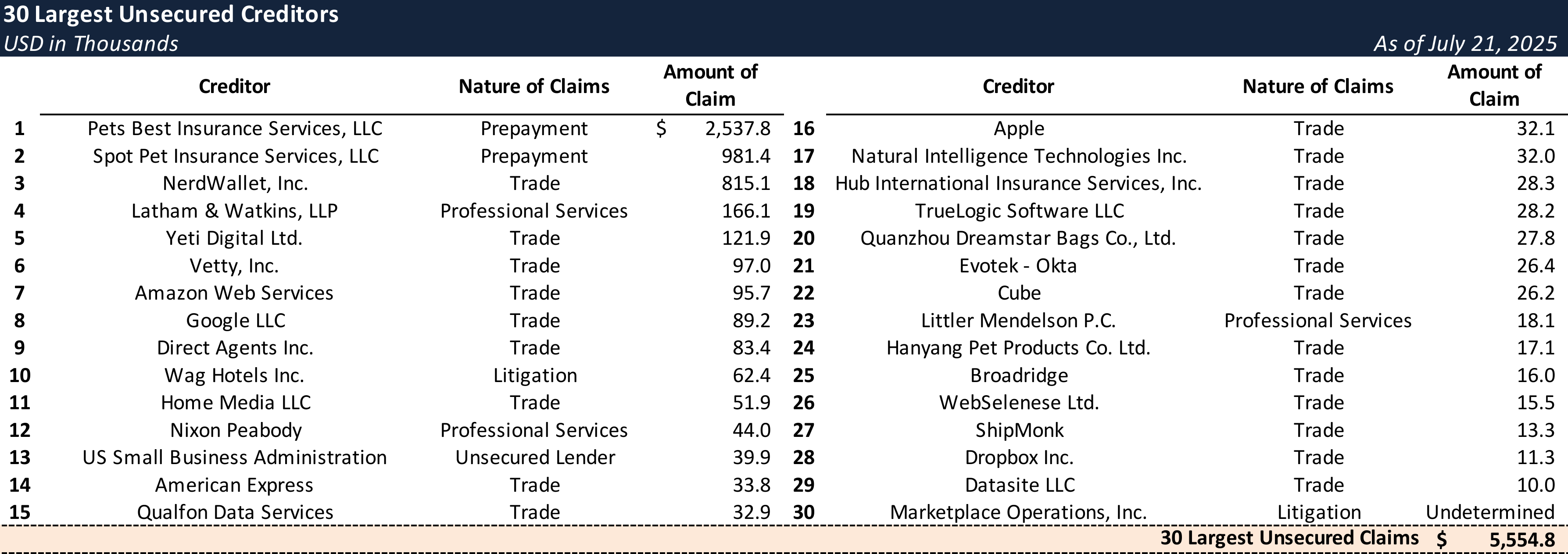

Top Unsecured Claims

Events Leading to Bankruptcy

Operational Losses and Capital Needs

- Wag! has a history of unprofitability, reporting net losses of $38.6 million in 2022, $13.3 million in 2023, and $17.6 million in 2024.

- The Company's core business was severely impacted by the COVID-19 pandemic, which caused a rapid decline in demand for dog walking and boarding services starting in March 2020.

- In an effort to address liquidity, the Company completed a public stock offering in July 2024, raising approximately $8.6 million. In July 2025, it sold its "Furscription" vet pharmacy assets for $5 million. These measures provided only temporary relief and were insufficient to resolve the Company's underlying cash burn and debt load.

Failed Sale and Refinancing Efforts

- In August 2024, the Board retained BofA Securities to explore a sale of the Company. Despite contacting 16 potential buyers and receiving three non-binding indications of interest, the nine-month process failed to yield a definitive offer. Potential suitors cited challenges in securing financing and a desire to acquire assets free of liabilities.

- Concurrently, a year-long effort in 2024, led by Arc Capital Markets, to refinance the Company’s secured debt also proved unsuccessful, with 26 potential financing sources declining to provide new capital.

Capital Structure Pressures

- Wag! was burdened by approximately $16.3 million in outstanding senior secured term loan obligations scheduled to mature in August 2025. With no viable refinancing options, the Company faced an inability to repay this debt.

- The Company’s stock price collapsed, trading below $1.00 since August 2024 and falling below $0.20 by March 2025, which triggered multiple delisting notices from Nasdaq and effectively cut off access to equity capital markets.

- As of the Petition Date, the Company had only $1.7 million in cash against $2.2 million in accounts payable.

Prepackaged Restructuring Plan

- With out-of-court options exhausted, the Board retained restructuring advisors in May and June 2025 and negotiated a prepackaged Chapter 11 plan with its secured lender, Retriever LLC (which had acquired the debt from Blue Torch Finance in April 2025).

- The plan, which received 100% support from the voting class, implements a comprehensive restructuring through a debt-for-equity swap:

- The entirety of the $16.3 million in secured debt will be extinguished in exchange for 100% of the equity in the reorganized Company and $5 million in new senior notes issued to Retriever LLC ("New Notes").

- All general unsecured creditors and other priority claims will be rendered unimpaired and paid in full.

- The sole exception is a contingent litigation claim asserted by Marketplace Operations, Inc., designated as the "Non-Go Forward Claim," which will be canceled with no recovery.

- All existing publicly traded equity will be canceled.

- Upon emergence, Wag! will become a private company, and its stock will be delisted from Nasdaq. The reorganized Company will be supported by an $18.3 million exit financing facility provided by Retriever LLC, comprising the New Notes, DIP claims, and new money.

- On July 22, 2025, the court approved $6.5 million in DIP financing from Retriever, including $4 million available immediately, to fund operations during the Chapter 11 cases.

- The DIP facility includes a milestone requiring confirmation of the proposed plan by August 29, 2025.

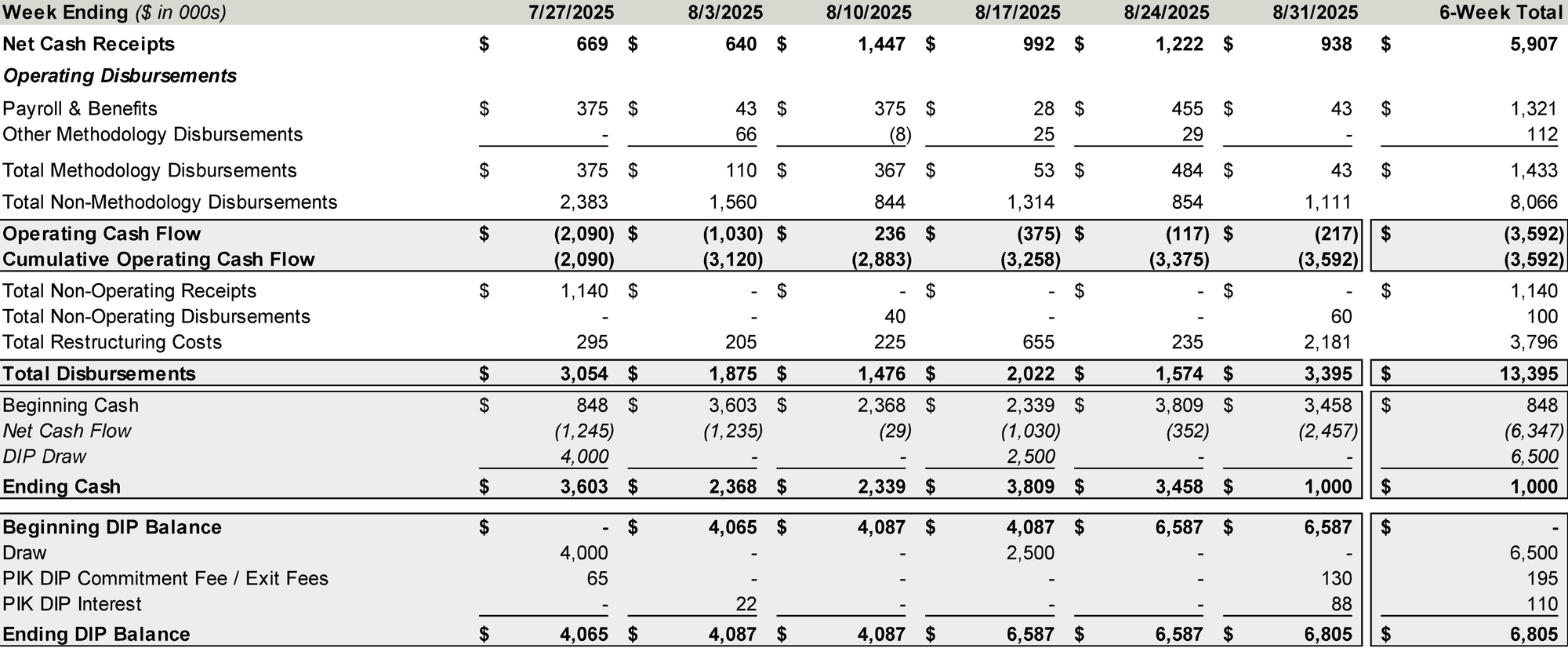

Initial DIP Budget

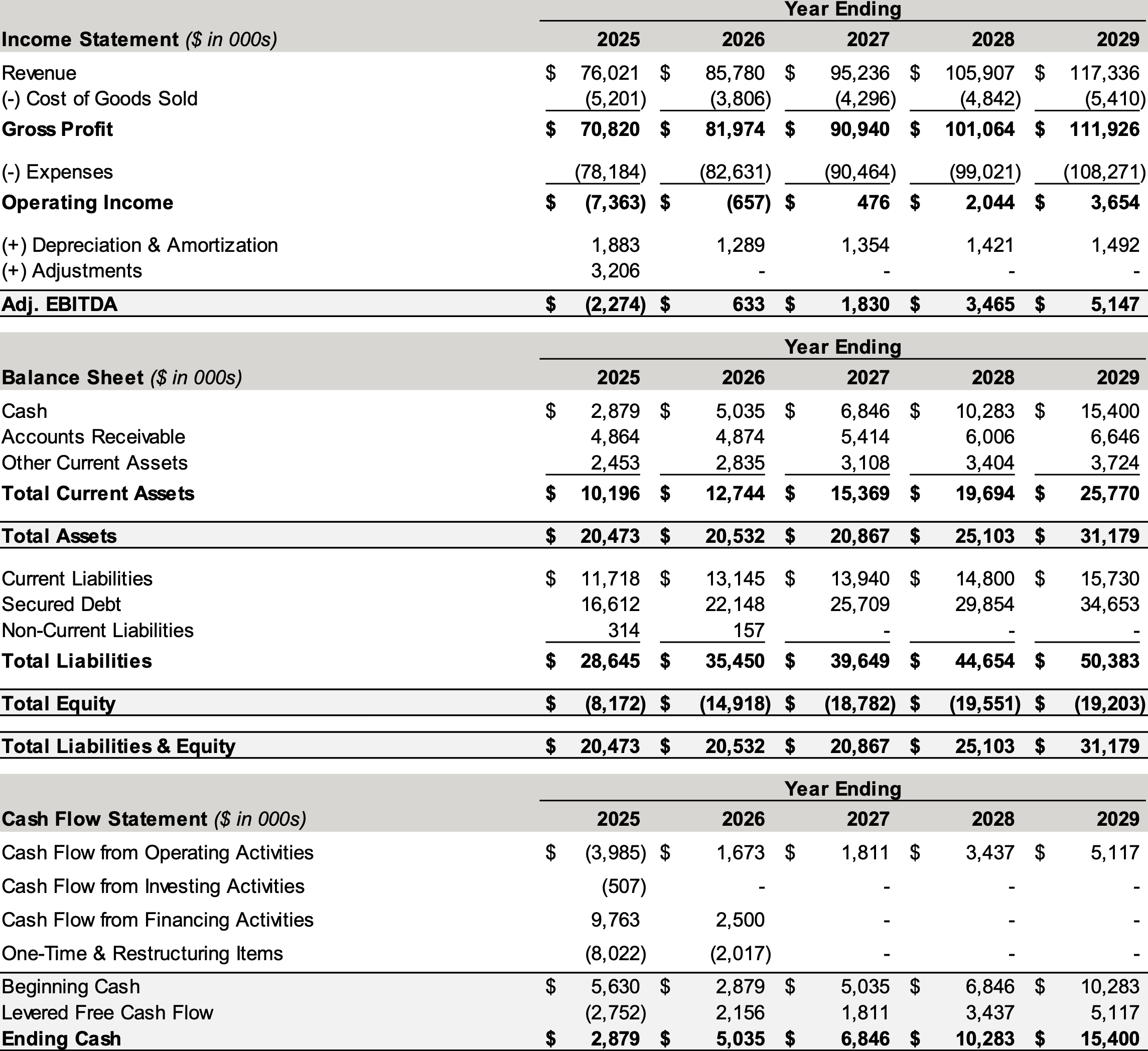

Debtors’ Financial Projections

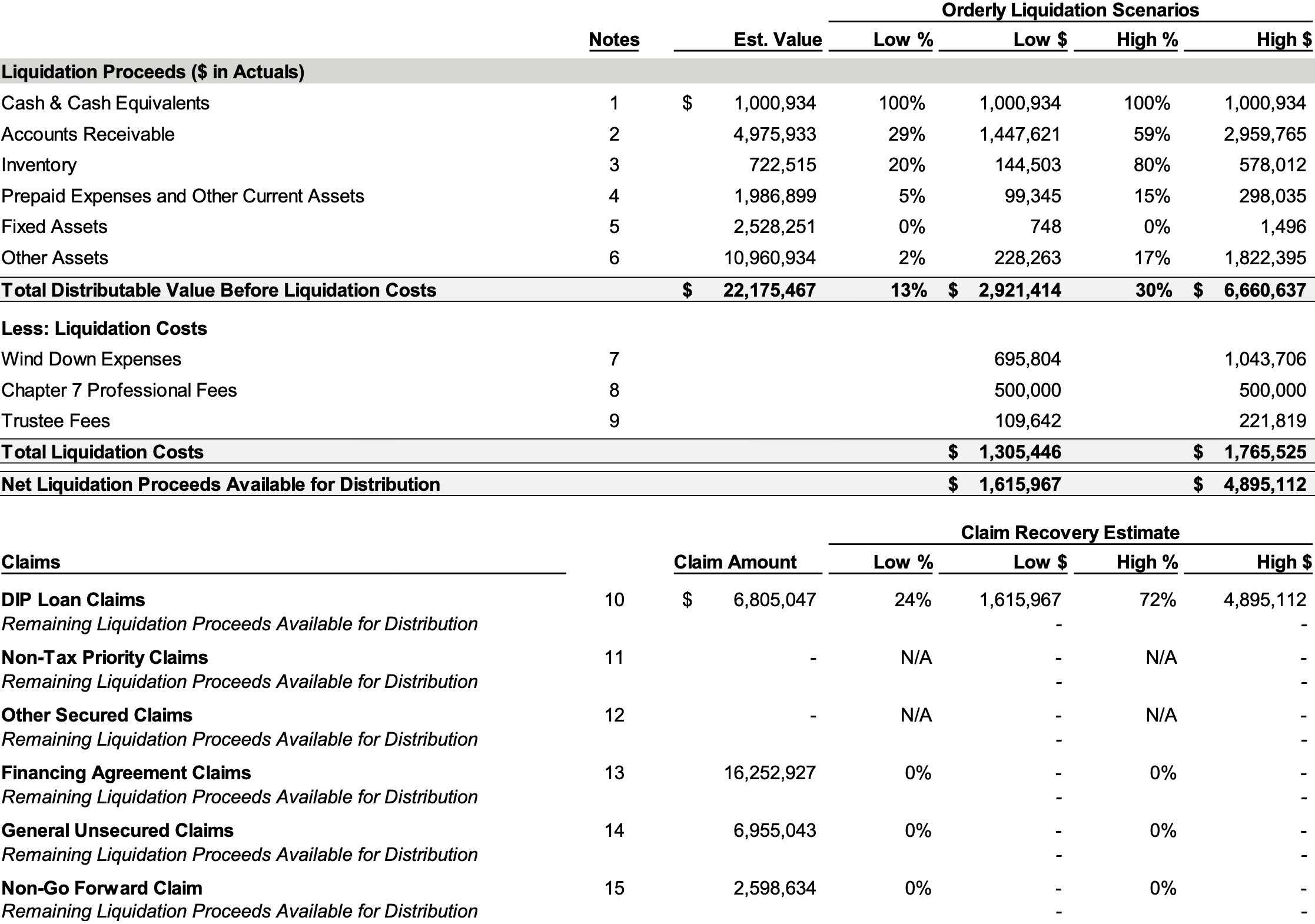

Debtors’ Liquidation Analysis

Key Parties

- Young Conaway Stargatt & Taylor, LLP (counsel); Portage Point Partners (financial advisor); Epiq Corporate Restructuring, LLC (claims agent).

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.