Case Summary: Wellmade Performance Flooring Chapter 11

Wellmade Performance Flooring has filed for Chapter 11 bankruptcy to stay a lender-initiated foreclosure and pursue a going-concern 363 sale following a March labor-trafficking probe, supported by $4 million in DIP financing.

Business Description

Headquartered in Tualatin, OR, Wellmade Floor Coverings International, Inc., along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "Wellmade" or the "Company"), is a privately-held manufacturer of hard-surface flooring, specializing in its patented High-Density Polymer Composite ("HDPC") rigid core technology. The Company supplies its innovative flooring products to leading flooring manufacturers, wholesale distributors, specialty retailers, and major big-box chains, including The Home Depot, Floor & Décor, and Costco.

- Wellmade’s core innovation, HDPC, is a composite core with a vinyl wear layer that offers superior performance benefits, including 100% waterproof construction, enhanced heat resistance, and high density.

- Building on this platform, the Company developed HDPC Opti-Wood, an award-winning waterproof flooring that bonds a real hardwood veneer to the rigid HDPC core, along with a portfolio of waterproof vinyl plank, tile, and strand woven bamboo flooring.

- The Company’s products feature advanced locking systems (Uniclic/Unipush) that allow for easy, glue-less installation.

Wellmade operates primarily as an original equipment manufacturer (OEM) and distributor, serving both residential and commercial end markets across the United States and in select international markets. Its ability to pioneer waterproof hardwood and bamboo flooring has positioned it as a technology leader in the fast-growing luxury vinyl and engineered flooring segments.

Wellmade Floor Coverings International, Inc. and its manufacturing affiliate Wellmade Industries MFR. N.A LLC (collectively, the "Debtors") filed for Chapter 11 protection on August 4, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the Northern District of Georgia, reporting $50 million to $100 million in assets and $10 million to $50 million in liabilities.

⁽¹⁾ Wellmade Industries MFR. N.A LLC.

Corporate History

Founded by brothers Ming “Allen” Chen and Zhu “George” Chen, Wellmade initially operated a small plant in Nanjing, China, producing bamboo flooring for the local market. The Company established its U.S. presence in 2021 with a sales office in Tualatin, OR, and secured a major contract with a national flooring retailer in 2005, which propelled its annual sales to approximately $15 million by 2009.

Diversification and Technological Innovation

- Recognizing the need to expand beyond bamboo, Wellmade pivoted into the high-volume rigid core flooring category in the mid-2010s.

- In 2015, the Company developed and patented its proprietary HDPC® rigid core technology, securing patents in China for stone plastic composite ("SPC") flooring structures. This innovation led to the launch of HDPC-based vinyl plank products and hybrid constructions, such as waterproof hardwood and bamboo with authentic wood veneers.

- The Company’s success was highlighted in 2019 when its Opti-Wood HDPC hardwood line received an Innovation Award from The Home Depot Canada.

U.S. Manufacturing Expansion

- In 2020, Wellmade announced a $35 million investment to build a 328,000-square-foot manufacturing facility in Cartersville, GA, to shorten lead times and reduce its reliance on imports.

- The plant began production in 2022 and rapidly expanded, doubling its output capacity to approximately 200 million square feet per year by 2025, making it the largest SPC/HDPC flooring factory in the United States.

- As of the Petition Date, the Georgia facility was producing an estimated 50% of all SPC rigid-core flooring made in the country, serving as a key OEM manufacturer for numerous well-known flooring brands.

Ownership and Leadership

- The Company is privately held, with parent entity Wellmade Floor Coverings International, Inc. ("WFCI") owned by Allen Chen (51%) and George Chen (49%). WFCI wholly owns the Georgia manufacturing subsidiary and several non-Debtor affiliates in China and the U.S.

- Following a lender default, David Baker of Aurora Management Partners was appointed Chief Restructuring Officer (CRO) in July 2025 with full authority over the Company's financial and restructuring efforts.

- Co-founder and former manager George Chen is no longer employed by the Company.

Corporate Organizational Structure

Operations Overview

Wellmade designs, produces, and distributes a wide range of hard surface flooring collections, operating through its manufacturing hub in Cartersville, GA, and its corporate headquarters and distribution center in Tualatin, OR. The Company is an established leader in flooring technology, specializing in patented waterproof rigid core products.

Product Portfolio and Technology

- HDPC Rigid Core Technology: Wellmade’s flagship innovation is its HDPC technology, a patented rigid core that is waterproof, dimensionally stable, and enhances durability. This non-toxic core is GREENGUARD certified for indoor air quality.

- Product Lines: Leveraging its HDPC core, the Company offers a diverse portfolio of flooring solutions suitable for both residential and commercial applications:

- HDPC Waterproof Vinyl: Available in plank and tile formats, these products feature realistic hardwood visuals and are constructed using a co-extrusion process that eliminates the need for adhesives.

- HDPC Waterproof Hardwood (Opti-Wood): This innovative hybrid product couples the performance of a rigid core with the authentic look and feel of a real hardwood veneer, making it highly resistant to moisture, dents, and scratches.

- HDPC Waterproof Bamboo: Similar to Opti-Wood, this line combines the natural aesthetic of strand-woven bamboo with the durability and waterproof features of the HDPC core.

- Advanced Features: Wellmade floors incorporate features designed for performance and ease of use, including the HardMax® Nano Finish for superior abrasion and stain resistance, and Uniclic®/Unipush® locking systems for simple, glue-less installation.

Manufacturing and Supply Chain

- U.S. Manufacturing: The Company’s 328,000-square-foot facility in Cartersville, GA, is a state-of-the-art plant featuring advanced automation for producing its rigid core flooring lines. Wellmade also maintains a global supply chain network, with its original strand bamboo manufacturing based in China.

- Go-to-Market Strategy: Wellmade primarily operates as an OEM supplier, creating private label collections for major flooring manufacturers, distributors, and large retail partners. The Company also offers Wellmade-branded products through a network of specialty flooring retailers.

Commercial and Distribution

- Wellmade's commercial division works directly with architects, designers, and contractors to provide flooring solutions for various sectors, including multi-family housing, retail, hospitality, and healthcare.

- The Company’s dual presence in Oregon and Georgia allows for an efficient distribution network, with its Tualatin-based warehouse serving the West Coast and the Georgia plant supplying customers across the rest of the country.

Prepetition Obligations

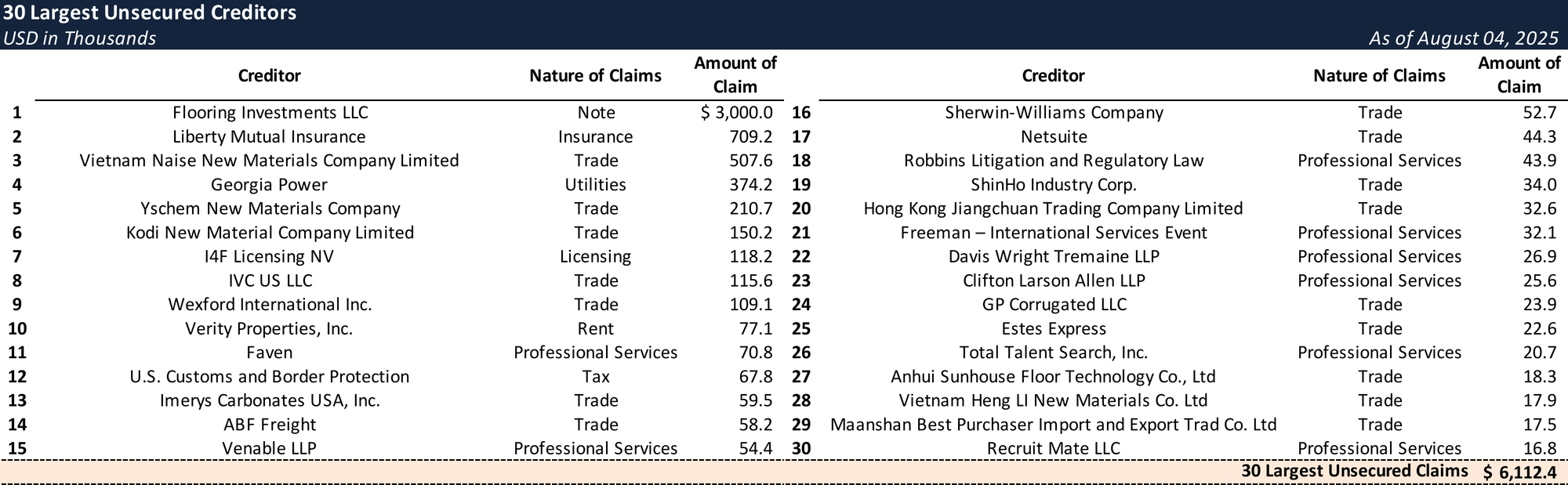

Top Unsecured Claims

Events Leading to Bankruptcy

Labor Trafficking Allegations and Operational Disruption

- On March 26, 2025, federal and state law enforcement, including U.S. Immigration and Customs Enforcement (ICE) and the FBI, raided Wellmade’s Cartersville plant as part of a multi-year labor trafficking investigation.

- Authorities arrested co-founder George Chen and his nephew, Jiayi “Jia” Chen, on state charges of trafficking persons for labor servitude.

- The Company was accused of fraudulently recruiting dozens of immigrant workers from China and subjecting them to harsh working and living conditions. A subsequent civil lawsuit was filed against Wellmade alleging violations of the Trafficking Victims Protection Act and federal labor laws.

- The raid and ensuing allegations caused severe reputational damage and operational instability, though the plant reopened two days later under interim management.

Lender Default and Forbearance

- The fallout from the raid triggered a swift financial crisis. On April 18, 2025, Wellmade’s primary lender, Northwest Bank ("NWB"), issued a notice of default, citing covenant breaches.

- NWB required the Company to engage a financial advisor, leading to the retention of Aurora Management Partners. By July 3, 2025, Aurora’s David Baker was appointed as Chief Restructuring Officer (CRO) with full control over the Company.

- On May 20, 2025, NWB exited the relationship by selling all of Wellmade’s debt to AHF IC, LLC, a major customer of the Company. AHF IC entered into a forbearance agreement with the Company, which expired on July 4, 2025.

Foreclosure Proceedings and Chapter 11 Filing

- After the forbearance period lapsed without a resolution, AHF IC initiated foreclosure proceedings, scheduling a UCC sale of Wellmade’s assets for July 22, 2025, to satisfy the outstanding $18 million in secured debt.

- The sale was postponed several times as AHF IC, acting as both creditor and prospective buyer, engaged in negotiations for a stalking-horse bid to acquire the business.

- With the final foreclosure sale looming on August 5, 2025, and no deal finalized, the Company filed for Chapter 11 protection to stay the sale and preserve the value of the business as a going concern.

DIP Financing and Proposed 363 Sale

- To fund operations through the bankruptcy, the Debtors secured a $4 million DIP financing facility from SummitBridge National Investments VIII LLC.

- The DIP financing provides immediate liquidity to maintain operations and support a court-supervised sale process, which had been initiated prepetition by investment bank Hilco Corporate Finance.

- The Debtors intend to conduct a sale of substantially all assets under Section 363 of the Bankruptcy Code, with the goal of maximizing value by selling the business as a going concern. AHF IC is considered a prime candidate to serve as the stalking-horse bidder.

Key Parties

- Greenberg Traurig, LLP (counsel); Aurora Management Partners (financial advisor / CRO, David Baker); Kurtzman Carson Consultants, LLC dba Verita Global (claims agent).

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.