Case Summary: White Forest Resources Chapter 11

White Forest Resources has filed for Chapter 11 bankruptcy amid operational challenges, seeking to sell one of its two coal mines as part of its restructuring.

Business Description

Headquartered in Ashford, WV, White Forest Resources, Inc., along with its Debtor affiliates⁽¹⁾ (collectively, "White Forest" or the "Debtors"), is a privately-held producer of premium metallurgical and thermal coal, operating primarily in the Central Appalachian coal basin.

- The Debtors manage two key mining operations in West Virginia, catering to a diverse customer base that includes steel producers, commodities brokers, and industrial customers for metallurgical coal, as well as electric utilities and industrial companies for thermal coal.

White Forest reported approximately $80.3 million in coal sales YTD through November 2024, with an EBITDA loss of $3.6 million for the same period.

As of the Petition Date, the Debtors employed approximately 125 workers, primarily at its mines, including 25 salaried staff and the rest hourly, none of whom are unionized. The Debtors also retained one engineering contractor.

White Forest filed for Chapter 11 protection on Feb. 7 in the U.S. Bankruptcy Court for the District of Delaware. As of the Petition Date, the Debtors reported $0 to $50,000 in assets and $50 million to $100 million in liabilities.

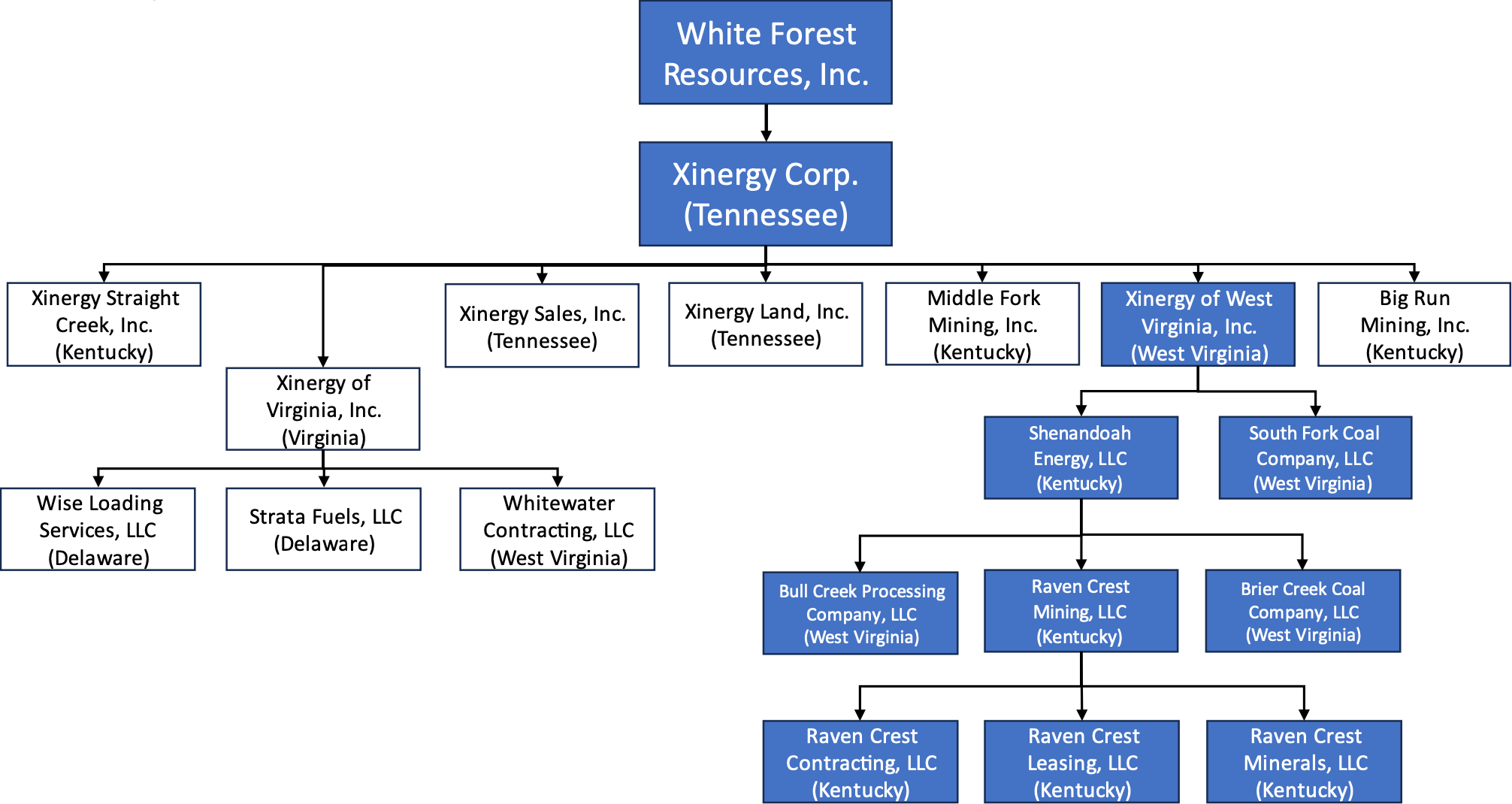

⁽¹⁾ Xinergy Corp.; Xinergy of West Virginia, Inc.; Shenandoah Energy, LLC; South Fork Coal Company, LLC; Bull Creek Processing Company, LLC; Raven Crest Mining, LLC; Brier Creek Coal Company, LLC; Raven Crest Contracting, LLC; Raven Crest Leasing, LLC; and Raven Crest Minerals, LLC.

Corporate History

White Forest Resources, Inc., a Delaware corporation, serves as the parent entity of the Debtors, with ownership primarily held by investment funds managed by Spectrum Group Management LLC.

Organizational Structure⁽²⁾

⁽²⁾ Debtor entities are highlighted in blue.

Operations Overview

Sales & Distribution

White Forest's metallurgical coal, predominantly sourced from the South Fork Mine, is sold under long-term contracts exceeding twelve months, with approximately 90% of production committed to such agreements.

- These contracts often feature negotiated prices or index-based pricing, some including annual floor pricing to mitigate volatility.

- In contrast, thermal coal and a smaller portion of metallurgical coal are sold through short-term contracts or spot pricing, exposing these sales to market fluctuations.

Operational efficiency is crucial, with costs encompassing production, transportation, and logistics. The majority of coal is transported via CSX railways, with the remainder shipped by truck, making the Debtors susceptible to rail disruptions and logistical challenges.

South Fork Mine

Located in Greenbrier County, WV, the South Fork Mine spans over 36,000 acres, producing premium mid-volatile metallurgical coal through contour and highwall mining.

- In 2024, through November, it yielded 304,094 tons of coal, processed at the Clearco Preparation Plant and shipped via CSX from the New River Freight District.

- The mine holds ten active permits from the West Virginia Department of Environmental Protection ("WVDEP"), with surety bonds covering reclamation obligations.

Raven Crest Mine

In Boone and Kanawha Counties, the Raven Crest Mine manages 26,000 acres, focusing on thermal coal production through contour and highwall mining.

- In 2024, through November, it produced 197,356 tons, processed at the Bull Creek facility and shipped via CSX from the Kanawha Freight District.

- The mine holds sixteen active permits from the WVDEP, with associated environmental obligations.

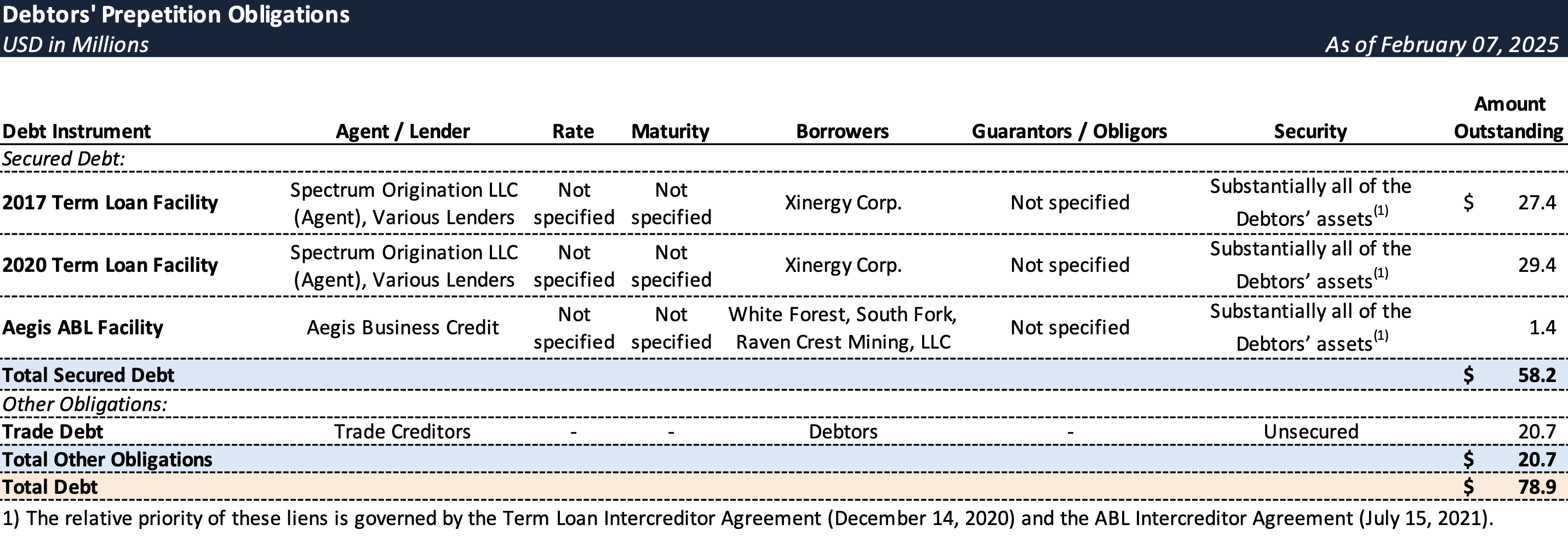

Prepetition Obligations

In addition to the loan facilities described above, the Debtors incur, collect, and remit various Taxes and Fees—including severance, reclamation, and business-related taxes and fees. As of the Petition Date, the total outstanding Taxes and Fees are estimated at approximately $14.7 million, with about $1.3 million becoming due within the first 21 days following the Petition Date.

Unpaid Severance & Reclamation Taxes:

- Certain Debtors—specifically, South Fork and Raven Crest Minerals—incur severance taxes (a tax on the extraction of natural resources such as coal) and reclamation taxes (related to the environmental restoration of mined land). These taxes are payable monthly to the West Virginia State Tax Department, and the State has filed tax liens for these unpaid liabilities.

Operating Leases:

- The Debtors are party to various operating leases related to their mining operations. For example, Raven Crest Minerals is bound by multiple leases—including a Coal Lease, a Coal Loading Facility Lease and Operating Agreement, and a Surface Lease with Penn Virginia Operating Co., LLC (or its subsidiaries)—while South Fork is similarly bound by its own set of leases. These arrangements require the payment of royalties and related fees.

Equipment Leases:

- The Debtors also lease equipment from various lessors. The terms—including interest rates, maturities, and outstanding balances—vary across agreements.

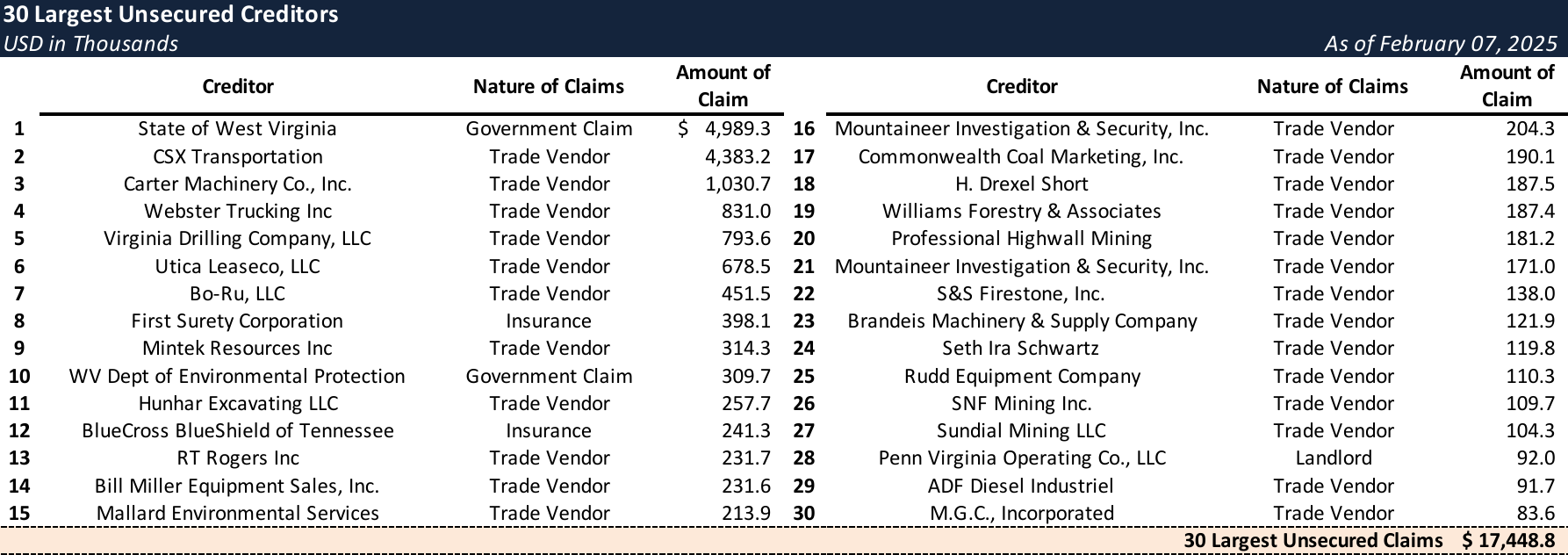

Top Unsecured Claims

Events Leading to Bankruptcy

Operational Challenges and Production Disruptions

- White Forest faced significant operational difficulties beginning in March 2019, with unexpected production halts at the South Fork Mine and reduced output at the Raven Crest Mine.

- These disruptions, compounded by a challenging weather season, eroded the liquidity cushion built in 2018, leading to a $5-$7 million shortfall in May 2019.

- In response, White Forest underwent a recapitalization to simplify its capital structure and improve leverage.

- Just two days post-recapitalization, a high wall miner accident at the South Fork Mine in June 2019 caused substantial damage, halting production for most of June and July. This necessitated significant unplanned expenditures for a replacement, straining liquidity in late 2019.

- The COVID-19 pandemic in 2020 exacerbated coal price drops, with a major customer cancelling orders, leaving 60,000 tons of unsold coal, valued at approximately $4 million based on 2019 pricing. The Raven Crest Mine was idled, and the Debtors faced liquidity constraints as coal markets struggled.

- A 2020 credit agreement was secured in December to address these challenges.

- Despite a rebound in 2021 and 2022, 2023 brought intermittent working capital issues, a trucking dispute, and high wall miner shutdowns, reducing liquidity by $2 million. Production fell sharply, with increased costs per ton.

- 2024 saw temporary recovery, but operational issues resurfaced in June with high wall miner outages at both mines.

- November and December 2024 brought further disruptions, including a snowstorm, water pump failures, and a rockslide, delaying shipments and worsening liquidity.

- January 2025 issues included equipment failures and a Cessation Order, further interrupting operations.

Liquidity Crisis and Financial Strain

- The cumulative operational disruptions from late 2024 into early 2025 led to severe liquidity issues, prompting the need for Chapter 11 protection to secure DIP financing and reorganize.

- White Forest plans to sell Raven Crest Mine assets via a Section 363 process and restructure the South Fork Mine operations.

Restructuring Initiatives and Sale Process

- In October 2023, the Debtors engaged Energy Ventures Analysis to market Raven Crest Assets, identifying potential buyers.

- A stalking horse bid was received, with terms finalized in the Raven Crest Stalking Horse APA.

- The sale process is expected to expedite due to limited funding, aiming to preserve asset value.

Post-Petition Financing

- The Debtors secured a DIP Facility offering up to $12.3 million, crucial for operational continuity and asset preservation.

- The DIP Facility comprises up to $8.3 million in new money term loans and up to $4 million in new money revolving credit.

- Despite exploring other options, this facility was deemed the best available, negotiated at arm's length with lender support.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.