Case Summary: Whitehorse 401 Chapter 11

Whitehorse 401 has filed for Chapter 11 bankruptcy for the second time in a year after losing its anchor tenant, aiming to halt foreclosure on its New Jersey office building.

Business Description

Whitehorse 401 LLC (“Whitehorse” or the “Debtor”) owns a 208,000 square foot office building known as Voorhees Tech Center Bldg 1, located at 401 White Horse Rd, Voorhees Township, NJ (the “Property”).

- The Property is situated on an approximate 26-acre site and was constructed in 1971, with renovations completed in 2000.

Whitehorse acquired the Property in January 2017 through a purchase and sale agreement dated August 30, 2016, with LSREF2 OREO (Direct), LLC, as the seller.

- The purchase was financed with a $12.95 million loan from LSTAR Capital Finance II, Inc., an affiliate of the seller.

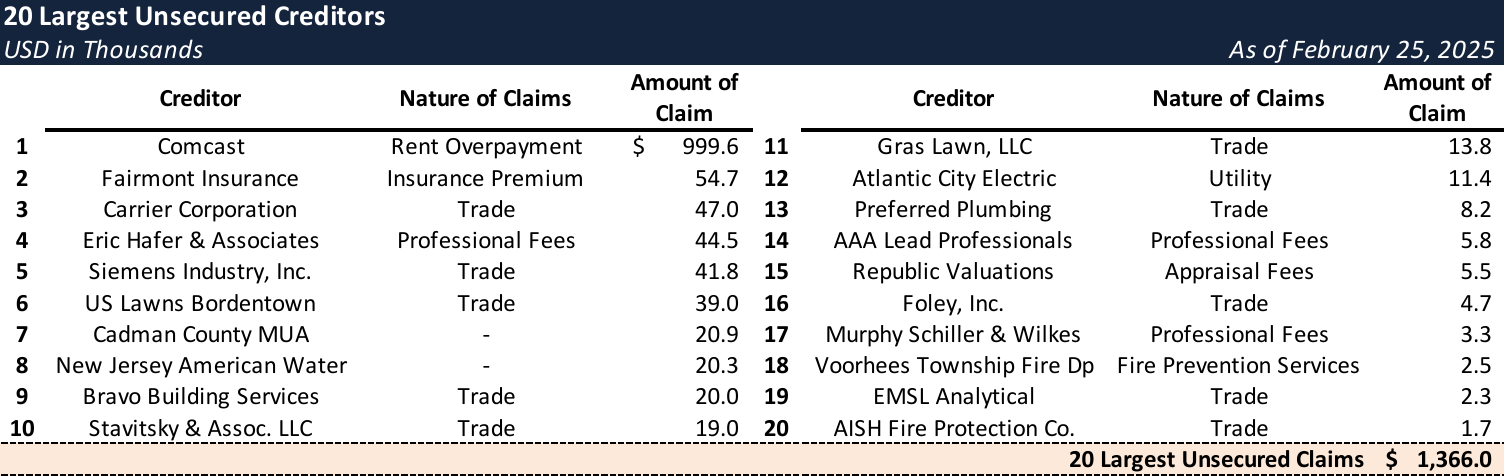

At the time of acquisition, the Property was fully leased to Comcast of New Jersey II LLC, generating sufficient rent to cover debt service. However, the Comcast Lease expired in June 2023, and Comcast opted not to renew, leaving the Property vacant.

Whitehorse filed for Chapter 11 protection on Feb. 25 in the U.S. Bankruptcy Court for the Eastern District of New York. As of the Petition Date, the Debtor reported $5.1 million in assets and $15.4 million in liabilities.

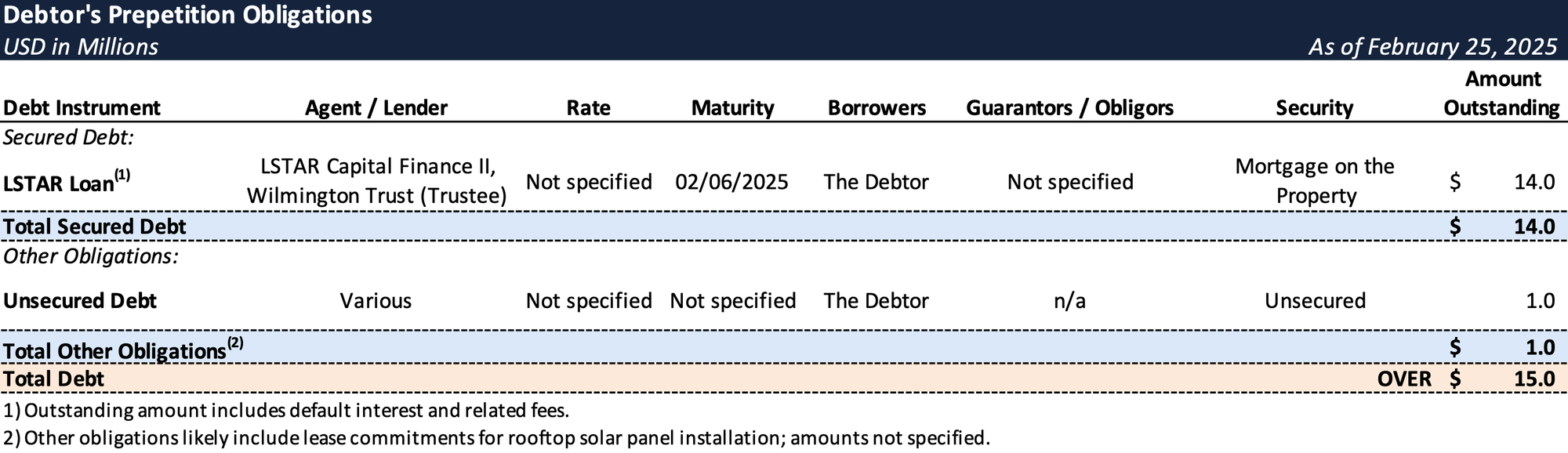

Prepetition Obligations

Top Unsecured Claims

Events Leading to Bankruptcy

- Whitehorse’s financial distress was triggered by the expiration of the Comcast Lease, resulting in a loss of rental income and subsequent default on the LSTAR Loan, now held by Wilmington Trust as trustee of the REMIC trust. Key events include:

- March 2023: Wells Fargo, as master servicer, declared a default after the Debtor failed to make the March loan payment. A default rate was subsequently imposed, nearly doubling monthly loan obligations.

- May 19, 2023: Wilmington Trust formally accelerated the LSTAR Loan due to continued defaults.

- July 2023: Wilmington Trust initiated foreclosure proceedings in New Jersey state court, securing a judgment of foreclosure.

- Whitehorse previously sought Chapter 11 protection on June 11, 2024 (Case No. 24-42466), but the case was dismissed on November 13, 2024.

- Following the dismissal, the foreclosure sale was scheduled for March 5, 2025.

Material Changes Leading to Second Chapter 11 Filing

- Since the dismissal of the prior Chapter 11 case, Whitehorse has made significant progress in re-leasing the Property:

- Whitehorse recently entered into an interim rental agreement with a division of the State of New Jersey, leasing 56,870 square feet to the Department of Law & Public Safety and the Department of Child Protection & Permanency for $1.41 million annually under a two-year term.

- The Debtor is also in active discussions to lease an additional 34,000 square feet to a prospective tenant.

Chapter 11 Filing

- To prevent foreclosure, preserve its investment, and mitigate potential tax consequences, Whitehorse has filed this second Chapter 11 case on February 25, 2025. The Debtor intends to either negotiate a resolution with the Lender or confirm a reorganization plan over the Lender’s objection.

- Whitehorse plans to file a plan of reorganization and disclosure statement shortly after the Chapter 11 filing.

- The Debtor will seek court approval to expedite proceedings, including motions for shortened notice to approve the disclosure statement and schedule a confirmation hearing on the plan.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.