Case Summary: Wolfspeed Chapter 11

Wolfspeed has filed for Chapter 11 bankruptcy amid liquidity pressures from uncertain CHIPS Act funding and upcoming note maturities, with a prepackaged plan to cut over $4.5 billion of debt.

Business Description

Headquartered in Durham, NC, Wolfspeed, Inc., along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, “Wolfspeed” or the “Company”), is a leading developer and manufacturer of wide-bandgap semiconductors, specializing in silicon carbide (“SiC”) and gallium nitride (“GaN”) technologies.

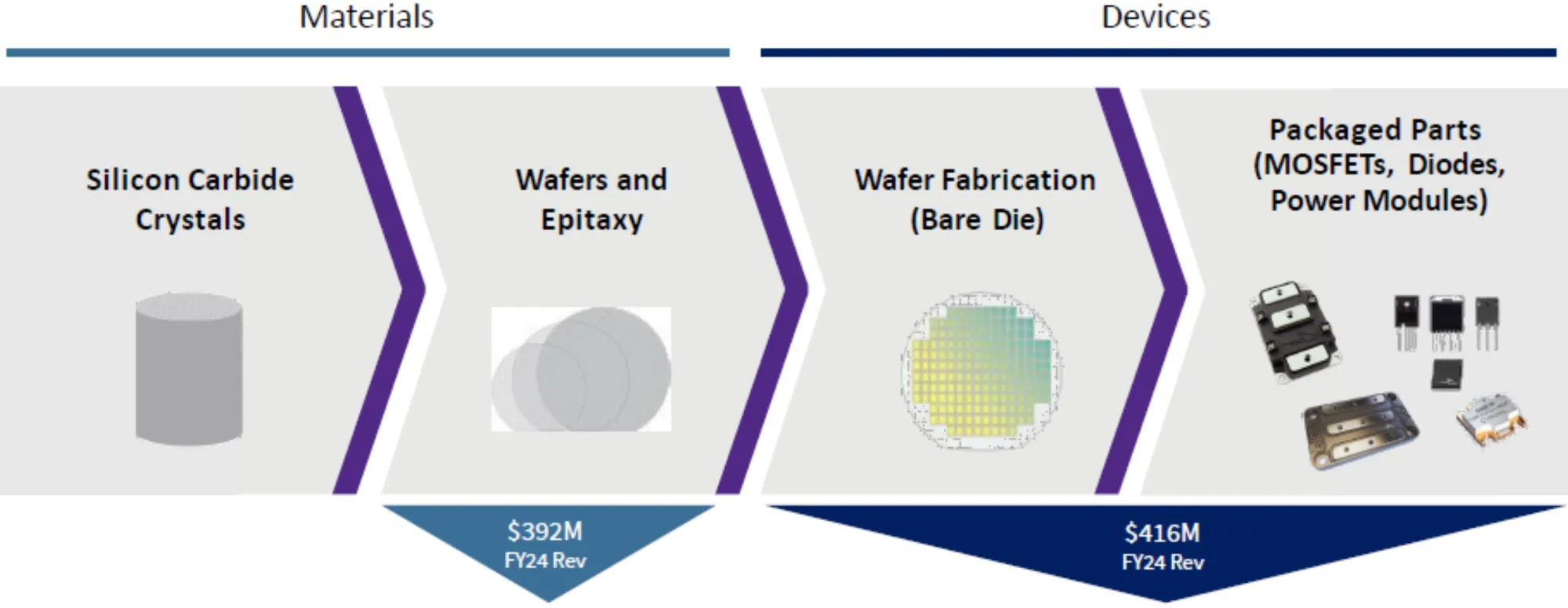

- The Company operates through two primary segments:

- Materials: Produces and sells SiC bare wafers, epitaxial wafers, and GaN epitaxial layers to corporate, government, and university customers for use in radio-frequency, power, and other applications.

- Power Devices: Designs and manufactures SiC-based power components, including Schottky diodes, metal-oxide-semiconductor field-effect transistors (MOSFETs), and power modules, which offer superior efficiency and performance over traditional silicon devices.

- Wolfspeed’s products are critical components in high-growth sectors such as electric vehicles (EVs), fast-charging infrastructure, renewable energy systems, server power supplies, and military and telecommunications applications.

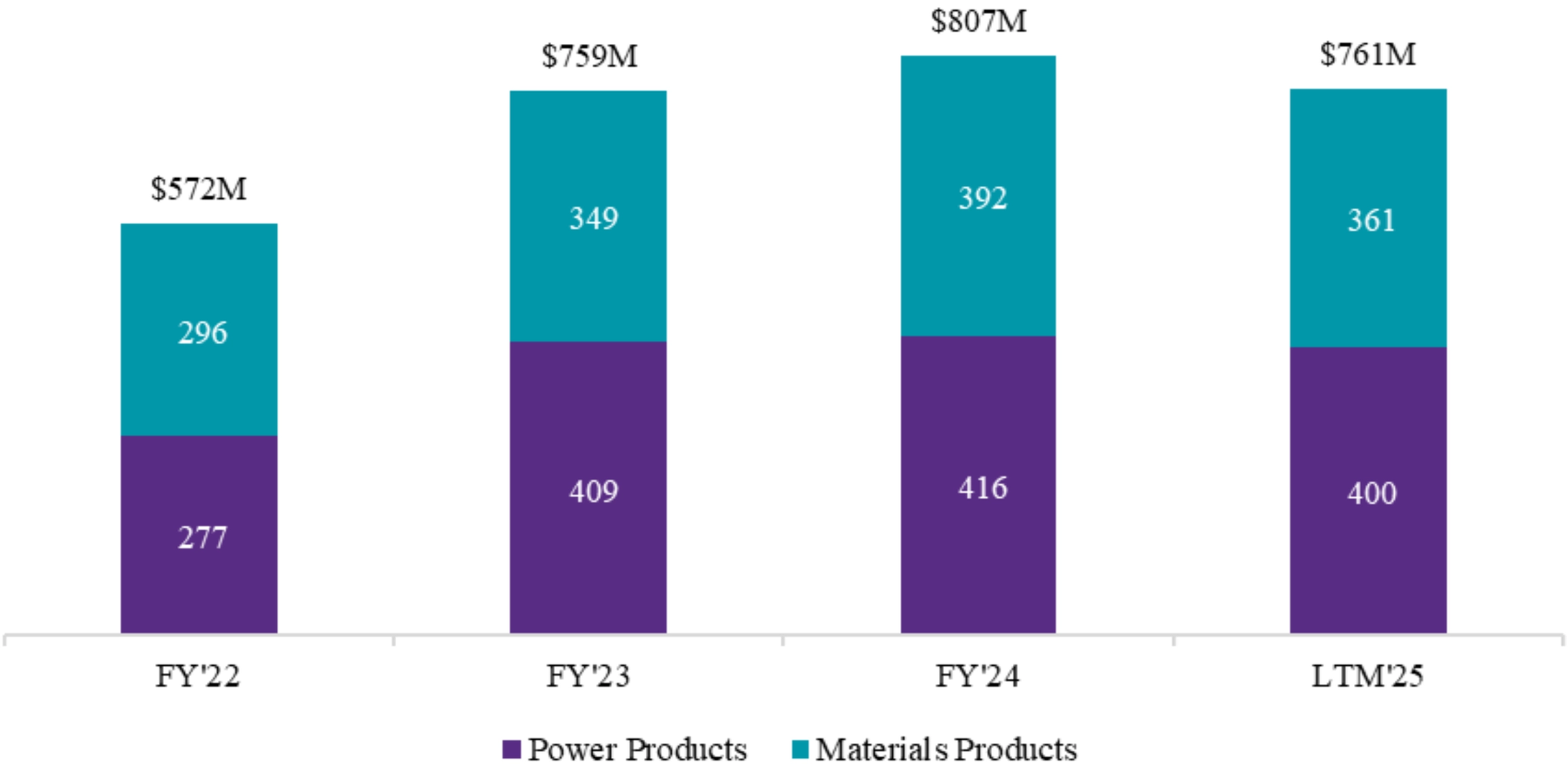

For the nine months ended March 30, 2025, the Company reported revenue of $560.6 million, a decrease from $606.5 million in the prior-year period, alongside a net loss of $939.9 million. The significant losses reflect the heavy costs associated with ramping up new manufacturing facilities and below-capacity utilization.

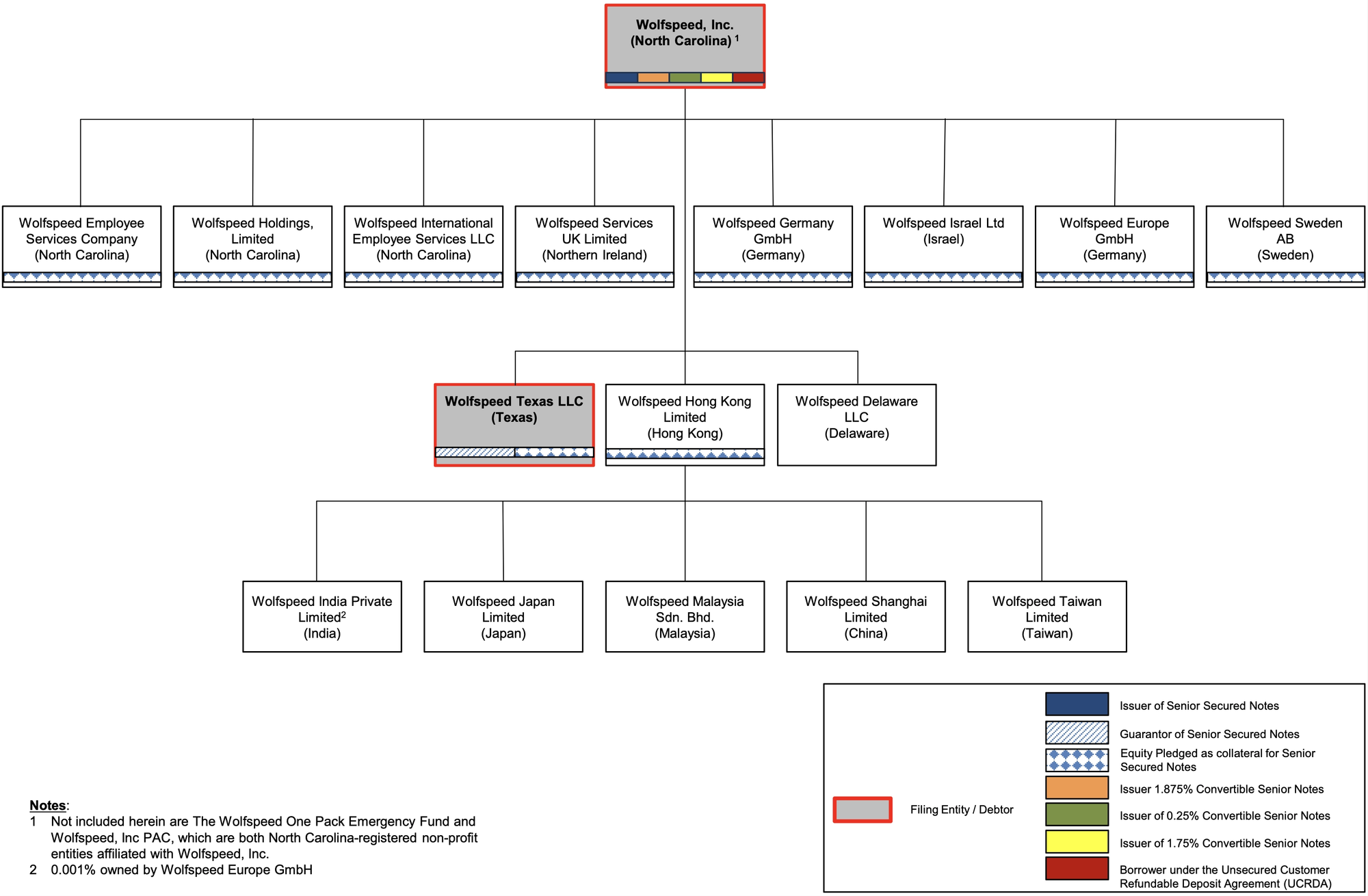

Wolfspeed, Inc. and Wolfspeed Texas LLC filed for Chapter 11 protection on June 30, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the Southern District of Texas. As of the quarter ended March 30, 2025, the Company reported $7.6 billion in assets and $6.7 billion in liabilities.

⁽¹⁾ Wolfspeed Texas LLC.

Corporate History

Founded in 1987 as Cree Research, Inc., the Company initially focused on developing silicon carbide for commercial use in semiconductors and lighting. After going public in 1993, Cree established itself as a pioneer in advanced materials, introducing the first commercial blue light-emitting diode (LED) in 1989 and the first commercial SiC wafer by 1991.

- The Company expanded through acquisitions, including Ruud Lighting in 2011 to broaden its LED lighting portfolio and certain radio-frequency (RF) power device assets from Infineon Technologies AG in 2018.

Strategic Pivot to SiC Pure-Play

- Beginning in the late 2010s, the Company executed a strategic pivot to concentrate exclusively on the high-growth SiC semiconductor market, divesting its non-core businesses:

- The Lighting Products division was sold in 2019.

- The LED business was sold in 2021.

- The RF business was sold to MACOM Technology Solutions in 2023.

- In October 2021, to underscore its new focus, the company officially rebranded from Cree, Inc. to Wolfspeed, Inc., adopting the name of its SiC semiconductor division.

Corporate Governance and Leadership

- Amid recent financial challenges, Wolfspeed’s Board of Directors underwent several changes. In March 2025, the Board appointed Robert Feurle as the new Chief Executive Officer, effective May 1, 2025. Two new independent directors, Mark Jensen and Paul V. Walsh, joined the Board in May 2025.

- To oversee its restructuring, the Board established special committees:

- A Finance Committee was formed in November 2024 to evaluate the Company’s capital structure and financing alternatives, holding over 90 formal meetings in the lead-up to the bankruptcy filing.

- A Special Investigation Committee was formed in May 2025 to investigate any potential claims or causes of action on behalf of the Company’s estate.

Corporate Organizational Structure

Operations Overview

Wolfspeed’s operations are centered on its advanced, U.S.-based manufacturing footprint, which supports its Materials and Power Devices business segments. The Company’s business model spans the entire SiC value chain, from producing raw wafers to fabricating finished power components.

Manufacturing Assets

- The Company’s primary manufacturing facilities are located in the United States and represent a multi-billion-dollar investment to scale capacity for the global shift toward electrification:

- Durham, NC: The Company’s headquarters and original campus, housing a SiC wafer fabrication facility and materials production.

- Mohawk Valley Fab (Marcy, NY): Opened in April 2022, this is the world’s first purpose-built, fully automated 200mm SiC fabrication facility, designed to significantly increase Wolfspeed’s device production capacity.

- Siler City Facility (Siler City, NC): The world’s largest 200mm SiC materials factory, which began operations in June 2024. The facility is projected to enable a more than tenfold increase in the Company’s materials production capacity.

- Fayetteville, AR: A key device manufacturing site.

- Plans for a European factory in Germany, announced in February 2023, were placed on indefinite hold in October 2024 as the Company grappled with financial pressures.

Revenue Breakdown

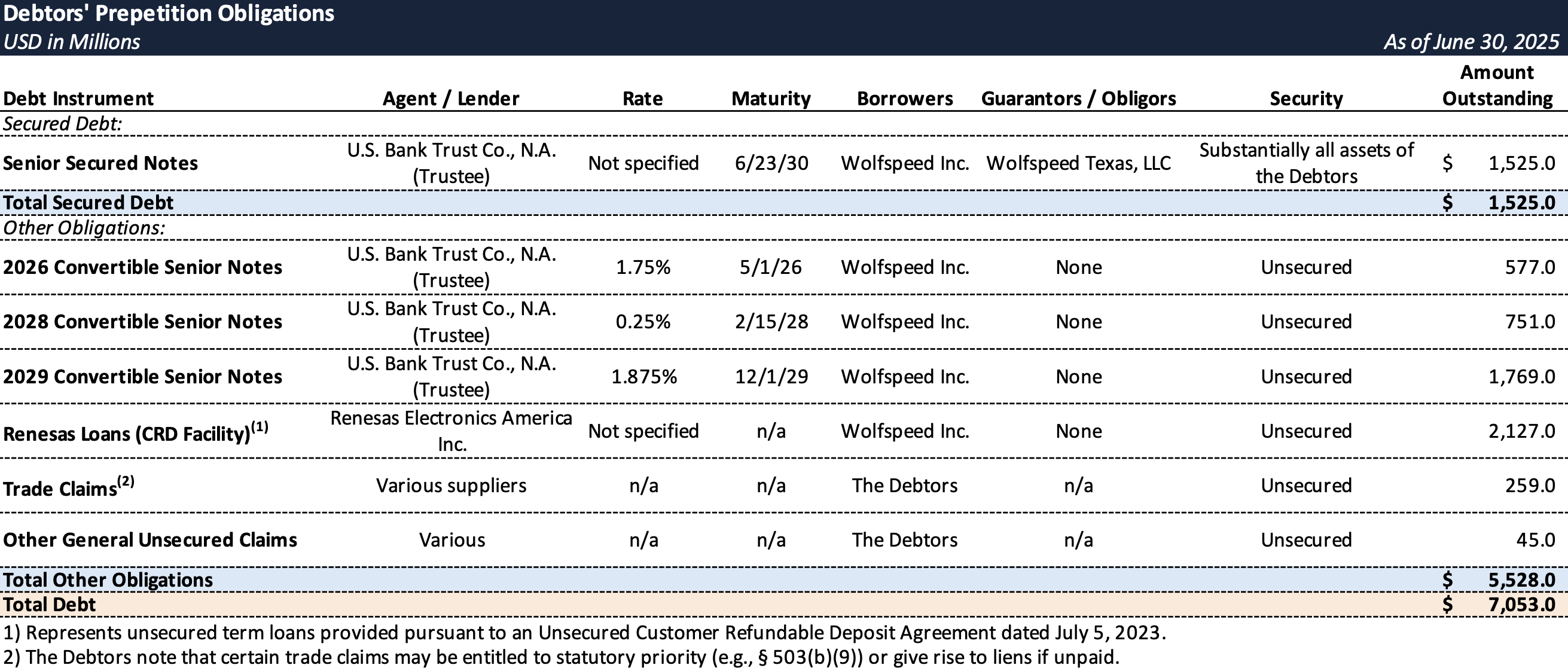

Prepetition Obligations

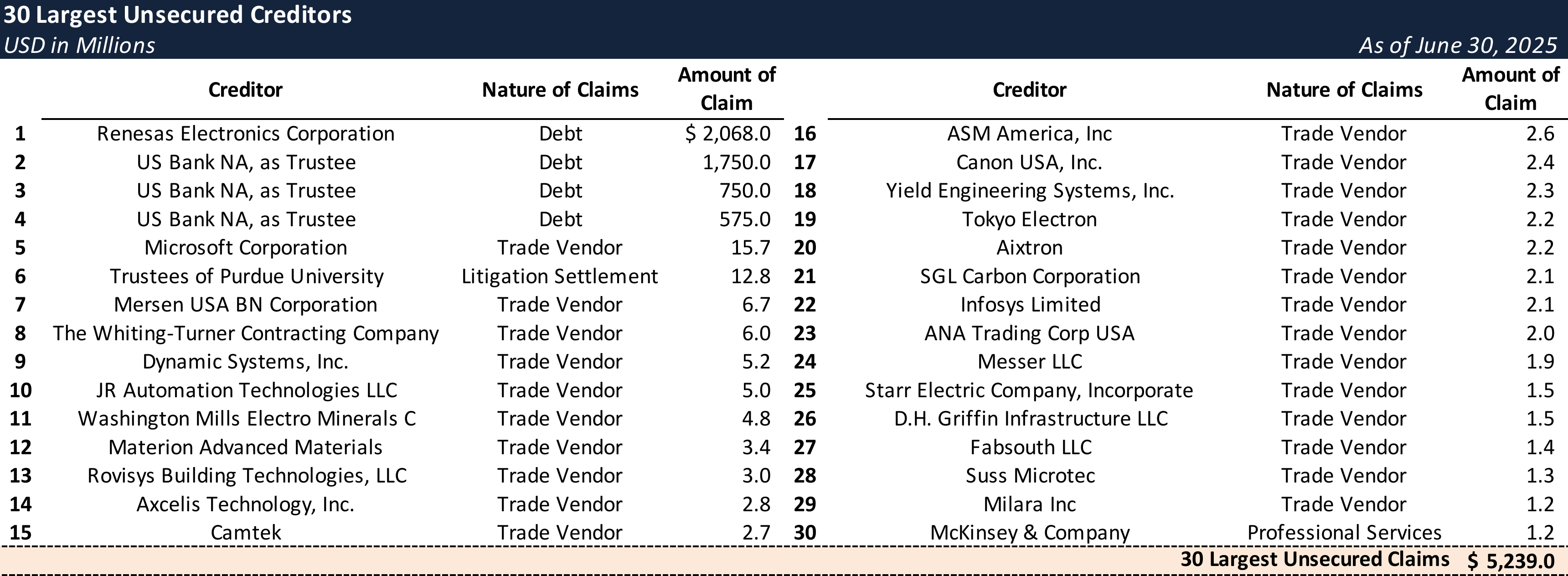

Top Unsecured Claims

Events Leading to Bankruptcy

Aggressive Expansion and Capital Strain

- The Company’s path to Chapter 11 stems from an aggressive, debt-fueled expansion strategy designed to capitalize on soaring demand for SiC technology used in electric vehicles, renewable energy and storage systems, and artificial intelligence data centers.

- Wolfspeed undertook several massive capital projects simultaneously—including the construction of its Mohawk Valley and Siler City facilities—requiring substantial investment that placed “significant pressure on the Debtors’ balance sheet.”

- This strategic overextension was compounded by operational challenges in ramping up the new facilities, particularly the Mohawk Valley Fab. The Company failed to disclose significant operational issues and softening customer demand, leading to a putative securities class action filed in November 2024 alleging that the Company made materially misleading statements about its projected utilization and revenue.

Uncertainty Over CHIPS Act Funding

- A key component of Wolfspeed’s financing strategy was anticipated federal support under the CHIPS and Science Act. In October 2024, the Company signed a non-binding preliminary memorandum of terms (PMT) with the U.S. Department of Commerce for up to $750 million in direct funding, in addition to an expected $1 billion in tax credits.

- Receipt of this funding was contingent upon several conditions, including refinancing its 2026 notes and meeting operational and capital expenditure milestones at the Siler City facility and Mohawk Valley Fab. However, by early 2025, “ongoing uncertainty” surrounding the future of the CHIPS Act complicated the Company’s liquidity forecasts and created a critical funding gap.

Mounting Financial Pressures and Prepetition Initiatives

- By early 2025, the Company’s financial position had become unsustainable, with approximately $6.5 billion in funded debt, negative adjusted EBITDA, and a projected annual cash interest expense of around $400 million.

- Wolfspeed initiated a series of measures to preserve liquidity:

- In November 2024, it launched a cost-reduction program, which included closing two manufacturing facilities and reducing its workforce by approximately 570 employees through June 2025.

- In January 2025, the Company raised approximately $200 million in gross proceeds through an at-the-market equity offering, though these funds were insufficient to address its long-term leverage issues.

Failed Out-of-Court Restructuring

- Recognizing the need for a comprehensive deleveraging, the Company engaged restructuring advisors in February 2025 and attempted a "public-style" out-of-court exchange transaction in March 2025.

- The effort failed to generate sufficient creditor support and was terminated on March 28, 2025. Following the announcement, Wolfspeed’s common stock plummeted by approximately 50%, wiping out significant market capitalization and signaling that an in-court solution was likely inevitable.

Negotiations and Restructuring Support Agreement (RSA)

- Immediately following the failed exchange, the Company pivoted to negotiating a pre-packaged Chapter 11 plan with its key stakeholders, including ad hoc groups of Senior Secured and Convertible Noteholders, as well as its major customer and creditor, Renesas Electronics.

- After months of intensive negotiations, the parties entered into a Restructuring Support Agreement (RSA) on June 22, 2025, to implement a comprehensive deleveraging transaction through Chapter 11.

- The pre-packaged plan, supported by the RSA, will reduce the Company’s funded debt by approximately $4.6 billion and cut its annual cash interest expense by around $240 million. Key terms include:

- Funded debt reduced from ~$6.7 billion to ~$2.1 billion (~70% deleveraging)

- Senior secured notes exchanged for new senior secured notes and cash payments.

- Convertible noteholders to receive new 2L notes and 56.3% of new equity (subject to dilution).

- Renesas to receive new 2L notes and 38.7% of new equity (subject to dilution), plus contingent consideration.

- ~$301 million new 2L convertible notes rights offering at 91.3% of par.

- General unsecured claims paid in full; existing equity cancelled and replaced with up to 5% of new equity.

Key Parties

- Latham & Watkins LLP and Hunton Andrews Kurth LLP (co-counsel); Perella Weinberg Partners LP (investment banker); FTI Consulting, Inc. (financial advisor); Epiq Corporate Restructuring LLC (claims and noticing agent).

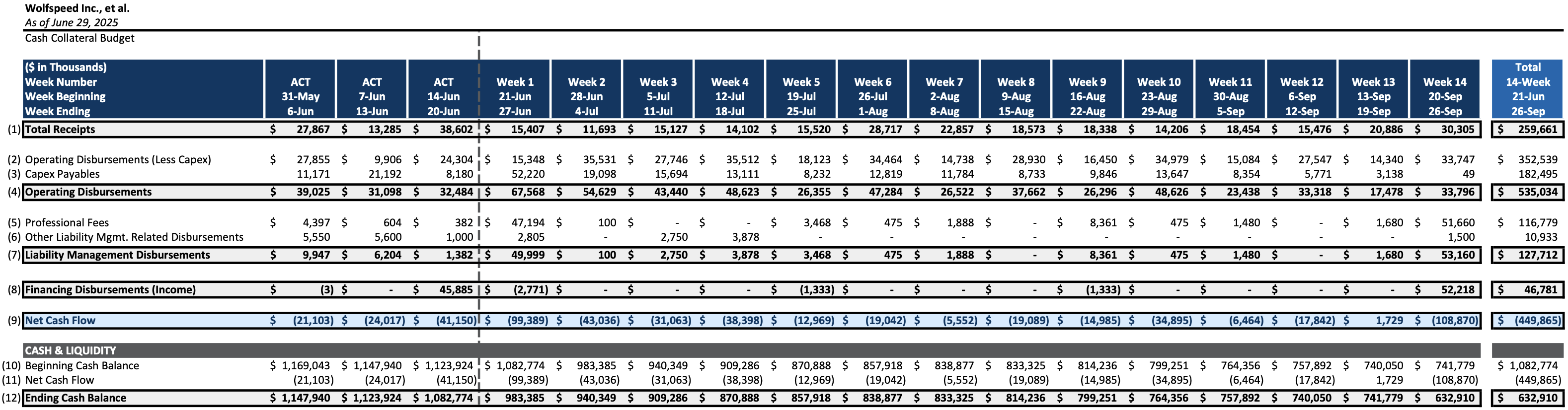

Initial Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.