Case Summary: Worldwide Machinery Chapter 11

Worldwide Machinery Group has filed for Chapter 11 bankruptcy to consummate a going-concern sale after its senior lenders undermined the process by pursuing a side deal to sell their defaulted loan to a liquidator.

Business Description

Headquartered in Houston, TX, Worldwide Machinery Group, Inc., along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "Worldwide" or the "Company"), is a family-owned heavy equipment rental and sales company with over 75 years of experience serving the civil construction, oil & gas pipeline, and renewable energy sectors.

- The Company is renowned for supplying a late-model, high-quality fleet of large earthmoving machines and specialty pipeline equipment, supported by comprehensive parts and service operations.

Worldwide operates through three primary business segments:

- Heavy Equipment Rentals: The Company’s core business, comprising a fleet of approximately 560 major pieces of machinery, including dozers, excavators, and motor graders. This segment is diversified across industries, with approximately 70% of its business serving civil infrastructure projects and 30% supporting pipeline construction and renewable energy initiatives.

- Equipment Sales: As an independent dealer, Worldwide buys and sells new and used heavy equipment from leading original equipment manufacturers (OEMs) such as Caterpillar and John Deere, leveraging a global network with experience in over 70 countries.

- "Superior" Specialty Equipment: The Company markets and rents a proprietary line of specialty equipment for the pipeline and renewable energy industries under the Superior brand. This line, featuring nearly 160 units, is developed in partnership with Italian manufacturer Laurini.

For the fiscal year ending June 30, 2025, Worldwide generated approximately $67 million in revenue. As of the Petition Date (defined below), the Debtors employed approximately 117 individuals across their U.S. operations.

Worldwide Machinery Group, Inc. and certain of its affiliates filed for Chapter 11 protection on September 11, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the Southern District of Texas. As of the end of August 2025, the Company's balance sheet reflects consolidated assets of approximately $116 million and consolidated liabilities of approximately $223 million.

⁽¹⁾ For a complete list of Debtor entities, see organizational structure chart below.

Corporate History

Founded in 1949 by Joseph Greenberg, Worldwide initially focused on supplying heavy construction equipment to support the post-WWII building boom in the U.S. The Company expanded internationally under the leadership of second-generation owner Alan Greenberg, who took control in 1967.

Third-Generation Leadership and Strategic Focus

- In 1991, Evan and Adam Greenberg assumed leadership and strategically pivoted the Company toward the energy sector, establishing a Pipeline Division that grew to become a leading global provider of specialized pipeline construction equipment.

- To diversify its revenue streams beyond oil and gas, the Company launched Worldwide Rental Services in 1997, a Denver-based division focused on serving the heavy civil, highway, and utility construction markets in the Rocky Mountain region.

Expansion and Financial Recapitalization

- Throughout the 2000s and 2010s, Worldwide expanded its domestic footprint to include approximately a dozen locations across the U.S. and established an international presence with affiliates in Mexico, Germany, Australia, and Italy.

- Amid mounting financial strain from a market downturn, the Company executed a corporate restructuring in January 2022. It reorganized under a new Delaware holding company and secured a $50 million second-lien term loan (the "Caspian Loan") to enhance liquidity.

Creditor Pressure and Governance Overhaul

- Despite the recapitalization, the Company defaulted on its first-lien credit facility in 2024. Under pressure from its senior lenders, Worldwide implemented significant governance changes to oversee a restructuring.

- Key appointments included:

- John T. Young, Jr. and Robert Warshauer as independent directors in August and October 2024, respectively, forming a Restructuring Committee.

- Scott Avila of Paladin Management as Chief Restructuring Officer (CRO) in October 2024.

- At the insistence of secured lenders, Alan, Evan, and Adam Greenberg resigned from the Board of Directors in January 2025, ending three generations of direct family governance.

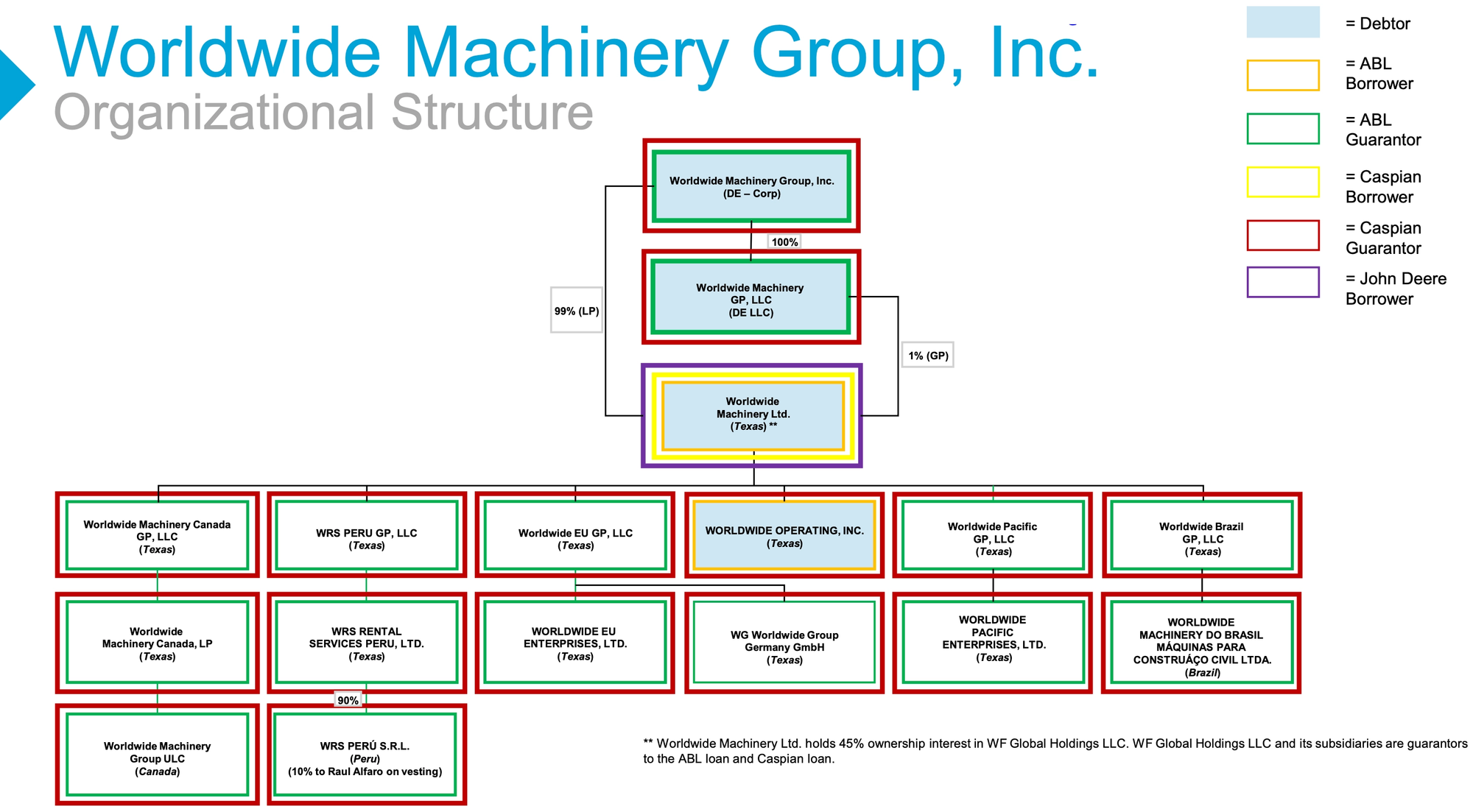

Corporate Organizational Structure

Equity Security Holders

- Adam Greenberg – 41.3% Equity Interest

- J. Evan Greenberg – 41.3% Equity Interest

- Caspian and affiliates – 10.0% Equity Interest

- Other Minority Holders – 7.4% Equity Interest

Operations Overview

Worldwide operates an integrated business model combining equipment rentals, sales, and proprietary product offerings, supported by a network of facilities and strategic partnerships.

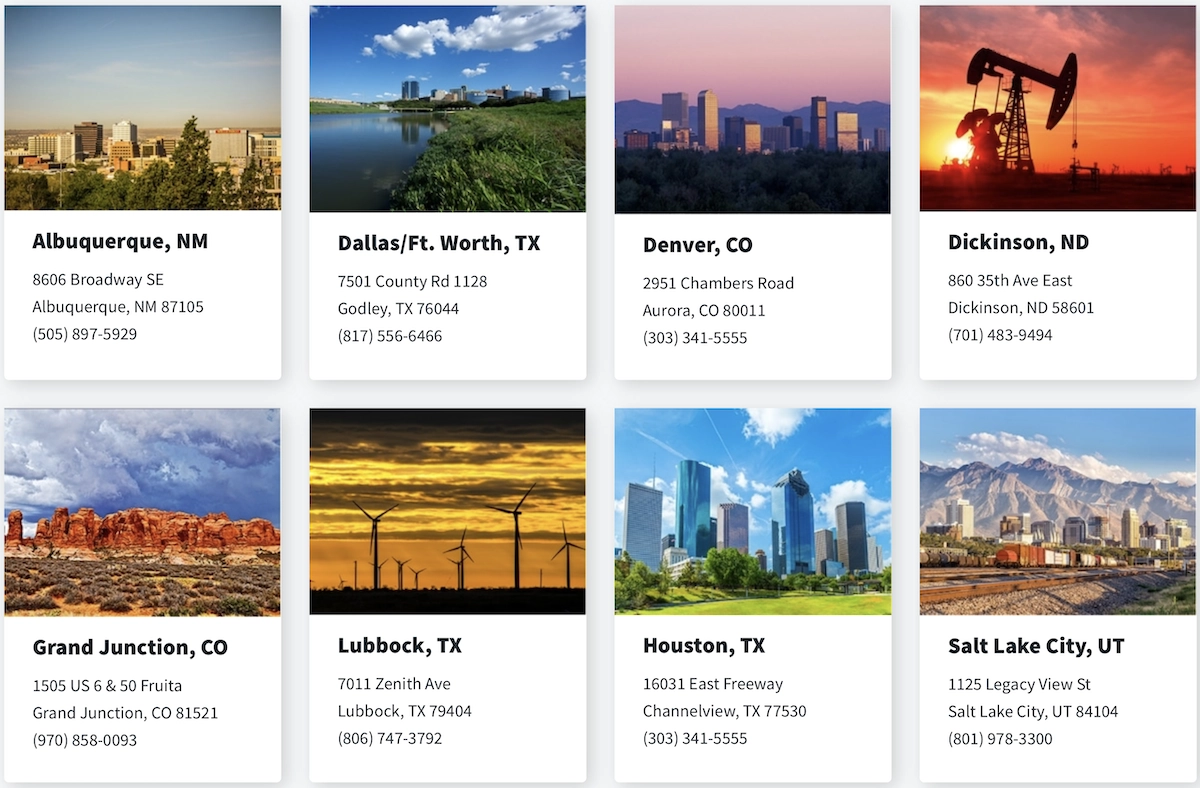

Geographic Footprint

- The Company is headquartered in Houston, TX, and operates seven full-service equipment yards in key U.S. markets, including Denver, CO; Salt Lake City, UT; Dallas, TX; and Dickinson, ND.

- Its international presence includes offices or affiliates in Mexico, Germany, Australia, Perú, and Italy, which support its global equipment trading and sourcing activities.

Rental Fleet and Assets

- The Company's primary asset is its rental fleet of approximately 560 major pieces of heavy machinery, designed to supply complete equipment spreads for large-scale civil and pipeline projects.

- The fleet includes a wide range of standard earthmoving equipment as well as specialized pipeline gear such as pipelayers, bending machines, and welding tractors.

Manufacturing Partnership and OEM Relationships

- For nearly 30 years, Worldwide has collaborated with Italian manufacturer Laurini S.p.A. to design and fabricate its proprietary "Superior" line of specialty equipment, including crawler carriers and padding machines tailored for the pipeline and renewable energy sectors.

- While not an authorized dealer, the Company maintains a global network for sourcing and trading equipment from leading OEMs like Caterpillar and John Deere. It also holds distribution and rental partnerships with niche manufacturers such as K-Tec Earthmovers.

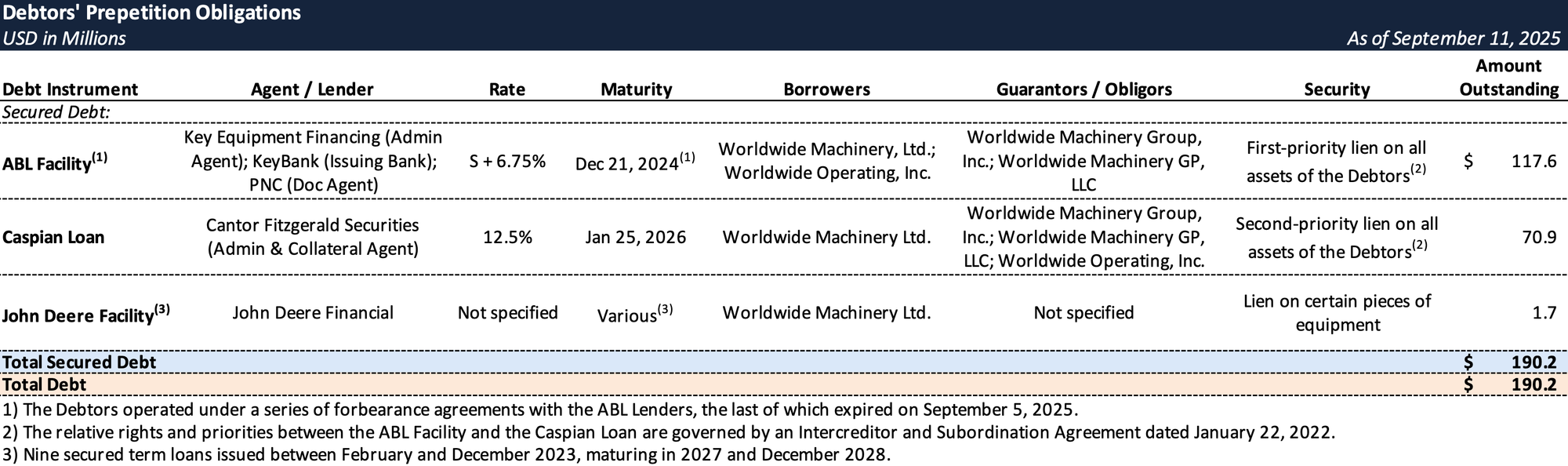

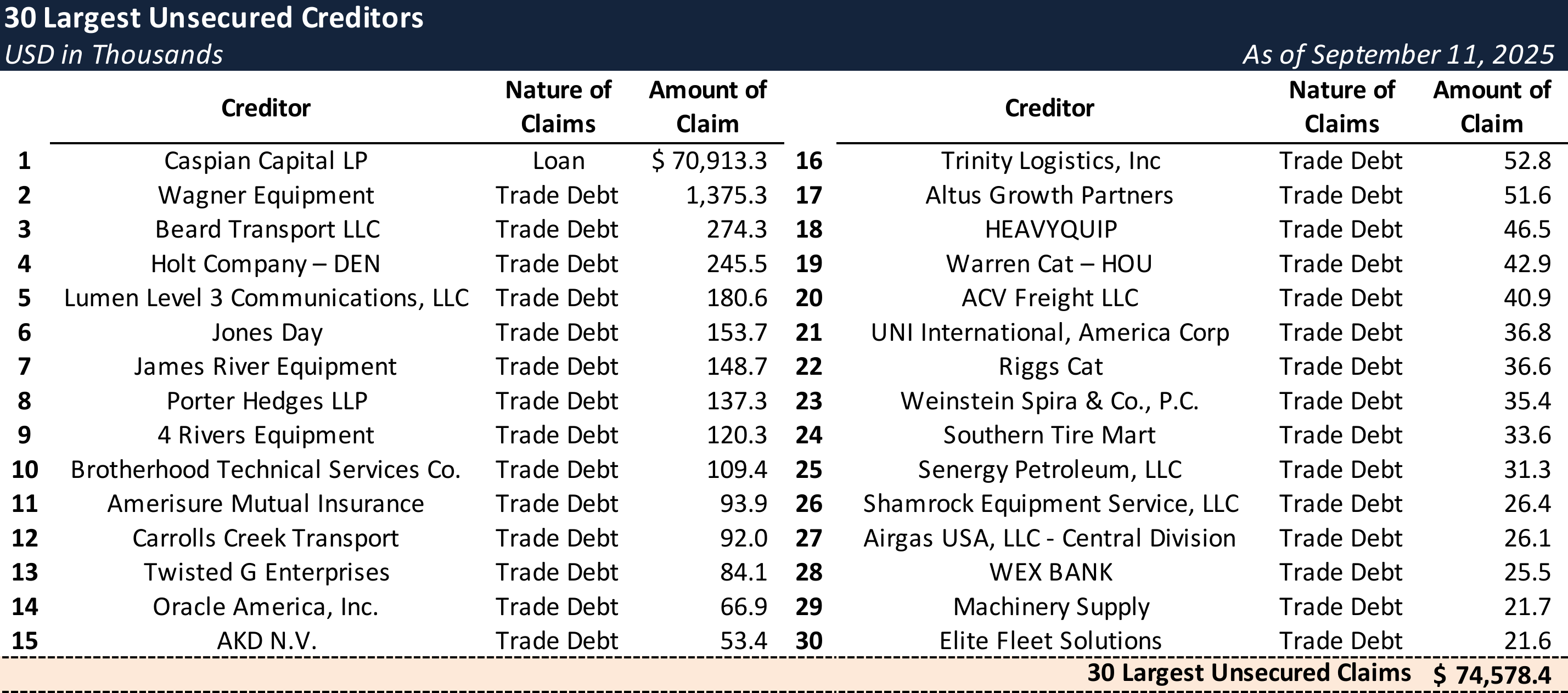

Prepetition Obligations

Top Unsecured Claims

Events Leading to Bankruptcy

Industry Downturn and Financial Strain

- The Company’s financial stability was severely undermined by a confluence of factors during 2020-2021, including construction slowdowns from the COVID-19 pandemic and a “catastrophic decline” in the pipeline industry driven by volatile oil prices and the cancellation of major projects.

- In January 2022, Worldwide secured a $50 million second-lien term loan to recapitalize the business. However, the high-cost debt, which grew to approximately $70.9 million due to paid-in-kind interest, added significant leverage without a corresponding market recovery.

- By late 2023, persistent losses led to defaults on its $132.5 million (since reduced to $122.5 million) first-lien asset-based lending (ABL) facility, administered by Key Equipment Financing. The ABL lenders entered into a series of forbearance agreements while pushing the Company to find a permanent solution.

Strategic Alternatives and Sale Process

- Under the oversight of a CRO and a Restructuring Committee of independent directors, the Company launched a comprehensive marketing process in mid-2025 to sell the business.

- The process yielded two primary options:

- Going-Concern Sale: An insider-led bid from Diversified Holding, LLC, an entity controlled by the Greenberg family and financed by Macquarie Equipment Capital. The offer included $52.5 million in cash and the assumption of approximately $13.1 million in trade liabilities, preserving the business and a majority of jobs.

- Liquidation: Bids were received from industrial auctioneers. A joint proposal from Hilco Industrial and Ritchie Brothers was determined to be competitive with the going-concern offer, while a separate bid from Gordon Brothers was deemed uncompetitive.

- In August 2025, the Restructuring Committee determined the going-concern transaction was the "highest and best" offer, as it provided superior recoveries for unsecured creditors and saved jobs while offering a marginally better outcome for senior lenders.

Lender Standoff and Chapter 11 Filing

- After receiving an uncompetitive bid for Worldwide's assets, the liquidator Gordon Brothers approached the Debtors to request permission to speak with the ABL lenders about purchasing their debt. The Debtors agreed to allow conversations, but did not consent to a transaction. Subsequently, Gordon Brothers and the ABL lenders entered into an exclusive arrangement for the sale of the lenders' claims at less than par, an action that was precluded by a non-disclosure agreement Gordon Brothers had signed with Worldwide.

- The ABL lenders then issued an ultimatum, stating they would not extend a forbearance period that was set to expire on September 5, 2025, unless Worldwide waived its rights and consented to the sale of the loan to Gordon Brothers. According to the Debtors, the lenders made this demand without disclosing the terms of the potential deal.

- The Company’s independent Restructuring Committee refused to consent. It viewed the deal as a maneuver that would end the competitive sale process, undermine the superior going-concern bid from Diversified, and harm the Company’s ability to maximize value for all stakeholders.

- With the forbearance agreement expired and access to cash cut off, Worldwide filed for Chapter 11 protection on an emergency basis on September 11, 2025. The filing imposed an automatic stay, preventing foreclosure and allowing the Company to continue pursuing the going-concern sale in a court-supervised process.

Path Forward in Chapter 11

- The Chapter 11 filing provides Worldwide with breathing room to consummate the sale to Diversified/Macquarie, which will serve as the stalking horse bidder in a court-supervised sale process.

- The proposed transaction includes:

- A cash purchase price of $52.5 million, funded by Macquarie.

- The assumption of approximately $13.1 million in trade payables.

- The retention of the majority of the Debtors' 117 employees.

- Worldwide intends to seek court approval to complete the sale within approximately 30 days of the Petition Date, preserving the business as a going concern under new ownership sponsored by the Greenberg family.

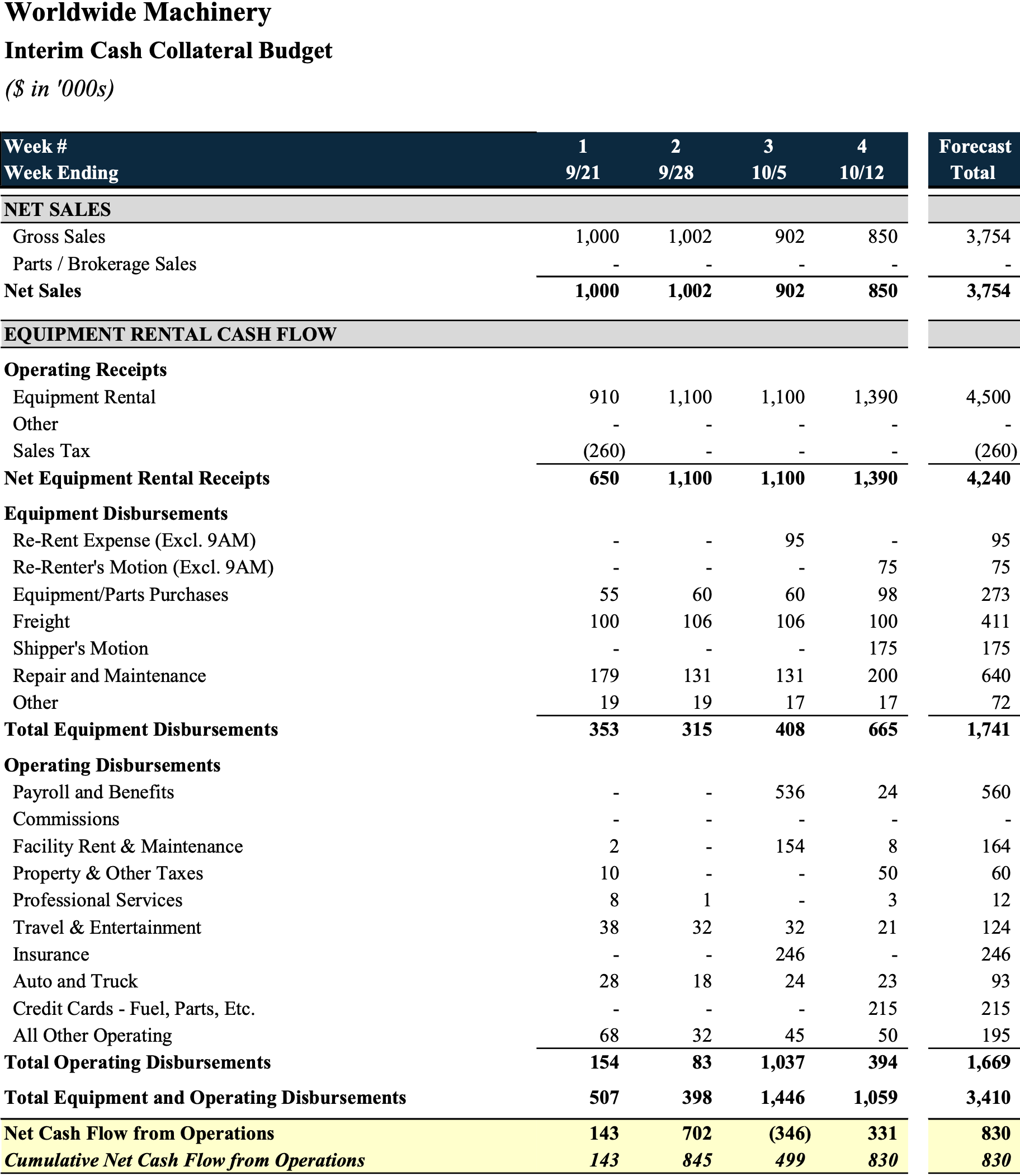

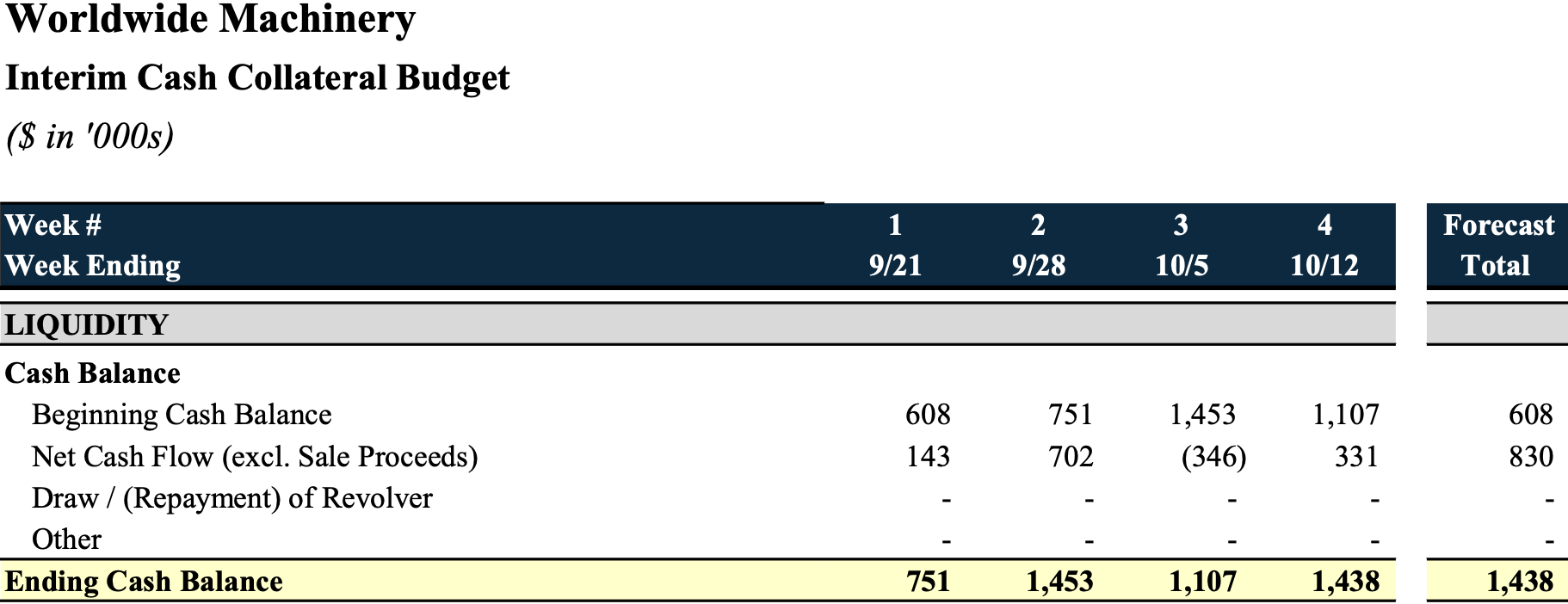

- On September 15, 2025, the Court granted an interim cash collateral order allowing continued operations under a $3.4 million four-week budget.

Interim Cash Collateral Budget

Key Parties

- White & Case LLP (counsel); Paladin Management Group (financial advisor / CRO, Scott Avila); Piper Sandler & Company (investment banker); Stretto, Inc. (claims agent).

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.