Case Summary: Wynne Transportation Chapter 11

Wynne Transportation has filed for Chapter 11 bankruptcy after a $32M arbitration loss to a former contractor.

Business Description

Headquartered in Dallas, TX, Wynne Transportation Holdings, LLC (“Wynne”), together with its wholly owned Debtor subsidiaries (collectively, the “Company” or the “Debtors”), provides turnkey ground transportation solutions under the “U.S. Crew Change” trade name.

- The Company maintains operating facilities in Orange, TX; Butler, PA; Lake Charles, LA; Gillette, WY; and Elko, NV.

The Debtors primarily serve the liquid natural gas, clean energy, petrochemical, mining, and oil and gas sectors through a fleet of 315 vehicles, comprising 178 owned and 137 leased assets.

- Notably, the owned vehicles are held outright without secured financing.

From 2021 to 2023, the Company generated average annual revenue and EBITDA (as defined by the Company) of approximately $78 million and $17 million, respectively.

As of the Petition Date, the Debtors reported assets and liabilities totaling $10-$50 million.

Corporate History

Wynne was incorporated in Delaware on January 2, 2019. It functions as a holding entity for its wholly owned Operating Subsidiaries:

- Wynne Transportation, LLC

- WTH Commercial Services, LLC

- Costal Crew Change Company LLC

- Southwest Crew Change Company, LLC

- Great Plains Crew Change Company, LLC

- Allegheny Crew Change Company, LLC

The equity ownership of the Company consists of Gemini Investors VI, L.P. (90%), Bedford Wynne (9.1%), and John Montgomery (0.9%).

- Wynne maintains full ownership of each Operating Subsidiary.

Operations Overview

The Company’s service offerings encompass four primary areas:

- Industrial Employee Transportation: Tailored transit for workforce needs, emphasizing safety and reliability.

- Turnaround Shuttle Services: Streamlined shuttle solutions for short-term projects to minimize operational downtime.

- Special Needs Government Ground Transportation: Rapid-response evacuation and relocation services during emergencies, including natural disasters.

- On-Site Shuttles: Efficient in-plant transit systems designed to reduce congestion and enhance productivity.

As of the Petition Date, the Debtors’ principal assets include owned vehicles, accounts receivable, and inventory, which the Company estimates to be valued at approximately $22.3 million, $4.3 million, and $0.9 million, respectively.

- The Debtors also maintain roughly $170,000 in cash on hand.

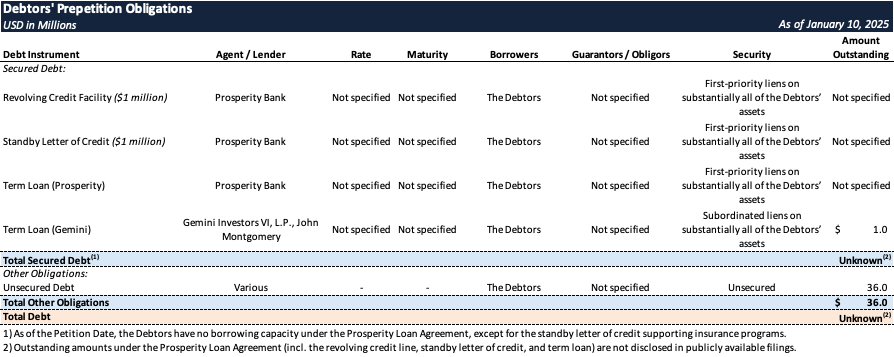

Prepetition Obligations

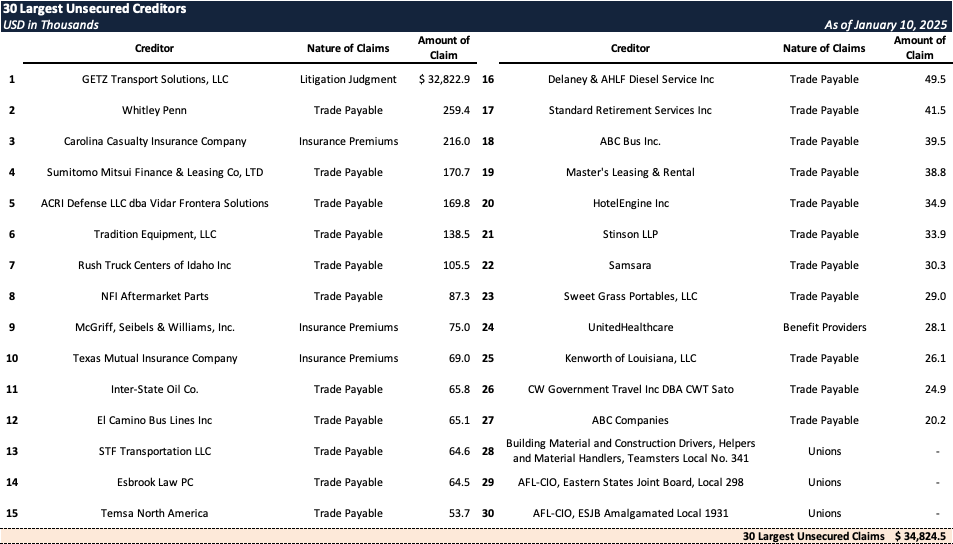

Top Unsecured Claims

Events Leading to Bankruptcy

Contractual Disputes and Arbitration with GETZ

- The Company entered into a Transportation Services Agreement with GETZ Transport Solutions, LLC ("GETZ") in May 2020, contingent upon securing a contract with the State of Texas for emergency transportation services.

- In August 2020, the Debtors signed Contract No. 958-M1 with the Texas Comptroller of Public Accounts to provide emergency services for the Texas Department of Emergency Management.

- In January 2023, the Debtors terminated their agreement with GETZ, which led to arbitration proceedings initiated by GETZ in April 2023, alleging breach of contract and fraud.

- On July 16, 2024, an arbitrator awarded GETZ $32.1 million in damages, plus $700,000 in legal and expert fees, with interest accruing at 8.5% annually.

- Mediation efforts failed, and GETZ pursued additional legal actions, including requests for security bonds and turnover relief, which were denied by courts.

- On December 12, 2024, a Texas court entered judgment for GETZ regarding the arbitration award, further pressuring the Company's financial position.

Operational Setbacks and Liquidity Constraints

- The Company faced critical operational disruptions as major contracts—representing 50% of projected FY 2024 revenue—experienced delays:

- The Sabine Pass Contract, relating to a gas import terminal in Texas, was postponed to Q1 2025.

- The CP2 LNG Terminal Contract in Louisiana faced similar delays.

- Legal fees from the GETZ litigation compounded liquidity pressures, leaving the Debtors reliant on the Gemini Term Loan to sustain operations until the Chapter 11 filing.

Proposed Restructuring Process

- The Debtors initiated Chapter 11 proceedings to stabilize operations, restructure their balance sheet, and address the adverse judgment from the GETZ arbitration award.

- To achieve these objectives, the Debtors secured a Senior Secured Superpriority DIP Facility with Gemini Investors VI, L.P., providing $5 million in incremental liquidity.

- According to the Company, this funding, combined with anticipated revenue from the Sabine Pass and CP2 Contracts, will cover Chapter 11 administrative costs and support business continuity.

- The Debtors aim to engage stakeholders, including any statutory committee formed, to evaluate restructuring options that maximize value and ensure long-term viability.

Enjoyed this summary? Stay informed on new Chapter 11 filings over $10 million in liabilities—subscribe to Bondoro for free and get insights delivered directly to your inbox.

Plus, explore our full archive for all past summaries.