Case Summary: Zips Car Wash Chapter 11

Zips Car Wash has filed for Chapter 11 bankruptcy to cut $279 million in debt, citing pressure from rising interest rates, higher labor costs, and intensifying competition.

Business Description

Headquartered in Plano, TX, Zips Car Wash, LLC, along with its Debtor affiliates⁽¹⁾ (collectively, "Zips" or the "Company"), operates as one of the largest privately owned express car wash operators in the U.S. With a presence across 23 states and over 260 locations, Zips has established itself as a trusted national brand through both organic growth and strategic acquisitions since its founding in 2004.

Zips conducts its operations through three distinct brands: Zips, Jet Brite, and Rocket Express. The Company generates revenue primarily through two core channels:

- Retail Washes: A traditional pay-per-wash model available to all customers, contributing approximately one-third of annual revenue.

- Unlimited Wash Club ("UWC"): A monthly subscription program offering unlimited car washes, accounting for over two-thirds of the Company's revenue.

Zips serves millions of customers annually, supported by a loyal base of 625,000 UWC members and a workforce of 1,800 employees. The Company reported $303 million in revenue over the last twelve months.

Zips filed for Chapter 11 protection on Feb. 5 in the U.S. Bankruptcy Court for the Northern District of Texas. As of the Petition Date, the Debtors reported $500 million to $1 billion in assets and $1 billion to $10 billion in liabilities.

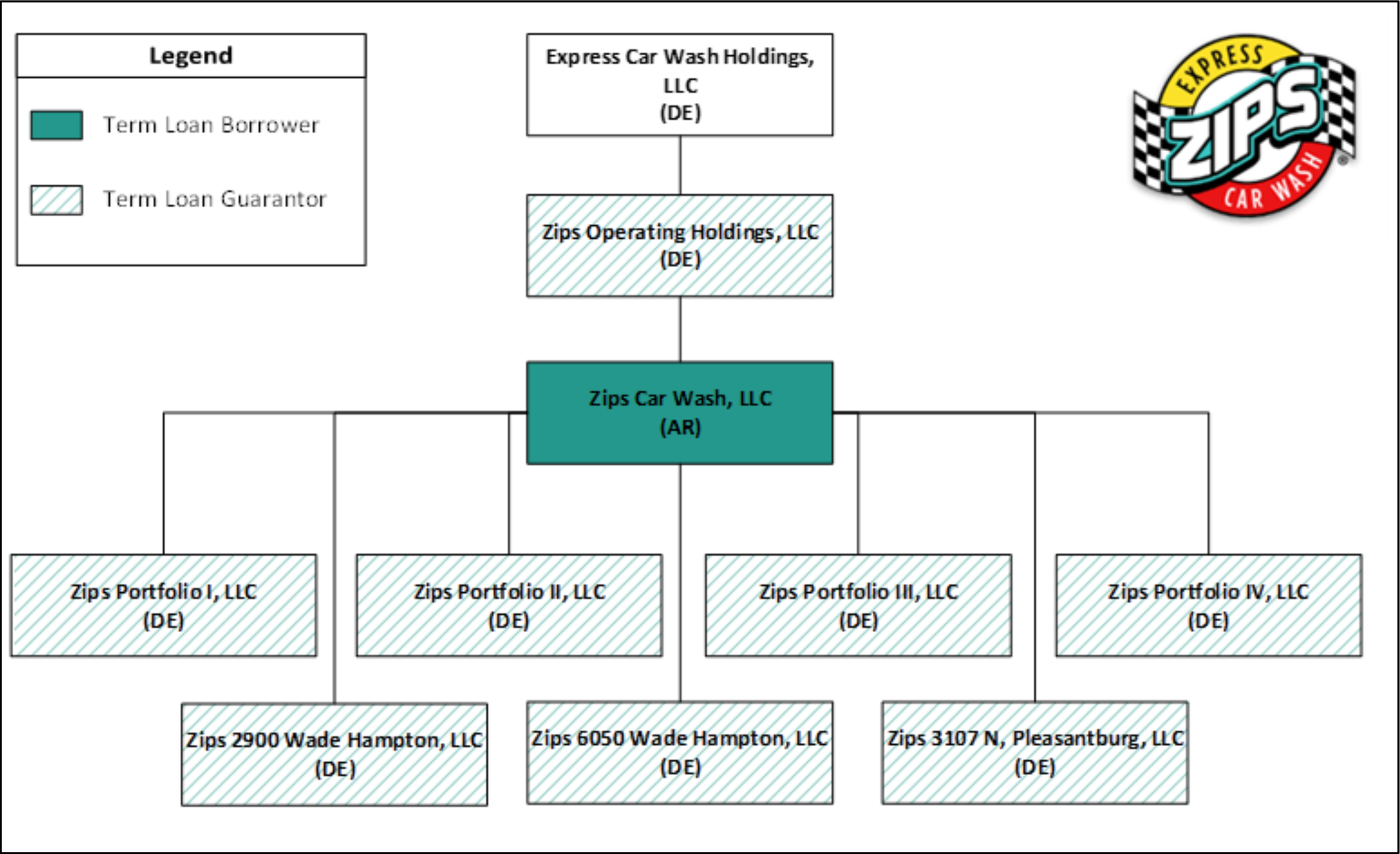

⁽¹⁾ Express Car Wash Holdings, LLC; Zips 2900 Wade Hampton, LLC; Zips 3107 N. Pleasantburg, LLC; Zips 6050 Wade Hampton, LLC; Zips Operating Holdings, LLC; Zips Portfolio I, LLC; Zips Portfolio II, LLC; Zips Portfolio III, LLC; Zips Portfolio IV, LLC.

Corporate History

Zips was founded in 2004 with two locations in rural Arkansas. The Company began expanding in 2009, entering markets in Kansas, Oklahoma, and Florida.

- This regional growth laid the groundwork for the launch of the UWC in 2013, a pivotal move that propelled Zips' national expansion across the southeastern U.S.

Strategic Acquisitions and Investments

- Between 2015 and 2019, Zips executed over 40 acquisitions, growing its portfolio to 130 locations and establishing itself as a recognized brand.

- By early 2020, Zips scaled to 185 locations across 17 states, driving annualized revenue exceeding $150 million—up from $13 million in 2015.

- In May 2020, ASC acquired a majority stake in Zips, facilitating further expansion. Additional investments in 2020 and 2022, totaling over $150 million, supported strategic acquisitions and market entry.

- From 2H 2020 to 2022, Zips had amassed a portfolio of over 260 locations, doubling its revenue from $184 million to $345 million while driving a more than six-fold increase in annual earnings.

In 2022, Atlantic Street Capital (“the Sponsor”) made an additional investment to acquire the remaining common equity from Zips’ founding shareholders and installed a new management team to drive growth and brand development.

Organizational Structure

Debtor Express Car Wash Holdings, LLC (“ECWH”) serves as the ultimate parent entity of the Debtors, with Zips operating through ECWH’s subsidiary entities.

Operations Overview

Zips operates through three brands, each offering distinct car wash experiences:

- Zips Brand: Provides standard wash sites with traditional tunnel lengths.

- Jet Brite and Rocket Express Brands: Operate "mega" sites with longer tunnels for higher throughput, located in Illinois, Idaho, and Utah.

Retail Washes

The Retail Wash segment offers exterior-only tunnel washes priced between $12 and $30. This model, while subject to external factors like seasonality, contributes about one-third of the Company's revenue.

Unlimited Wash Club ("UWC")

Launched in 2013, the UWC is Zips’ flagship subscription program, offering unlimited washes for a monthly fee of $20 to $45. This model has driven revenue growth, stabilized cash flow, and strengthened brand loyalty. UWC now accounts for over two-thirds of total revenue, with memberships per site increasing from approximately 1,080 in May 2020 to 2,250 in June 2024.

Express Car Wash Model

Zips employs an efficient, automated express model, allowing up to 140 car washes per hour. This approach minimizes labor and operational costs. Key features include:

- Convenience: Quick service with minimal customer wait time.

- Speed: High throughput due to advanced technology.

- Affordability: Customizable options at low prices.

- Consistency: Automated processes ensure quality washes.

Marketing and Customer Engagement

Zips engages customers through the Zips App, launched in 2024, which offers purchases, tracking, and personalized offers. Additionally, UWC member events and partnerships enhance loyalty and attract new members.

Supply Chain Management

Zips leverages its scale to secure competitive pricing from suppliers, notably Sonny’s Enterprises, ensuring efficient inventory management and access to premium products.

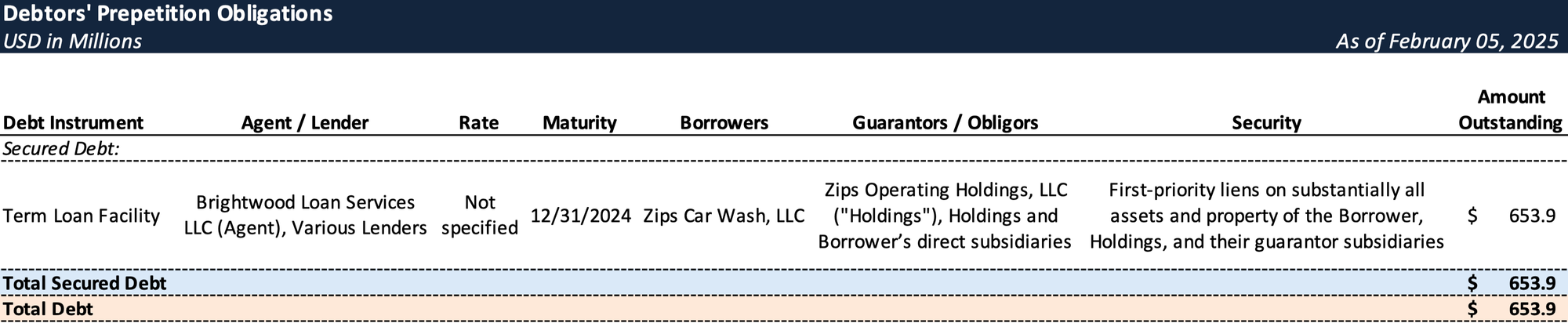

Prepetition Obligations

The Company’s capital structure includes approximately $300 million in Preferred Equity Interests, split between Senior and Junior Preferred Equity.

- Senior Preferred Equity: The Company raised $229 million in senior preferred equity from alternative investment firms between 2020 and 2022 to fund strategic acquisitions.

- This tranche accrues in-kind interest at 13.5% and carries governance rights under the ECWH Limited Liability Company Agreement, including consent rights over any bankruptcy filing that does not result in full redemption.

- The Senior Preferred Equity Holders have consented to the Chapter 11 filing.

- Junior Preferred Equity: The Company also has $70.8 million in junior preferred equity, with the majority held by ASC-Zips Holdings, Inc., a non-Debtor entity managed by ASC. The Senior Preferred Equity Holders hold a nominal portion of this tranche.

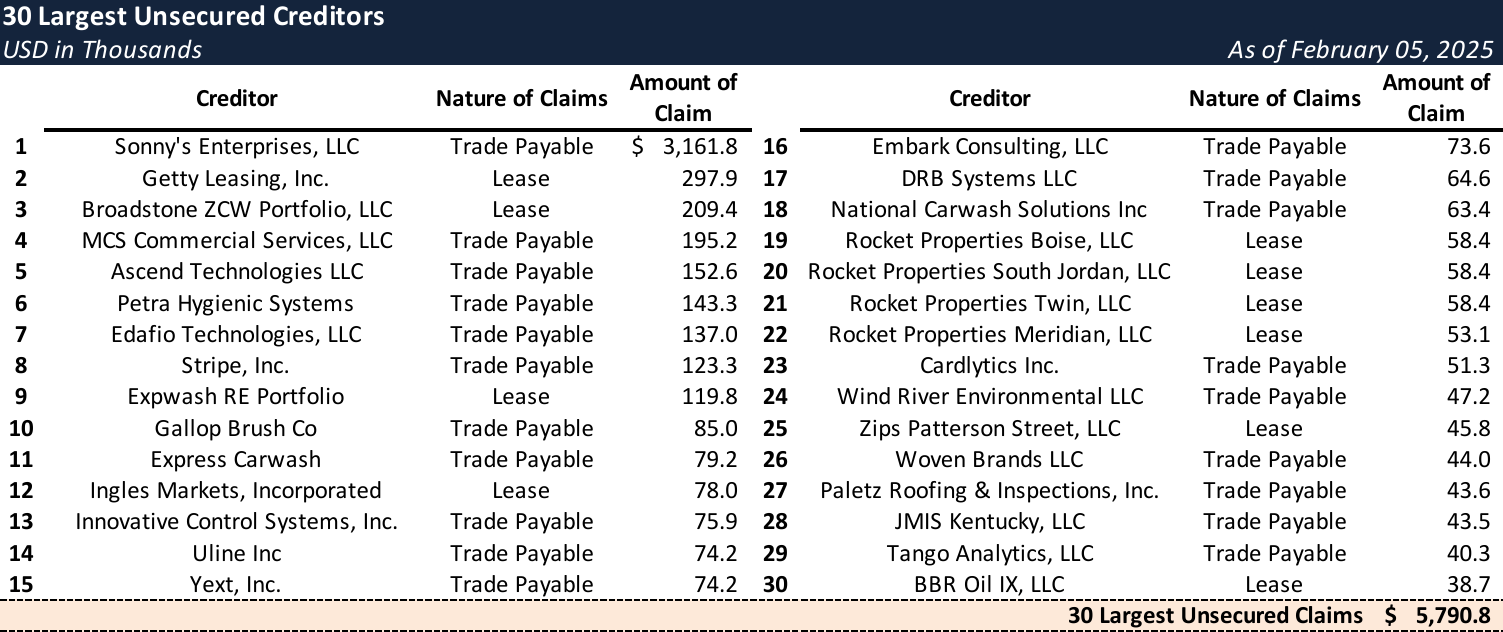

Top Unsecured Claims

Events Leading to Bankruptcy

Macroeconomic Headwinds and Operational Challenges

- The Company’s financial performance was adversely affected by a confluence of macroeconomic factors and industry-specific headwinds:

- Rising federal interest rates caused annual cash interest expenses to surge—from $59 million in FY 2022 to $93 million in FY 2023—exacerbated by a sharp increase in the three-month SOFR from 0.68% to 5.33%.

- Inflationary pressures drove up operating costs, including chemical, supply, and labor expenses, while softening consumer discretionary spending and diminishing retail traffic.

- Increased churn in UWC membership further strained cash flow and limited resources to invest in strategic M&A opportunities.

- The Company’s balance sheet was burdened by substantial funded-debt obligations—approximately $653.9 million in debt with senior secured term loans that matured on December 31, 2024—and off-market lease commitments tied to underperforming locations.

Operational Turnaround Initiatives

- In response to the deteriorating operating environment, the Company implemented a series of turnaround initiatives:

- ZipsMe 2.0 Program: Launched in mid-2023, this program aimed to standardize and enhance car wash quality by adopting more powerful cleaning chemicals, establishing a national pricing model, and upgrading site aesthetics. The initiative also included a digital refresh—with a new website, social media strategy, and the early-2024 launch of the Zips App to capture actionable customer insights.

- Project Refresh: Initiated in early 2024, this pilot program invested approximately $300,000 per site to refurbish targeted locations. Although the program demonstrated tangible improvements in retail traffic and customer experience, its broader implementation was constrained by the significant capital expenditure required.

Refinancing Efforts and Advisor Engagement

- To address the looming debt maturity and persistent liquidity challenges, the Company undertook several refinancing measures:

- An amendment to its Credit Agreement extended the maturity date to December 31, 2024, and established strict refinancing milestones.

- Equity infusions—totaling approximately $70 million from the Sponsor, in addition to liquidity injections starting in mid-2023—provided temporary relief.

- In August 2024, Evercore was retained to solicit refinancing proposals; however, only a handful of initial proposals were received, and none met the material terms required to satisfy the refinancing deadline.

- With refinancing prospects waning, the Company engaged restructuring advisors, including Kirkland & Ellis LLP and AlixPartners, in August and September 2024 to evaluate alternative capital structure solutions.

Corporate Governance and Management Changes

- Amid mounting operational and financial challenges, the Company proactively restructured its governance framework:

- In August 2024, the Board appointed Scott Vogel as an independent, disinterested manager and established a Special Committee to oversee restructuring alternatives.

- In October 2024, Robert Warshauer joined the Special Committee, broadening the mandate to address potential conflicts and investigate claims against related parties.

Increased Competition and Strategic Divestitures

- The competitive landscape in the car wash industry intensified as approximately 900 new sites opened annually over the past five years:

- The influx of new market entrants and capital investments accelerated the shift from a “do-it-yourself” to a “do-it-for-me” service model, placing additional pressure on the Company’s legacy locations.

- In response, the Company reviewed its portfolio and pursued strategic divestitures to optimize its asset base.

- Targeted asset sales were executed to shore up liquidity:

- A non-binding letter of intent for the St. Louis operations was executed on June 19, 2024, with an anticipated net proceeds generation of approximately $20 million, while simultaneously reducing go-forward lease liabilities.

- A similar process for the Orlando operations culminated in a sale on February 4, 2024, generating approximately $58.5 million based on a multiple exceeding ten times earnings.

- As part of a Forbearance Agreement entered into in October 2024 after failing to meet refinancing milestones, net proceeds from the Orlando Sale were directed into an escrow account maintained at Citi Bank, N.A. for the benefit of Term Loan Lenders, with $54.3 million released on February 5, 2025, to satisfy obligations under the Term Loan Facility.

Revised Business Strategy and Lease Restructuring

- Recognizing that operational improvements alone could not resolve its balance sheet issues, the Company developed a revised go-forward business plan:

- A comprehensive footprint assessment and site-level evaluation, conducted with Hilco Real Estate in November 2024, identified underperforming locations and sites burdened by unfavorable lease terms.

- Discussions were initiated with key landlords to renegotiate leases, while asset purchase agreements for regional operations were executed as part of broader portfolio alignment efforts.

Credit Agreement Amendments and Transaction Negotiations

- As refinancing prospects dwindled, the Company advanced negotiations with its lenders and the Sponsor to mitigate liquidity pressures:

- In September 2024, Amendment No. 25 to the Credit Agreement secured the Term Loan Lenders’ consent for the St. Louis Sale, with the Sponsor funding $30 million into an escrow account as a safeguard.

- Throughout the fall of 2024, the Company engaged in intensive discussions with an ad hoc group of term loan lenders and senior preferred equity holders regarding a comprehensive deleveraging transaction. Non-binding term sheets exchanged in early November ultimately proved insufficient as new money commitments failed to materialize.

- With Sponsor Guaranty funds exhausted by early January 2025, the Company’s liquidity position deteriorated to a point where only in-court financing could bridge the funding gap.

Plan Implementation and DIP Financing

- After months of strategic review and negotiations, the Company resolved to file for Chapter 11 to execute a pre-negotiated restructuring plan:

- The Joint Plan of Reorganization calls for a reduction of approximately $279 million in outstanding funded debt, the issuance of $375 million in take-back debt, and access to a new $15 million revolving credit facility upon emergence.

- To support ongoing operations—with only about $1 million in cash on hand—the Company secured an $82.5 million DIP financing facility, including $30 million in new money, which was critical to satisfy vendor obligations and maintain business continuity during the restructuring process.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.