Filing Alert: Zynex Chapter 11

Zynex Files Chapter 11 in Southern District of Texas

Update (Dec. 16, 2025): A comprehensive case summary is now available for the Chapter 11 bankruptcy filing of Zynex, Inc.

Zynex, Inc. and its debtor affiliates⁽¹⁾, an Englewood, CO-based medical device company that manufactures, markets and distributes electrotherapy devices and related rehabilitation products for pain management and physical rehabilitation, filed for Chapter 11 protection on Dec. 15 in the U.S. Bankruptcy Court for the Southern District of Texas.

The filing was precipitated by a liquidity crisis following a payment suspension by Tricare, a government insurance network representing 20-25% of annual revenue, amid investigations into the company's billing practices. Facing $60 million in convertible notes maturing in May 2026 and numerous lawsuits, the debtors entered into a Restructuring Support Agreement (RSA) with an ad hoc group holding approximately 80% of the notes.

The RSA contemplates a sale of the business with the ad hoc group serving as the stalking horse bidder via a credit bid, subject to higher or better offers. To fund the case, the ad hoc group and CEO Steven Dyson have committed to provide $22.3 million in new-money DIP financing.

Zynex, Inc. reports $45.3 million in assets and $86.7 million in liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-90810.

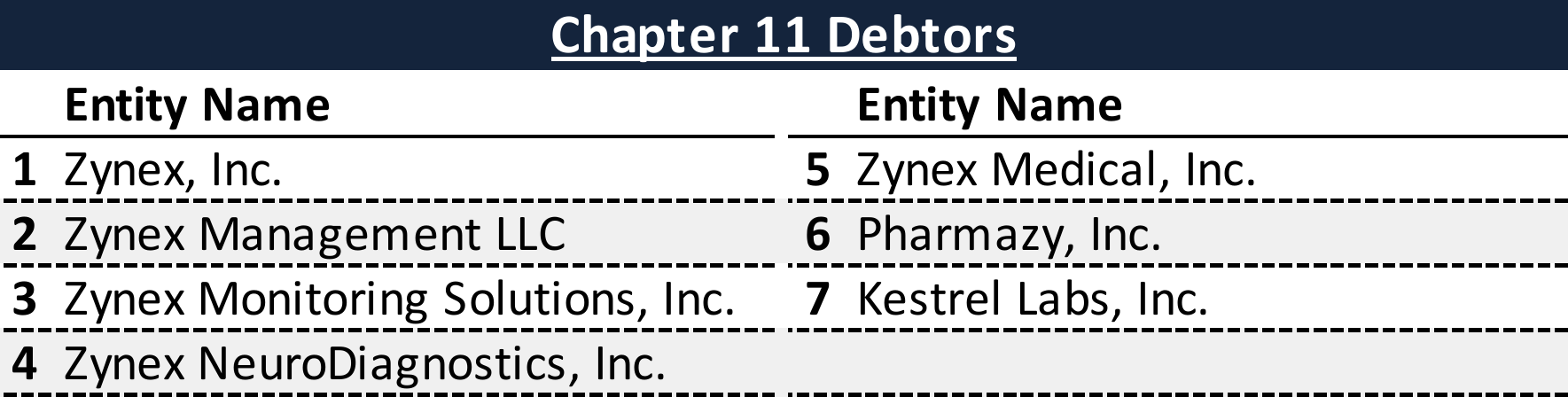

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table.

Chapter 11 Debtors

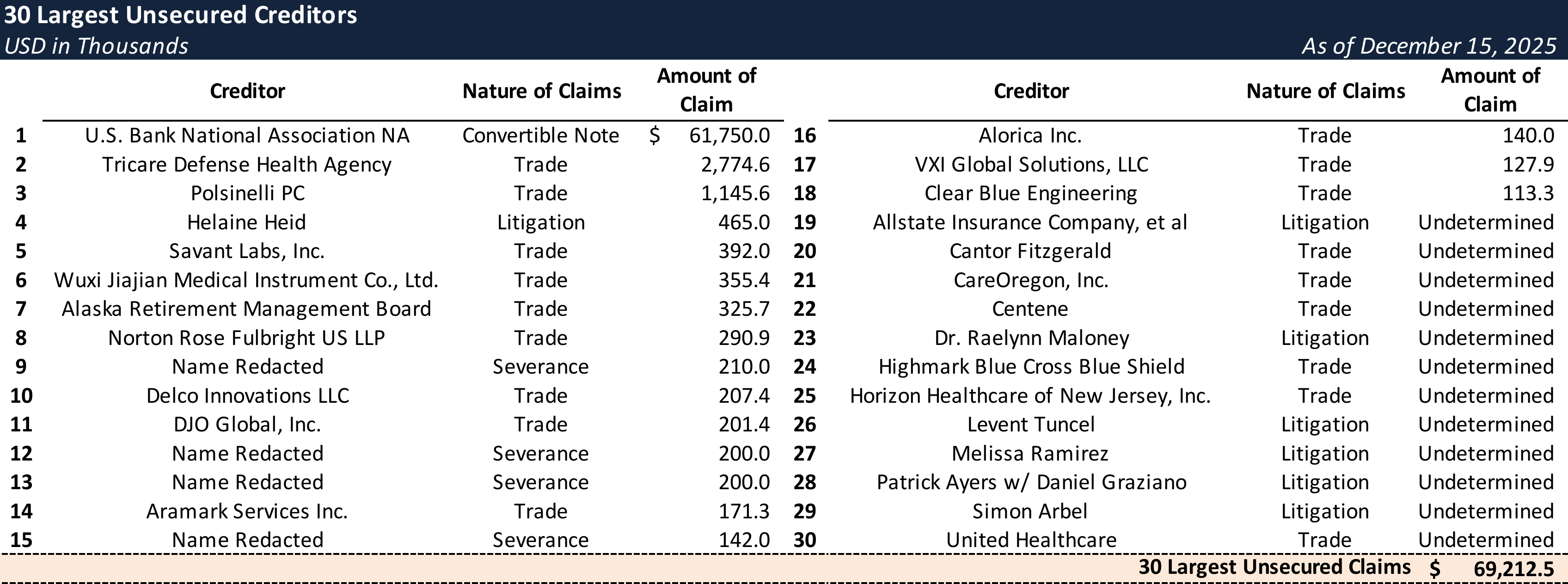

Top Unsecured Claims

Key Parties

Counsel:

- Omar J Alaniz

Reed Smith LLP

Email: [email protected]

Attorneys:

- Simpson Thacher & Bartlett LLP

Financial Advisor:

- Province LLC

Signatories:

- Vikram Bajaj – Chief Financial Officer of Zynex, Inc.

Claims Agent:

Equity Security Holders:

- Thomas Sandgaard – approximately 50%

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.