Case Summary: First Brands Group Chapter 11

First Brands Group has filed for Chapter 11 bankruptcy to address mounting leverage and liquidity pressures, backed by $1.1 billion in DIP financing.

Business Description

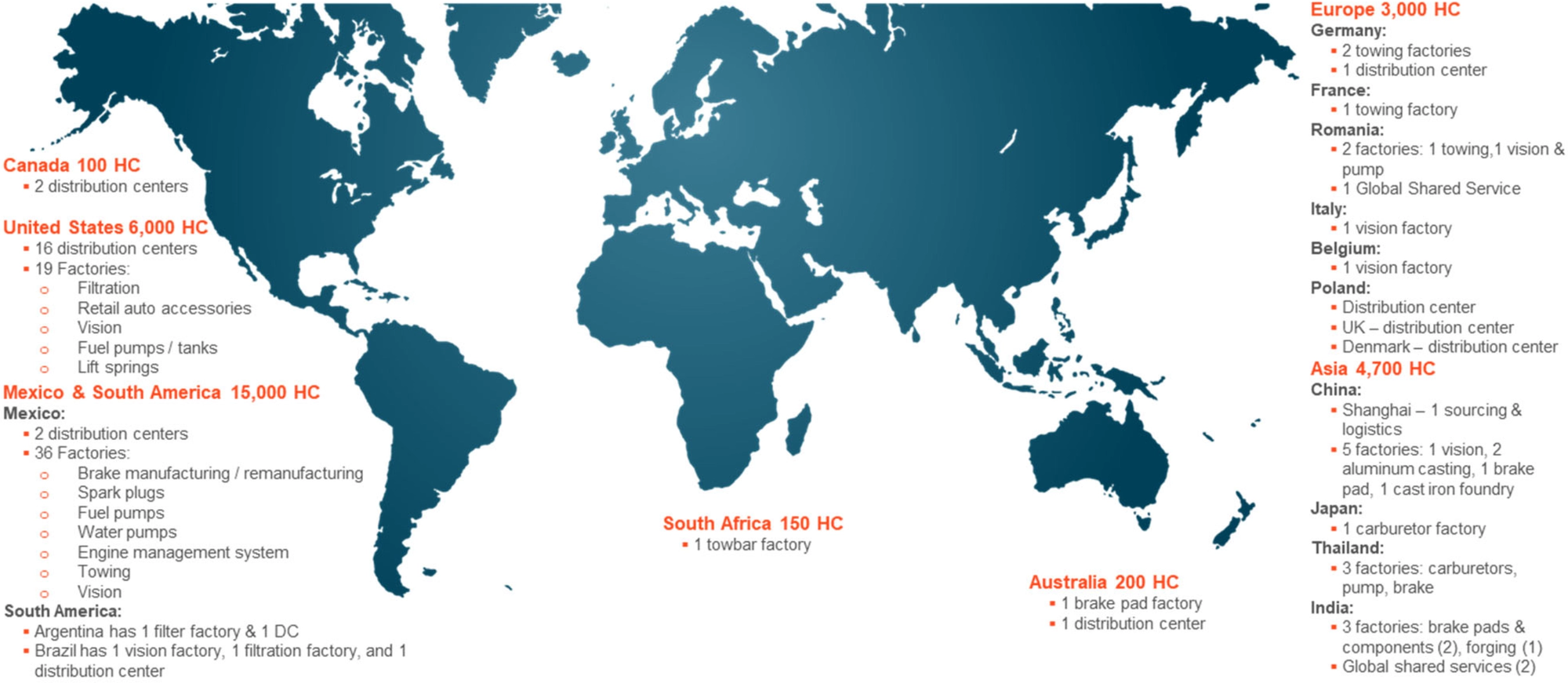

Headquartered in Cleveland, OH, First Brands Group, LLC ("FBG"), along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "First Brands" or the "Company"), is a leading global manufacturer and supplier of automotive aftermarket parts. The Company operates a vertically integrated network of manufacturing and distribution facilities spanning five continents, employing approximately 26,000 people worldwide, including about 6,000 in the United States.

- First Brands develops, manufactures, and markets a comprehensive range of automotive replacement components under a portfolio of more than 25 market-leading brands. Its extensive product lines, which have led industry observers to note, “if you own an older car with third-party parts, there’s a good chance at least one was made by First Brands,” include:

- Braking Systems: Brake pads, rotors, and calipers under brands such as Raybestos®, Centric Parts®, and StopTech®.

- Filtration Products: Oil, air, fuel, and cabin filters sold under the FRAM® and Luber-finer® brands.

- Vision Products: Windshield wipers, including TRICO® and ANCO®, and blades licensed under the Michelin® brand.

- Engine & Repair Components: Autolite® spark plugs, Carter® fuel pumps, and Airtex® engine management parts.

- Towing & Trailering Equipment: A full lineup of towing products featuring brands like REESE®, Draw-Tite®, BULLDOG®, and Westfalia®.

The Company serves a diversified customer base across all major automotive aftermarket channels, including leading auto parts retailers (Advance Auto Parts, AutoZone, O’Reilly Auto Parts), warehouse distributors, mass merchants (Walmart, Costco), and e-commerce platforms like Amazon. While approximately 82% of revenue is generated from the aftermarket, First Brands also supplies certain products directly to vehicle OEMs.

For the year ended 2024, First Brands reported net sales of approximately $5 billion. Revenue segmentation, based on estimates for the last twelve months, included braking products at approximately 33%, vision and lighting at approximately 29%, repair and towing at approximately 24%, and filtration products at approximately 14%.

First Brands Group, LLC and certain affiliates filed for Chapter 11 protection on September 28, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the Southern District of Texas, reporting $1 billion to $10 billion in assets and $10 billion to $50 billion in liabilities.

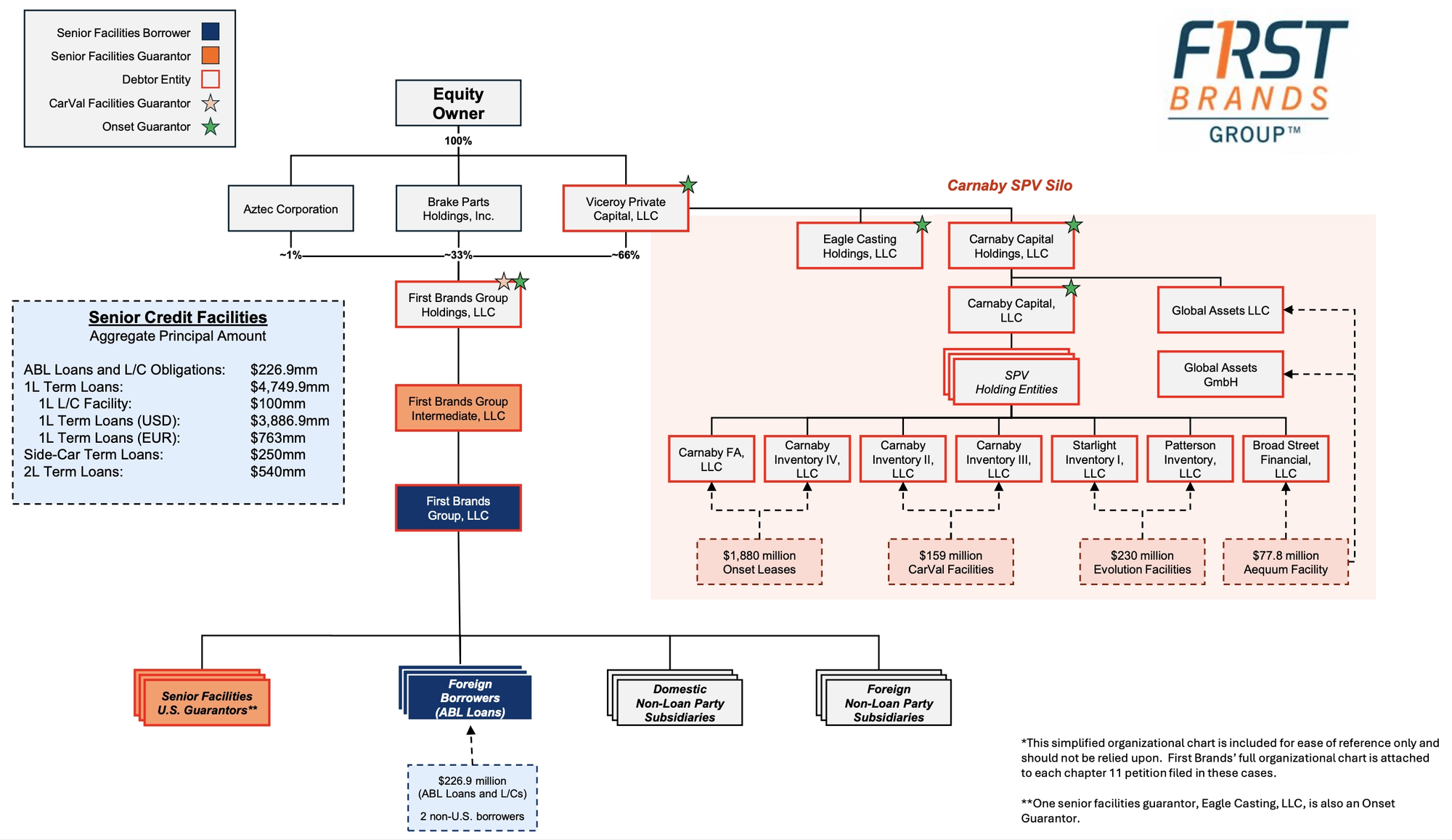

⁽¹⁾ For a complete list of Debtor entities, see organizational structure chart.

Corporate History

First Brands’ origins trace to 2013 when it was founded as Crowne Industrial Group by its current owner, Patrick James. The Company was established as a platform to consolidate automotive parts suppliers, executing its first major deals between 2013 and 2014 with the acquisitions of Carter® Fuel Pumps and Trico® Products.

Accelerated Expansion Through Acquisitions

Beginning in 2019, the Company, then operating as Trico Group, embarked on a rapid, debt-fueled acquisition strategy that dramatically expanded its scale and product portfolio. Key transactions included:

- 2019: Acquired FRAM Group, adding the iconic FRAM® filters and Autolite® spark plugs brands. The combined entity was subsequently rebranded as First Brands Group in 2020.

- 2020: Completed several transformative acquisitions, including:

- Brake Parts Inc. (July): Added the Raybestos® brand, a century-old leader in brake products.

- Champion Laboratories Inc. (July): Acquired the Luber-finer® heavy-duty filtration brand.

- Centric Parts (December): Gained a leading portfolio of brake components, including the StopTech® performance brand, cementing its position as a market leader in aftermarket braking.

- 2023: Executed two significant acquisitions:

- Horizon Global Corporation: Acquired the publicly traded towing and trailering equipment company for approximately $48.5 million, adding a suite of premier brands such as Reese®, Draw-Tite®, and Westfalia®.

- Cardone Industries: Purchased the 53-year-old automotive parts remanufacturer, further broadening its offerings in under-car "hard parts" and reinforcing its one-stop-shop capabilities.

Through more than 15 acquisitions in over a decade, First Brands assembled a portfolio of over 25 brands, becoming one of the largest players in the global aftermarket parts industry. However, this expansion was financed with significant debt, creating a highly leveraged capital structure that ultimately proved unsustainable.

Ownership and Governance

First Brands is a privately held enterprise, with 100% of its equity indirectly owned by its founder, Patrick James, who also served as CEO and president. In mid-2025, amid growing financial distress, the Company’s board established a Special Committee of independent directors to oversee restructuring efforts and investigate financial irregularities, particularly concerning its off-balance-sheet financing arrangements. In September 2025, Charles Moore of Alvarez & Marsal was appointed Chief Restructuring Officer (CRO) to guide the Company through its restructuring.

Corporate Organizational Structure

Operations Overview

First Brands operates an extensive global manufacturing and distribution network characterized by vertical integration and regionalized production. The Company’s in-house capabilities include metal casting, precision machining, electronics assembly, and specialty coatings, enabling it to control quality and costs across its diverse product lines. By leveraging manufacturing hubs in North America, Europe, and Asia, First Brands efficiently serves local markets, with over 90% of products sold in North America and 100% of products sold in Europe manufactured within the region.

Strategic Mexican Footprint

- A cornerstone of the Company’s supply chain is its significant presence in Mexico, which includes 36 factories, two distribution centers, and approximately 14,000 employees.

- These facilities produce a wide array of products and provide strategic proximity to the U.S. market. Critically, over 92% of the Company’s imports from Mexico qualify for tariff exemptions under the USMCA trade agreement, yielding an estimated $285 million in annual savings and mitigating exposure to tariffs on goods from Asia.

Distribution and Logistics

- The Company’s vertically integrated distribution network features consolidated warehouses that allow it to ship multiple product categories together, enhancing efficiency and providing a one-stop solution for its largest customers, such as national auto parts chains and mass-market retailers.

- This unified logistics system is essential for managing a complex catalog of tens of thousands of SKUs and ensuring high fill rates for its retail and wholesale partners.

Research & Development

- First Brands supports its product portfolio with significant investment in research and development, operating 12 R&D and testing labs across 10 countries.

- The Company holds over 2,900 active patents and launches approximately 5,000 new or improved parts annually. Recent innovations include extended-life (25,000-mile) oil filters and wiper blades with color-changing wear indicators.

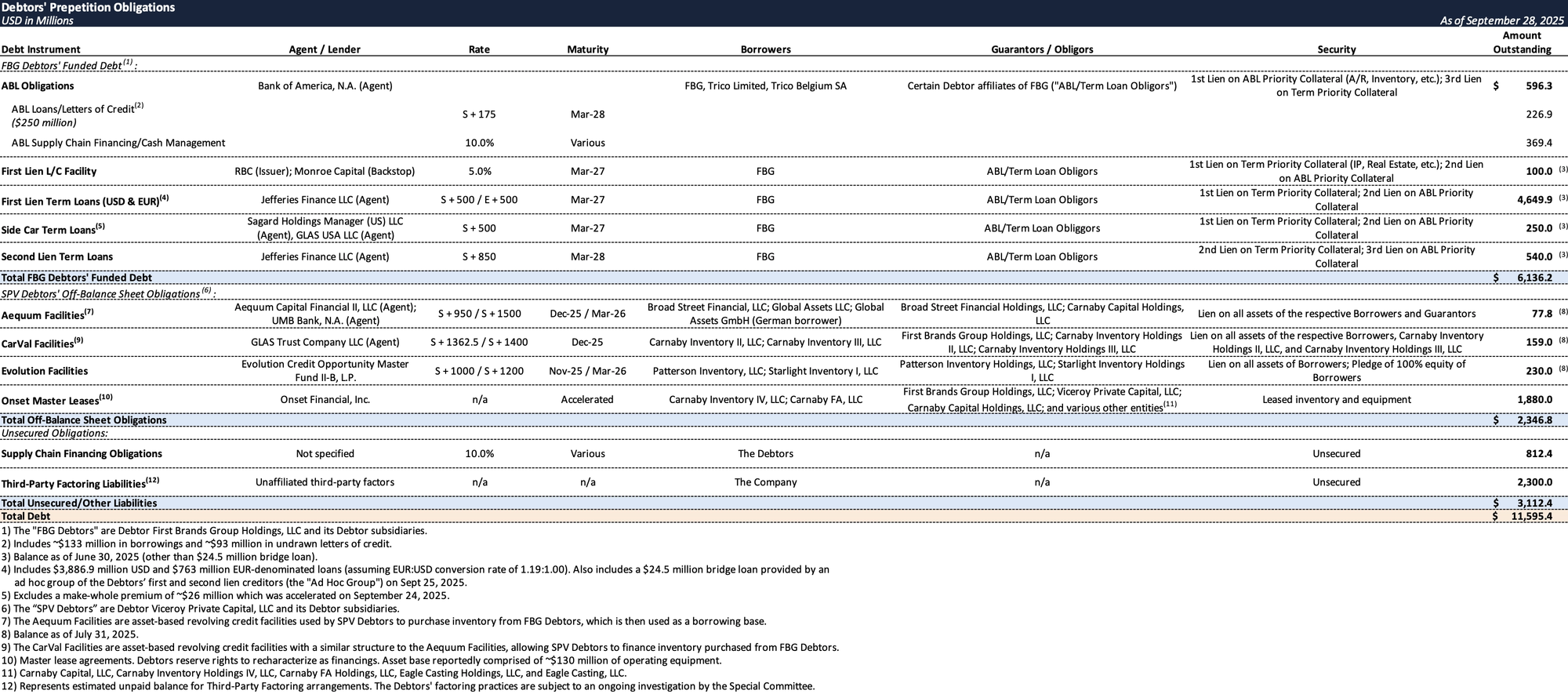

Prepetition Obligations

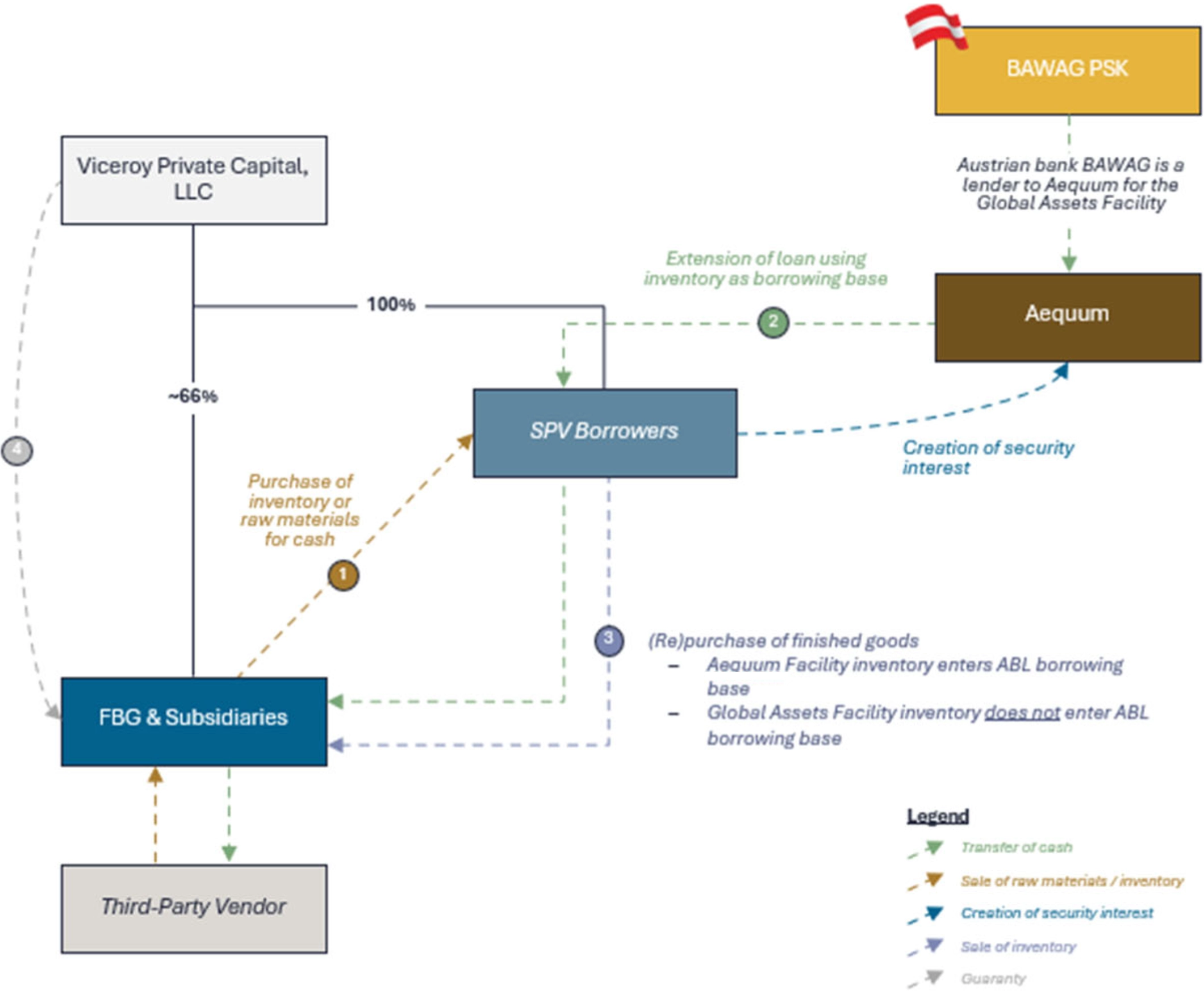

Aequum Facilities Overview

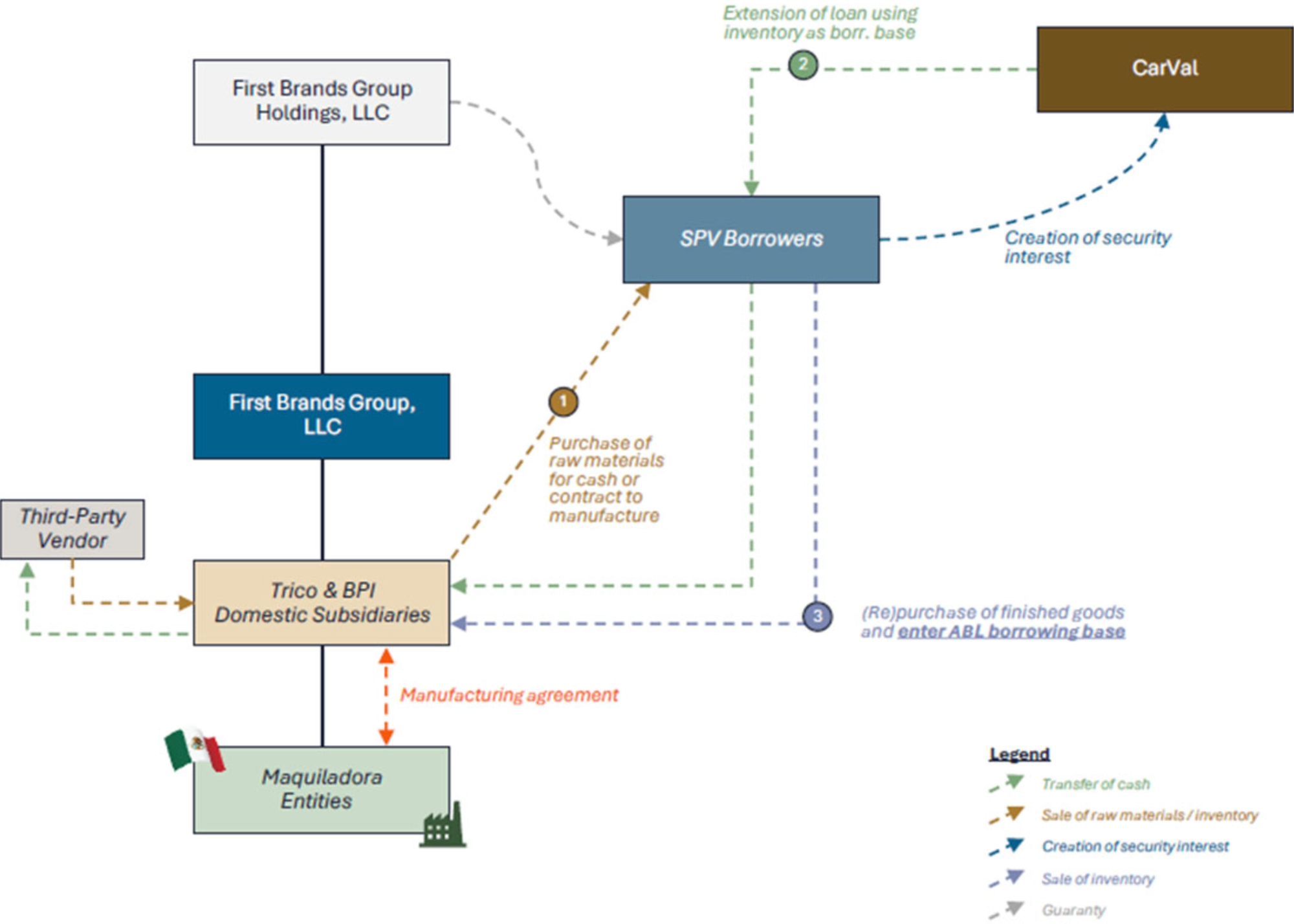

CarVal Facilities Overview

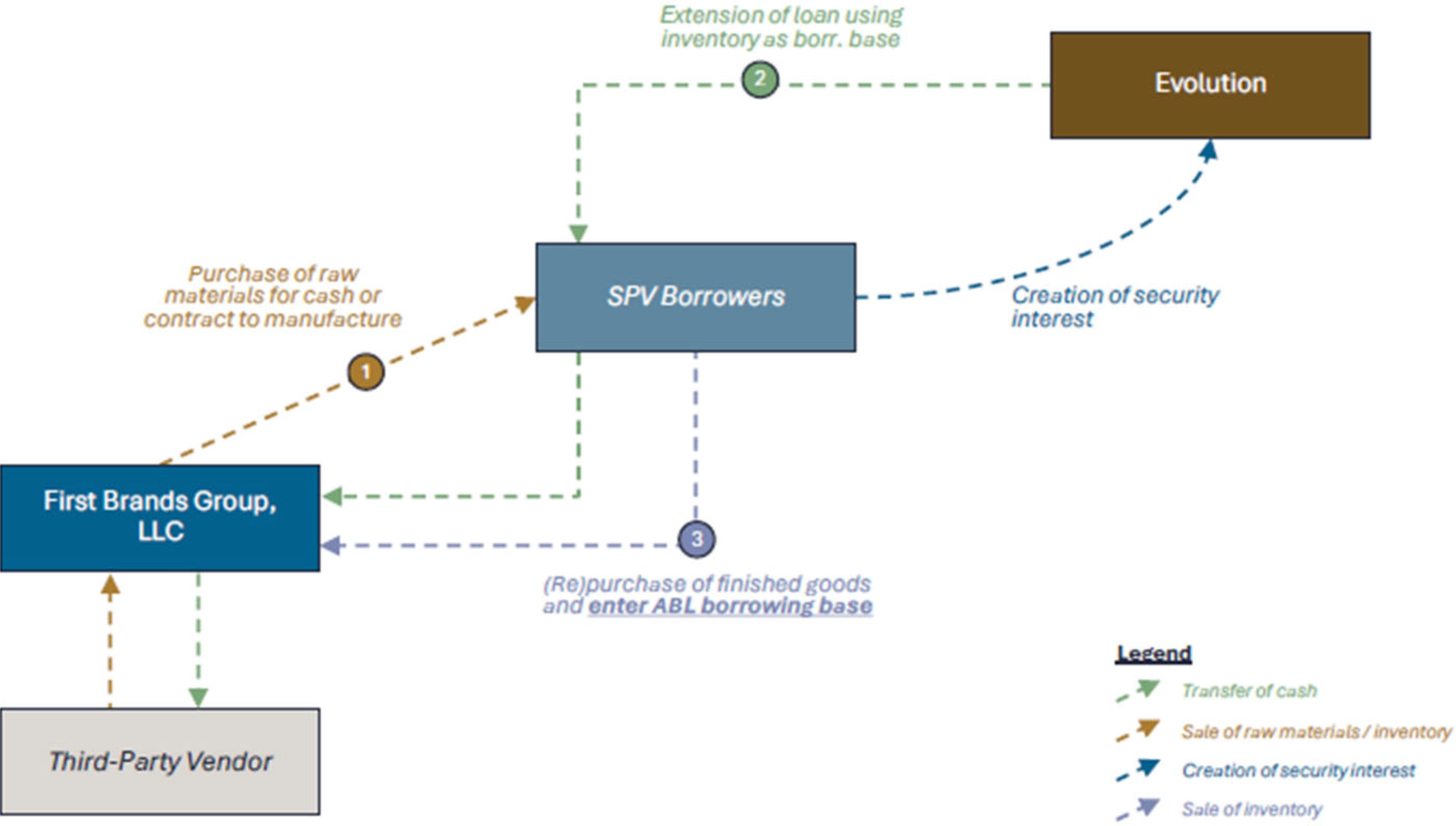

Evolution Facilities Overview

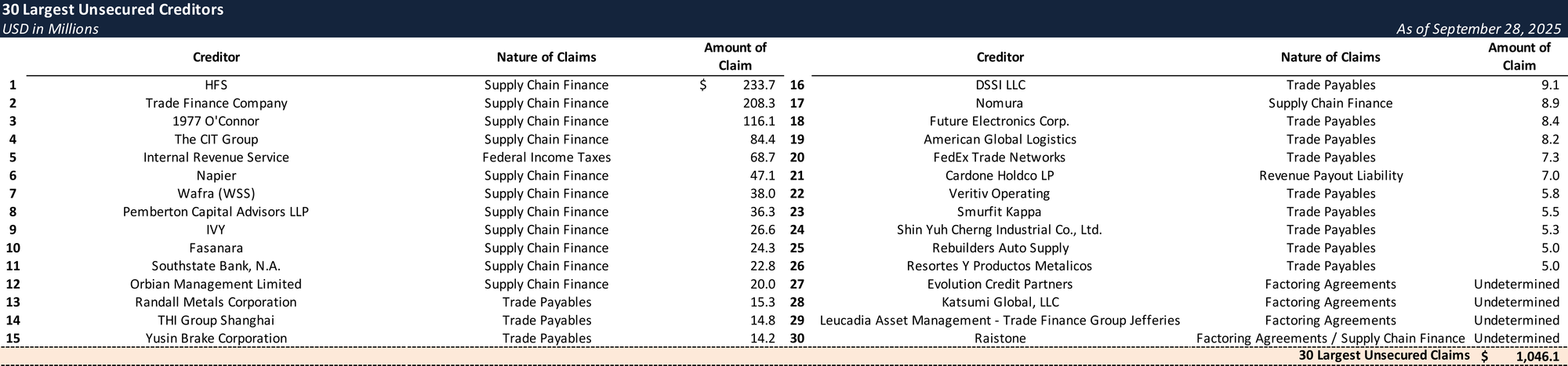

Top Unsecured Claims

Events Leading to Bankruptcy

Unsustainable Leverage from Debt-Fueled Acquisitions

- The Company’s aggressive acquisition strategy left it with an overleveraged and unsustainable capital structure. At filing, total liabilities exceeded $10 billion, including roughly $5.5 billion in term loans, $226.9 million in ABL borrowings and letters of credit, and more than $2.3 billion in off-balance-sheet inventory and lease facilities. The debt load carried an annual interest burden exceeding $900 million, with near-term maturities tightening liquidity.

- In late September 2025, Fitch Ratings downgraded First Brands Group’s IDR to ‘CCC’ from ‘B’ and subsequently withdrew the ratings, citing limited options to address upcoming maturities and an elevated risk of a distressed exchange or bankruptcy.

Tariffs and Expansion Costs

- In April 2025, new U.S. government tariffs of up to 73% were imposed on certain imported goods, increasing costs across the aftermarket parts industry. The Company incurred approximately $220 million in total tariff-related costs, which included spending $60 million to pre-buy inventory to mitigate supply chain disruptions.

- The Company's acquisition-heavy strategy also required significant upfront capital. In the 12 months leading up to June 2025, First Brands incurred nearly $160 million in integration costs and an additional $200 million to launch new business programs between June and September 2025.

Escalating Liquidity Crisis and Failed Workouts

- The Company's financial state deteriorated rapidly in the third quarter of 2025:

- Failed Refinancing and Market Collapse: An attempt in July 2025 to execute a $6.2 billion debt refinancing stalled after potential lenders, concerned about the Company's financial disclosures, insisted on a Quality of Earnings report. As concerns around the Company’s off-balance-sheet financing came to light, its debt prices collapsed; in a matter of weeks, its first-lien term loans traded down from near par to $0.36, and its second-lien loans fell from $0.91 to $0.10.

- Onset Default: On September 9, 2025, after missing payments on a nearly $1.9 billion inventory financing facility, lessor Onset Financial declared a default in early September and accelerated the full amount owed.

- Setoff and Bridge Financing: Just days before the filing, SouthState Bank set off approximately $27 million from the Company’s accounts, its last remaining U.S. liquidity, citing roughly $30 million in alleged unpaid obligations. The setoff left the Company with only about $14 million in cash, insufficient to meet payroll and other near-term obligations. To avoid a disorderly bankruptcy, an ad hoc group of the Company’s first and second lien lenders (the "Ad Hoc Group") provided an emergency $24.5 million prepetition bridge loan to fund payroll and critical expenses, facilitating an orderly transition into Chapter 11.

Chapter 11 Filing and Path Forward

- On September 28, 2025, First Brands and certain affiliates filed for Chapter 11 protection. The Company secured a $1.1 billion debtor-in-possession (DIP) financing facility from the Ad Hoc Group, including an immediate infusion of $500 million in new money.

- The DIP financing provides the necessary liquidity to maintain global operations, pay employees and vendors, and ensure business continuity for customers. The Company intends to use the Chapter 11 process to pursue a value-maximizing transaction, such as a sale or recapitalization, while its Special Committee continues to investigate the circumstances surrounding the off-balance-sheet financing irregularities.

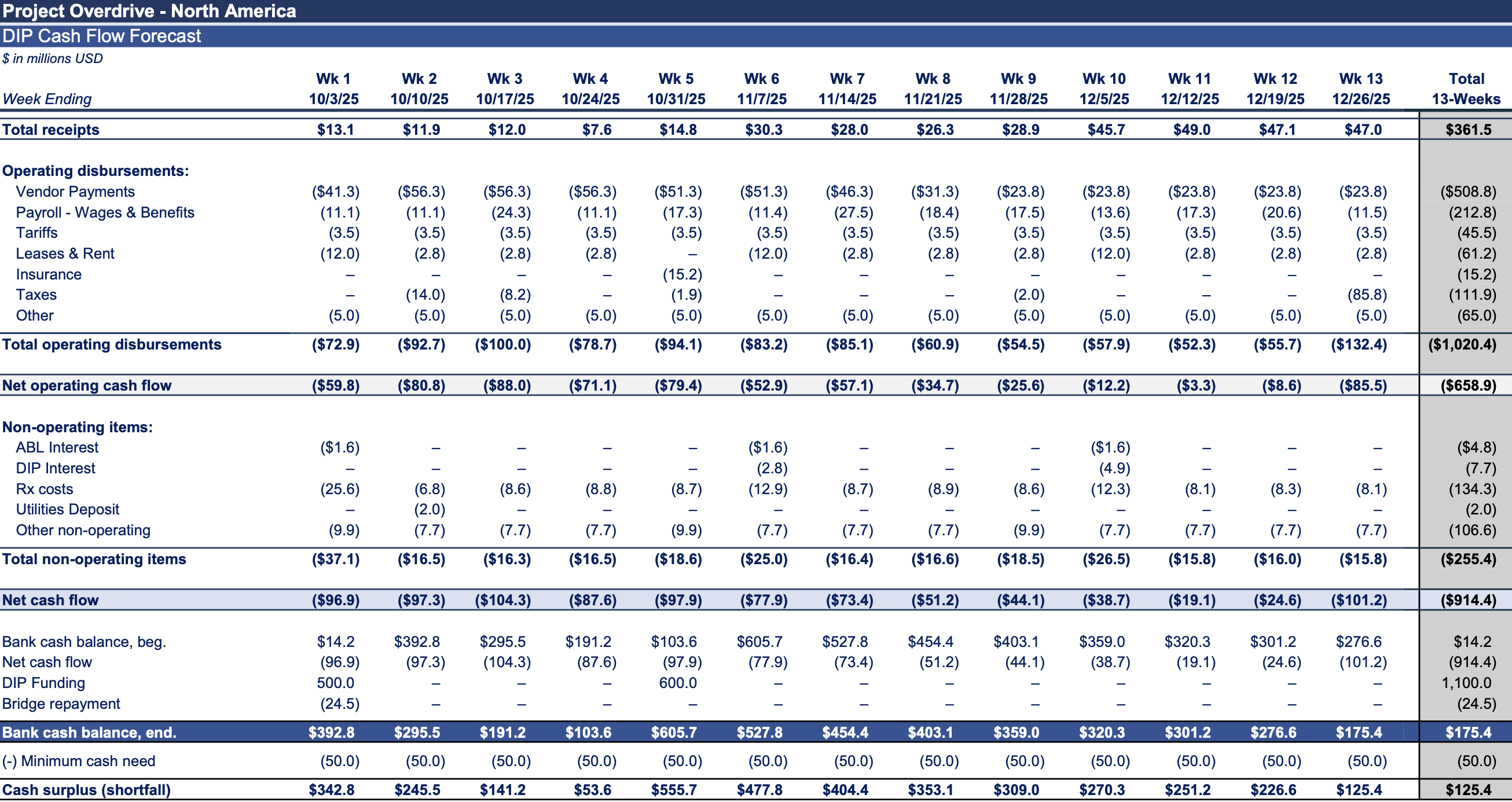

Initial DIP Budget

Key Parties

- Weil, Gotshal & Manges LLP (counsel); Alvarez & Marsal North America, LLC (financial advisor / CRO, Charles M. Moore); Lazard Frères & Co. (investment banker); Kroll Restructuring Agency, LLC (claims agent).

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.