Case Summary: Grow Schools Chapter 11

Charter School Capital (dba Grow Schools) has filed for Chapter 11 bankruptcy, citing a post-pandemic decline in financing demand, elevated real estate carrying costs, and a costly dispute with its majority shareholder, with plans to pursue a going-concern sale of its assets.

Business Description

Headquartered in Portland, OR, Charter School Capital, Inc. ("CSC," the "Debtor," or the "Company"), recently rebranded as Grow Schools, is a specialized provider of financial and operational support services exclusively to U.S. charter schools.

- The Company delivers operational funding, facilities financing, and enrollment marketing services, aiming to serve as a comprehensive financial partner for charter schools. These institutions frequently encounter structural funding gaps, driven by reliance on enrollment-based public funding and limited access to traditional district financing mechanisms.

- Since inception, the Company has extended over $3 billion in capital to approximately 1,000 charter schools, representing about one in every eight such schools nationwide.

As of the Petition Date, CSC operates under the Grow Schools brand, providing receivables financing to 15–20 schools and enrollment services to 36 schools. The Company also owns and manages a portfolio of eight charter school real estate assets.

CSC filed for Chapter 11 protection on June 8, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the District of Delaware, reporting $10 million to $50 million in both assets and liabilities.

Corporate History

CSC was co-founded in 2006 by Stuart Ellis (CEO) and Brad Coburn (CIO) to address the chronic funding volatility experienced by U.S. charter schools.

Founding Vision and Growth Capital

- CSC initially focused on receivables financing, providing charter schools with immediate liquidity by purchasing state per-pupil payments in advance. The Company scaled quickly due to demand for cash-flow solutions in the charter sector.

- Orthogon Partners ("Orthogon"), a New York-based private investment firm led by Rishi Ganti, joined as a growth equity investor in the late-2010s. Orthogon eventually became CSC’s majority shareholder with a 52.1% stake as of the Petition Date.

Product Expansion

- In 2014, CSC, in partnership with American Infrastructure MLP Funds, established American Education Properties ("AEP") to address the growing demand for charter school facilities financing.

- Through AEP and its successors, CSC acquired and managed dozens of charter school properties, often under long-term leases with eventual transitions to school ownership via tax-exempt municipal bonds.

- In the late 2010s, CSC launched marketing and enrollment consulting services, positioning itself as a one-stop growth platform for charter operators.

Rebranding and Governance

- In November 2023, CSC adopted the public-facing brand “Grow Schools” to reflect its broadened mission and service offerings. The legal corporate name remained Charter School Capital, Inc., as evidenced in court filings.

- CSC is privately held, with voting control retained by CEO Stuart Ellis via Common A shares. On a fully diluted basis as of the Petition Date, Orthogon holds 52.1% of the equity, Ellis owns 16.8%, and co-founder Brad Coburn holds 14.6% (directly or via affiliated entities).

Subsidiary Structure

- CSC utilized numerous subsidiaries to segregate assets and manage financing. Key entities included Public Charter School Receivables Company, LLC (for receivables), and various real estate holding companies like Charter School Real Estate Holdings, LLC ("CSREH," which held interests in seven school facilities) and CSRC Charter Lisa, LLC (which owned one facility).

Operations Overview

CSC operates through three integrated business lines, supported by a network of over 20 subsidiaries and special-purpose entities.

Working Capital Financing (“Money to Run Your School”)

- CSC advances cash to charter schools based on anticipated state funding. Schools assign receivables to CSC, which funds them upfront and collects payment via state intercept mechanisms. The Company earns a profit on the spread between the discounted purchase price paid for the receivables and the full amounts collected, net of financing costs.

- The program is operated through non-Debtor Public Charter School Receivables Co., LLC, with back-end financing provided by Bank of America and oversight by U.S. Bank as indenture trustee.

- Financing volume declined from a peak of ~$300 million annually pre-COVID to just $32.6 million in 2024, due to pandemic-era federal aid reducing schools’ need for liquidity advances.

Facilities Financing (“Money to Buy Your School”)

- Through its non-Debtor subsidiary SPEs, CSC acquires, develops, and leases facilities to charter operators under long-term leases.

- The Company provides a structured “path to ownership” by assisting schools in buying the property via tax-exempt bonds after several years of tenancy.

- As of the Petition Date, CSC owns eight active school properties through its SPEs.

Enrollment Marketing and School Services (“Kids to Fill Your School”)

- CSC offers charter schools outsourced marketing campaigns, student recruitment consulting, and branding services under performance-based or fixed-fee models.

Prepetition Obligations

Funded Debt: CSC holds no direct secured or unsecured funded debt. Its sole third-party financial exposure is a guarantee capped at $8.5 million on behalf of its indirect non-Debtor subsidiary, GS 50 2nd Street, LLC (controlled by affiliate CSREH), under a Building Hope Finance real-estate loan dated Nov. 21, 2024. All other funded borrowings exist at non-Debtor subsidiaries, secured primarily by real property and rent assignments. These subsidiary obligations have no recourse to the Debtor.

Unsecured Obligations: As of the Petition Date, the Debtor estimates total unsecured obligations of approximately $3.7 million, comprising ordinary-course trade, lease, and other payables of roughly $0.7 million, in addition to an insider claim of approximately $3 million arising from an adverse arbitration award.

Liquidity: As of the Petition Date, CSC has approximately $1.29 million in unrestricted cash, available to support operational needs during the Chapter 11 case.

Intercompany Position: CSC maintains a net creditor position with affiliates, holding intercompany receivables totaling roughly $18.2 million. This includes approximately $1.24 million outstanding on an intercompany note originally issued by CSRC ($1.25 million principal dated Sept. 18, 2018; extended Sept. 5, 2023) and $16.95 million across eight promissory notes due from non-Debtor Charter School Real Estate Company, LLC. The Debtor itself is not an obligor on any intercompany debt instruments.

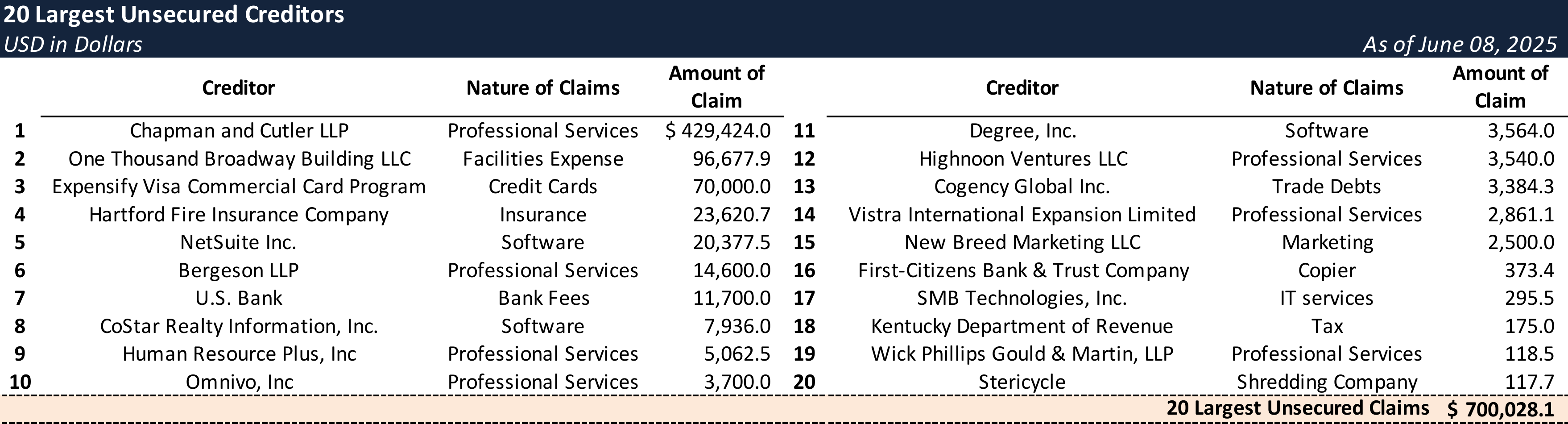

Top Unsecured Claims

Events Leading to Bankruptcy

Revenue Decline and Macroeconomic Headwinds

- CSC’s working capital business suffered a structural contraction as federal COVID-19 relief and increased state funding reduced schools’ reliance on third-party liquidity.

- Annual receivables financed fell from ~$300 million pre-pandemic to ~$32.6 million in 2024, significantly reducing fee income and liquidity.

- CSC’s facilities business faced increased carrying costs amid rising interest rates and a cooling municipal bond market, delaying planned exits of school properties and straining cash flow.

- Management responded with workforce reductions (approx. 40% since 2022), cost cuts, and efforts to refinance or sell properties, but liquidity pressures persisted.

Investor Dispute with Orthogon Partners

- In 2023, CSC secured $11.6 million in preferred equity from Orthogon, which later alleged material financial misrepresentations and sought rescission of its investment. Because the funds had already been deployed to acquire real estate, redemption was not feasible, and a dispute ensued.

- The parties negotiated a “Preferred Stock Framework” in June 2024, but it was never executed. CSC proceeded with a November 2024 real estate transaction over Orthogon’s objection, triggering further conflict.

- Orthogon filed an arbitration demand in December 2024. Following April 2025 hearings, the arbitrator awarded Orthogon ~$3.1 million (including fees and costs) on May 22, 2025.

- Orthogon sought to confirm the award in New York court, posing a threat to CSC’s stability and chilling potential sale discussions with strategic acquirers.

Restructuring Initiatives and Chapter 11 Filing

- In response to the escalating crisis, CSC formed a Restructuring Committee in May 2025 composed of two independent directors: Edward Weisfelner and Craig Jalbert.

- The committee was granted full authority to evaluate strategic alternatives, including approving a bankruptcy filing.

- In parallel, CSC negotiated with a potential strategic buyer who submitted a revised proposal in late May requiring a 363 sale process.

- On June 8, 2025, CSC filed for Chapter 11 in the District of Delaware to stay enforcement of the Orthogon award and preserve the value of its business through a going-concern sale.

Key Parties

- Restructuring Counsel: Goodwin Procter LLP

- Co-Counsel: Potter Anderson & Corroon LLP

- Financial Advisor & Sales Agent: Rock Creek Advisors, LLC

- Claims Agent: Epiq Corporate Restructuring LLC

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.