Case Summary: Meyer Burger Chapter 11

Meyer Burger’s U.S. subsidiaries have filed for Chapter 11 bankruptcy as capital shortfalls, production setbacks, and lost 45X tax-credit revenues forced the shutdown of their Goodyear, AZ, facility, with an ad hoc bondholder group providing a $23 million DIP to fund an expedited asset sale.

Business Description

Meyer Burger (Holding) Corp. and its U.S. Debtor affiliates⁽¹⁾ (the "Debtors" or the "Company"), subsidiaries of Swiss-based Meyer Burger Technology AG ("MBT AG"), are developers of a planned U.S.-based solar module manufacturing operation. The Company’s strategy was centered on establishing a "Made in America" production footprint to capitalize on domestic manufacturing incentives provided by the Inflation Reduction Act of 2022 (IRA).

- The Company’s core value proposition is built on its parent’s proprietary and high-efficiency solar technology platform, which combines Heterojunction (HJT) solar cells with SmartWire Connection Technology (SWCT®) to produce premium, high-performance solar modules.

- Operations were to be anchored by a 276,000-square-foot module assembly facility in Goodyear, AZ, which was designed to produce up to 2.1 gigawatts of solar modules annually and employ a workforce of 600 at full capacity.

Prior to ceasing operations, the Company had secured master supply agreements with major renewable energy developers, including D. E. Shaw Renewable Investments ("DESRI") and Ingka Investments, leveraging over $102 million in customer prepayments to help fund the initial build-out.

Meyer Burger (Holding) Corp. and its affiliates filed for Chapter 11 protection on June 25, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the District of Delaware, reporting $100 million to $500 million in assets and $500 million to $1 billion in liabilities.

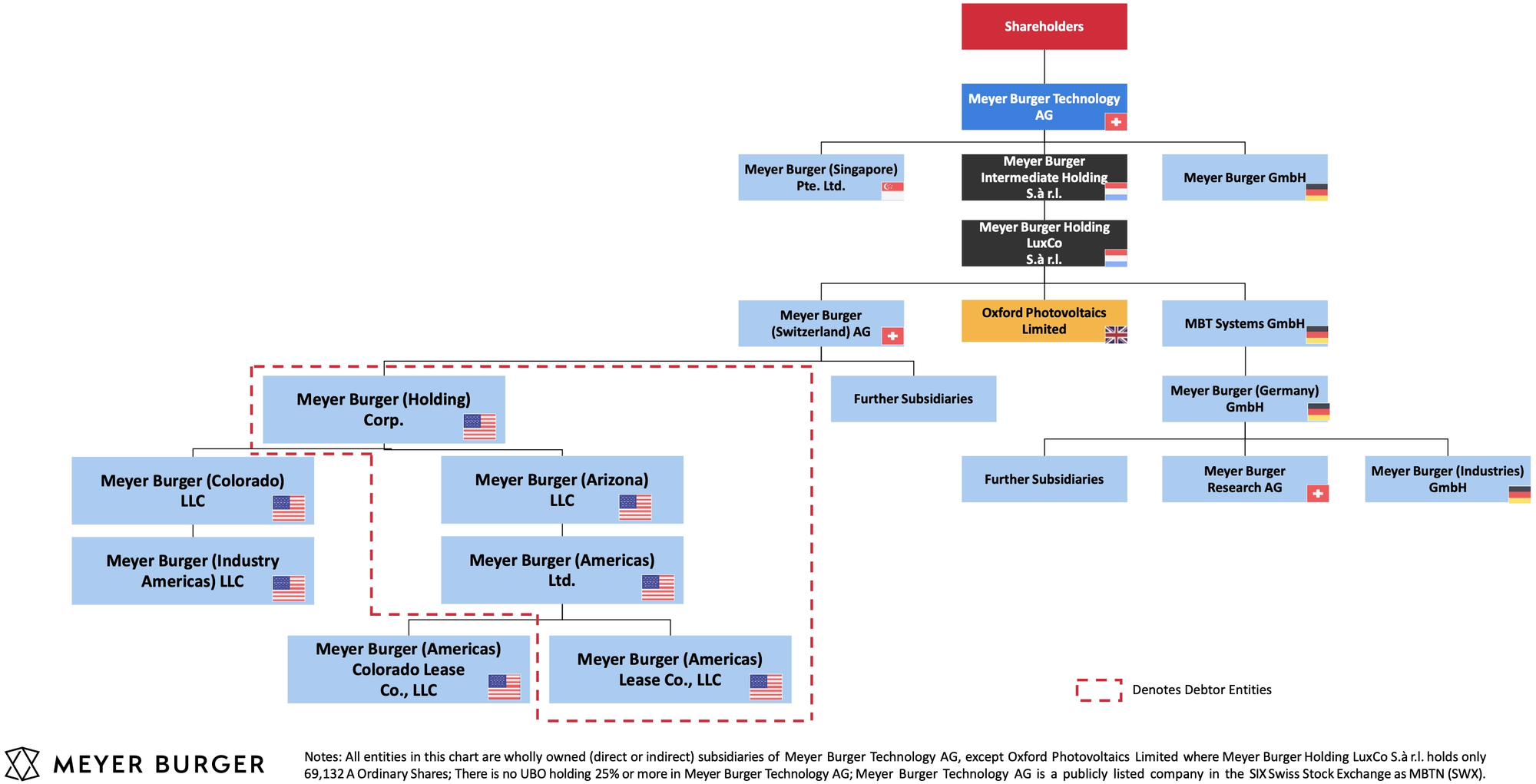

⁽¹⁾ For a complete list of debtor entities, see the organizational structure chart below.

Corporate History

The Debtors’ U.S. venture is a direct extension of a high-risk strategic transformation undertaken by its Swiss parent, MBT AG. Founded in 1953, MBT AG operated for decades as a leading technology provider and equipment supplier to the global solar industry, pioneering key innovations in wafer cutting and cell production.

Strategic Pivot to Manufacturing

- In 2020, facing intense price pressure and market distortion from an oversupply of low-cost Chinese products in Europe, MBT AG pivoted from its capital-light licensing model to become a vertically integrated manufacturer of its own high-performance solar cells and modules.

- This transformation involved acquiring and re-tooling former solar factories in Germany and fundamentally altered the company's risk profile and capital structure, exposing it to the commodity manufacturing market.

The American Gambit

- The expansion into the United States was a defensive strategy designed to escape the European price wars and capitalize on the attractive financial incentives offered by the IRA. The U.S. was viewed as a stable market with strong government support, where the company could establish a profitable, premium "Made in America" business.

- CEO Gunter Erfurt framed the move as essential to making the company "independent of political decisions in Europe" and positioning it for profitable growth.

Corporate Organizational Structure

- The U.S. Debtors are indirectly, wholly owned by the publicly listed Swiss parent, MBT AG. Ownership flows through a non-Debtor Swiss affiliate, Meyer Burger (Switzerland) AG, which holds the patents for the proprietary technology used in the U.S. operations.

- This structure created a complex web of intercompany debt (approximately $370 million) and operational dependencies, most notably the U.S. operation's reliance on German affiliates for its solar cell supply, which ultimately became a conduit for insolvency.

Operations Overview

The Company’s U.S. strategy was predicated on establishing a vertically integrated manufacturing footprint, which was ultimately abandoned, and a proprietary technology platform that was more complex and costly than mass-market alternatives.

Manufacturing Assets

- Goodyear, AZ Module Production Facility: The centerpiece of the U.S. operations was a 276,000-square-foot manufacturing plant and an adjacent 218,451-square-foot warehouse, both leased by Debtor MB Lease Co. and operated by Debtor Meyer Burger (Americas) Ltd. ("MBA"). The Company invested approximately $60 million to convert the former warehouse space into a state-of-the-art facility.

- The facility was designed for three production lines with a nameplate capacity of 2.1 gigawatts annually. However, only one line was ever partially operational, a second was partially installed, and the third was never installed due to deteriorating finances. The plant never approached its designed capacity.

- Abandoned Colorado Springs, CO Cell Production Facility: The original plan included a dedicated solar cell plant in Colorado to create a fully domestic supply chain and maximize IRA "domestic content" tax credits.

- This critical project was discontinued after the Company failed to secure the necessary financing, a strategic failure that broke the domestic supply chain and forced a pivot to a riskier trans-Atlantic model reliant on a single German affiliate for its supply of HJT cells.

Proprietary Technology Platform

The Company’s competitive strategy relied on the superior performance and efficiency of its HJT/SWCT® technology platform to justify a premium price point.

- Heterojunction (HJT) Technology: An advanced solar cell architecture that combines crystalline and amorphous silicon layers to minimize electron loss, resulting in higher energy yield, better temperature stability, and stronger low-light performance compared to conventional cells.

- SmartWire Connection Technology (SWCT®): A patented cell connection method that replaces traditional metal busbars with a dense grid of 18 micro-wires. This design offers several advantages:

- Reduced Shading: Increases the module’s power output by allowing more sunlight to reach the silicon.

- Enhanced Durability: The wire mesh reinforces the cell against micro-cracks, improving long-term reliability.

- Lower Cost: Significantly reduces the consumption of expensive silver paste by over 85%, according to CSEM researchers.

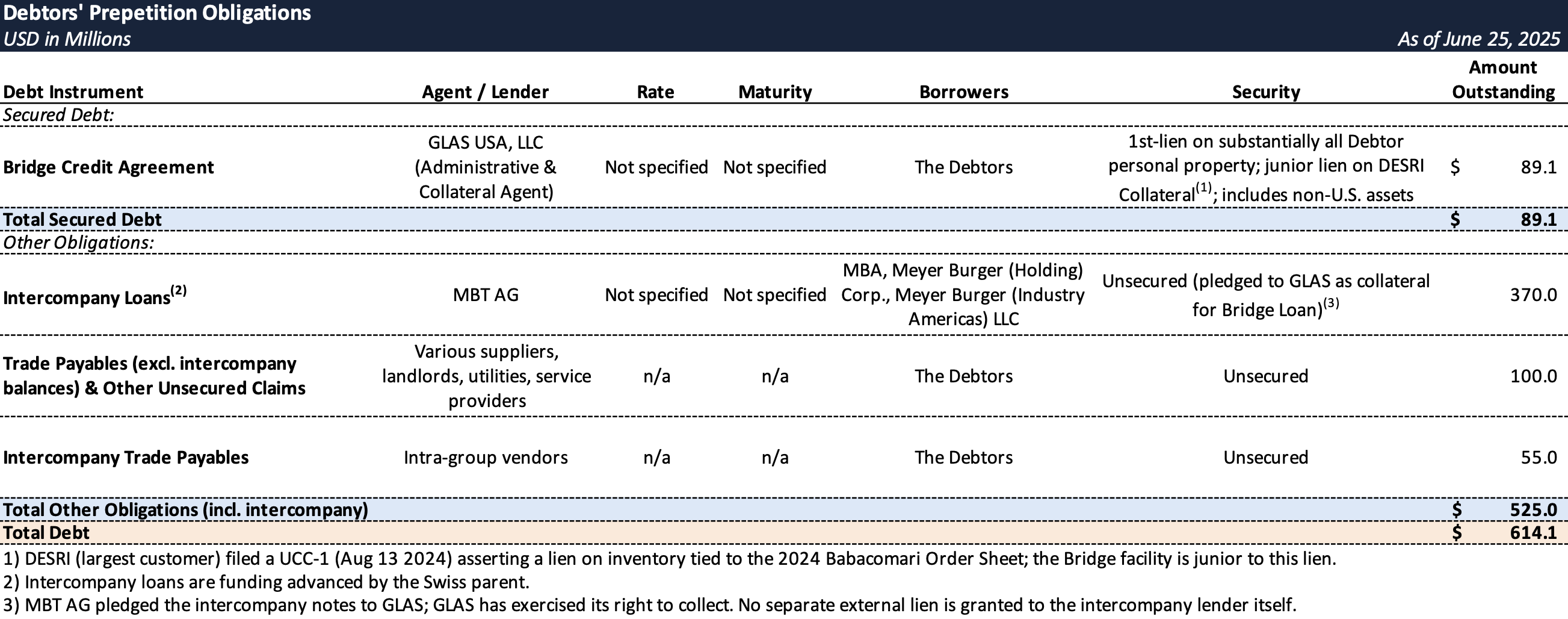

Prepetition Obligations

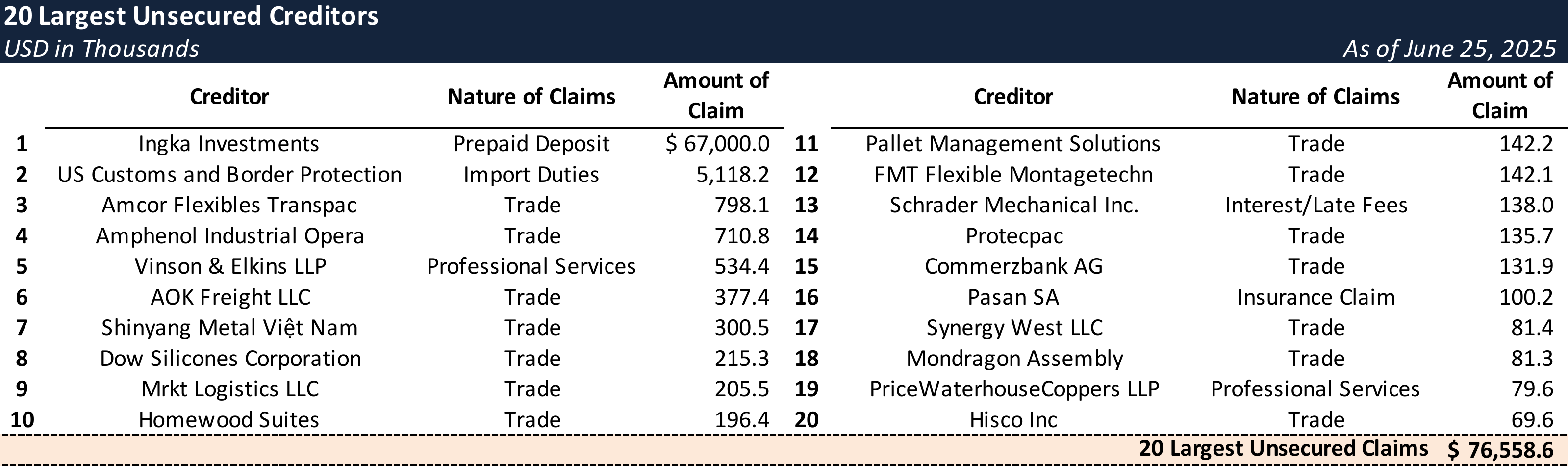

Top Unsecured Claims

Events Leading to Bankruptcy

The Chapter 11 filing by Meyer Burger's U.S. operations is the culmination of a high-stakes strategic pivot, severe macroeconomic headwinds, operational missteps, and a cascade of financial and contractual failures that ultimately led to a cross-continental insolvency contagion.

Operational Challenges and Negative Feedback Loop

- The Arizona facility experienced significant operational problems from the outset, hindering its ability to achieve projected production levels and profitability.

- An initial six-month delay was caused by a fundamental design flaw in the production lines, requiring costly re-engineering to produce the correct solar modules.

- These internal issues were compounded by global supply chain disruptions, leading to delays in equipment delivery and damaged goods, which prevented the facility from achieving anticipated automated production efficiency.

- This confluence of factors meant the facility never reached production volumes to generate significant revenue or, crucially, to monetize the Section 45X tax credits from the Inflation Reduction Act (IRA) upon which the business model critically depended. This created a vicious cycle: lack of production meant no tax credits, exacerbating the liquidity crisis that further hampered production.

Failing Financial Bedrock of MBT AG

- The U.S. expansion was predicated on substantial financial support from its Swiss parent, MBT AG, including approximately $370 million in intercompany debt and $240 million in equity financing.

- However, MBT AG's consolidated financial performance revealed a company in deep distress, unable to underwrite such an ambitious undertaking:

- In FY 2021, MBT AG reported a net loss of CHF 100.5 million on CHF 39.9 million in revenue, with negative cash from operations of CHF 84.1 million.

- By FY 2023, the net loss escalated to CHF 291.9 million on CHF 135.0 million in revenue, with cash from operations at a negative CHF 152.4 million and total equity plummeting to CHF 191.4 million from CHF 428.9 million in FY 2022.

- This financial collapse at the parent level rendered the promised U.S. funding unsustainable, making a liquidity crisis for the Debtors inevitable.

Failed Quest for External Capital

- Recognizing the parent company's inability to fully fund the expansion, the Debtors pursued a multi-pronged external financing strategy, which ultimately failed:

- Goldman Sachs Commercial Loan: An indicative term sheet was signed in 2023 but the loan never closed, as the Debtors failed to meet conditions precedent by the July 2024 deadline, citing budget overruns and unresolved commercial issues.

- U.S. Department of Energy (DOE) Loan: The Debtors pursued a $200 million to $250 million loan under the DOE’s Title 17 program and were invited to submit a Part II application in February 2024; however, the loan was no longer feasible due to the lack of private financing and equity support, and the lengthy review process with earliest disbursement in spring 2025.

- German Export Credit Facility: A parallel effort to secure a German export credit facility also failed due to the absence of accompanying private financing.

Catastrophic Contract Defaults

- The Debtors secured over $102 million in prepayments from key customers under long-term master supply agreements, including Ingka Investments (IKEA's parent group, for ~2 GW of modules) and D. E. Shaw Renewable Investments (DESRI, for up to 5 GW of modules).

- The DESRI contract was particularly critical, providing demand visibility and anchoring the U.S. business. However, operational failures at the Arizona facility made it impossible to meet production requirements and delivery schedules.

- On November 14, 2024, DESRI terminated its master supply agreement, citing alleged breaches by Meyer Burger.

- This public termination, disclosed via a Swiss Ad Hoc Notice, severely hampered the Debtors’ efforts to secure new financing. On June 12, 2025, DESRI issued a formal notice of default and foreclosure, declaring its intent to auction collateral securing its prepayments.

The Unfulfilled Promise of the Inflation Reduction Act

- The financial viability of the U.S. venture was critically dependent on generating up to $1.295 billion in Section 45X Advanced Manufacturing Production Credits between 2024 and 2030.

- However, the Debtors' inability to achieve meaningful production volumes meant these credits could not be generated at the scale needed for profitability, creating a "subsidy trap" where the business plan collapsed without the contingent revenue.

- Legislative uncertainty, including a proposed phase-out of Section 45X credits by H.R. 1 in the U.S. House of Representatives, further deterred potential investors from backing a business heavily reliant on potentially unstable government subsidies.

Desperate Measures and Insolvency Domino Effect

- As financial distress deepened, MBT AG and its advisors engaged in urgent negotiations with an ad hoc group (the "AHG") of bondholders for a recapitalization transaction.

- In December 2024, the AHG provided a secured Bridge Loan of up to $39.48 million as a temporary lifeline, but a parallel effort to sell the entire global enterprise failed to produce a binding offer.

- A final attempt to secure a major recapitalization with a third-party investor collapsed at the end of April 2025, exhausting all out-of-court rescue options.

- The failure of recapitalization efforts triggered a rapid chain reaction across the Atlantic:

- On May 30, 2025, MBT AG filed for a debt restructuring moratorium in Switzerland, signaling its inability to meet financial obligations.

- Shortly thereafter, its financially dependent German affiliates, Meyer Burger (Industries) GmbH (the sole supplier of HJT solar cells to the U.S. plant) and Meyer Burger (Germany) GmbH, filed for insolvency proceedings in Germany. This severed the U.S. facility's critical supply chain.

- With their supply chain severed and funding exhausted, the Debtors ceased all production at the Arizona facility by May 31, 2025, terminating their entire U.S. workforce of more than 400 employees. This led to a class-action lawsuit alleging violations of the federal Worker Adjustment and Retraining Notification (WARN) Act.

- Facing a dire liquidity position and no viable out-of-court options, the Debtors filed for Chapter 11 protection on June 25, 2025, with the goal of pursuing an expedited Section 363 sale of substantially all assets.

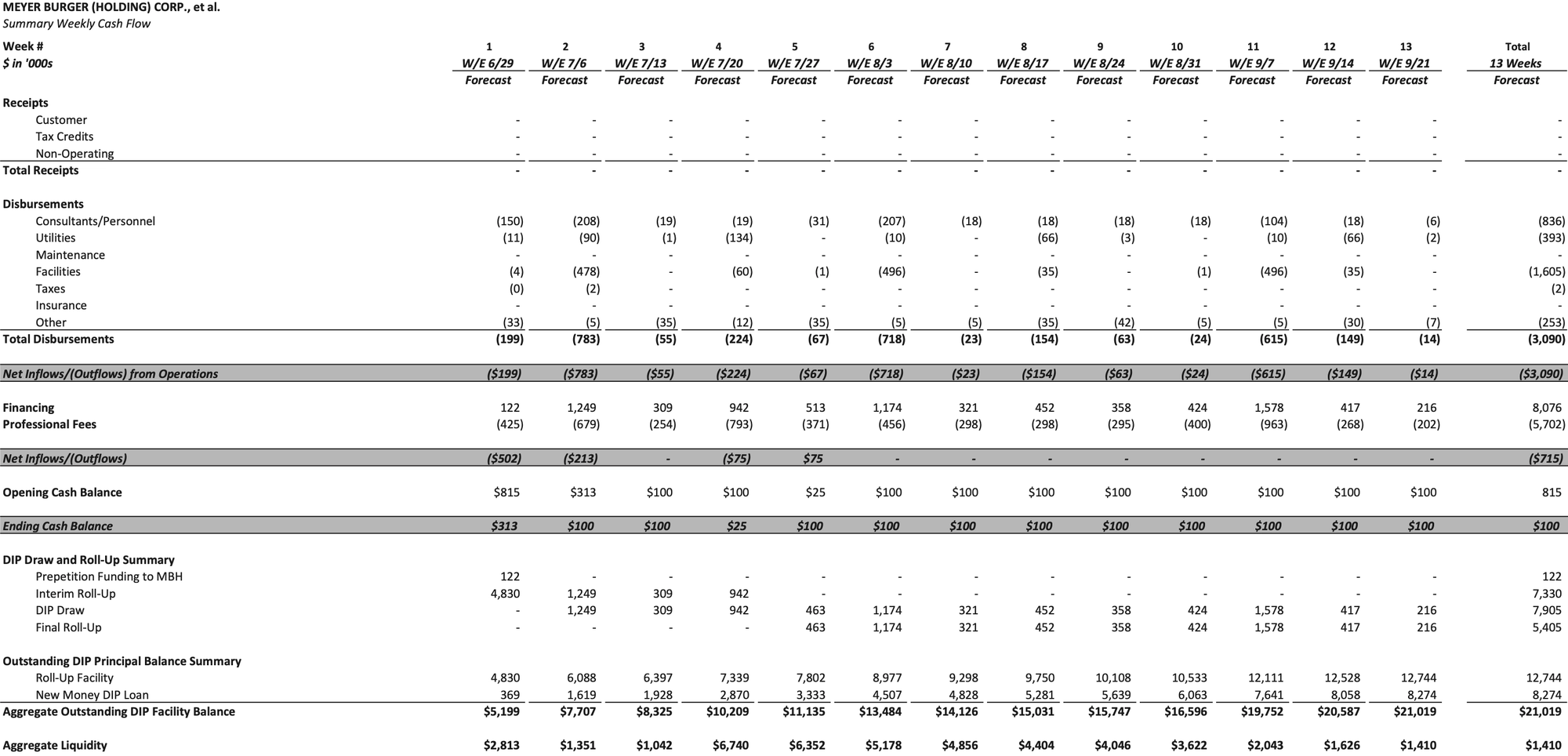

- To facilitate the administration of the cases and the sale process, the Debtors secured a DIP financing facility totaling approximately $23.3 million from their prepetition secured lenders (the AHG), comprising ~$9.2 million in new money and a roll-up of prepetition loans.

- On June 26, 2025, the Delaware court granted interim approval for $2.5 million in new money funding and an initial roll-up of approximately $4.8 million in prepetition secured obligations.

- A final hearing to approve the remaining ~$6.7 million in new money and the full roll-up of prepetition loans is scheduled for July 18, 2025.

Key Parties

- Richards, Layton & Finger, P.A. (counsel); FTI Management, Inc. (financial advisor / CRO — Justin D. Pugh); Jefferies LLC (investment banker); Kroll Restructuring Administration LLC (claims agent).

Initial DIP Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.