Case Summary: NLC Energy Denmark Chapter 11

NLC Energy Denmark, an affiliate of NLC Energy, filed for Chapter 11 to reject its long-term offtake contract with the University of California and restructure over $75M of senior secured notes through a prepackaged plan, after years of production underperformance and operating losses.

Business Description

NLC Energy Denmark LLC ("NLC" or the "Debtor") is a renewable energy company specializing in the conversion of organic waste into biomethane, also known as Renewable Natural Gas (RNG), and valuable co-products.

- The Debtor operates an anaerobic digestion facility in Denmark, WI, designed to process food waste and agricultural manure into pipeline-quality RNG.

- Beyond RNG, the facility captures and monetizes environmental co-products, including carbon dioxide (sold as food-grade liquid CO2 or dry ice) and nutrient-rich residuals (digestate) suitable for use as fertilizer.

The Debtor’s vertically integrated anaerobic-digestion platform delivers low-carbon RNG and related environmental co-products by processing multiple waste streams. The platform serves industrial and transportation customers that substitute RNG for fossil gas, with emphasis on decarbonization programs in markets such as California.

NLC posted $10.4 million of revenue for FY 2024, down from $11.2 million in 2023. Gross margin contracted to 16.1% from 20.5% YoY. Despite the revenue and margin pressure, net loss narrowed to $14.5 million from $19 million. The improvement was driven by higher other income ($4 million vs. $0.3 million), lower other expenses ($13.2 million vs. $14.3 million), and reduced operating expenses ($6.9 million vs. $7.2 million).

- As of June 30, 2025, liquidity was limited with $1.5 million of cash and escrow and $6.8 million of current assets against $58.7 million of current liabilities, including $57.6 million of intercompany payables. Total assets measured $72.7 million versus $161.4 million of liabilities, leaving negative equity of $88.8 million.

NLC Energy Denmark LLC filed for Chapter 11 protection on August 16, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the Eastern District of Wisconsin.

Corporate History

NLC's journey traces back to 2008, when it was initially formed as NEW Organic Digestion LLC by individuals no longer associated with the company. This early iteration was a modest biogas developer operating a single anaerobic digester in Denmark, WI, producing electricity from local food waste.

Joint Venture and Early Expansion

- In 2016, NEW Organic Digestion joined forces with Bruce S. MacDonald and Douglas F. Blough, who created NLC Energy Venture 30, LLC (a wholly owned subsidiary of NLC Energy LLC). Together with Big Ox Energy, they launched NLC Energy-Big Ox LLC, a joint venture designed to drive business expansion.

- Nebraska Acquisition: The joint venture's first major step came in early 2016 with the acquisition of a troubled biogas plant in South Sioux City, NE. The facility was plagued by immediate operational issues, including sewer backups into nearby homes and environmental violations that later resulted in $1.8 million in settlements.

- In May 2019, the Nebraska plant was forced to shut down after a prolonged foam-over, triggered when a supplier switched to a high-fat slurry without notifying management. The facility stayed offline for several years.

- Denmark Expansion & UCal Contract: Concurrently, the JV prioritized a major expansion of the original Denmark, WI, facility into a large-scale RNG production hub.

- In August 2016, the company secured a critical 20-year off-take agreement with the University of California ("UCal") to purchase RNG, a deal instrumental in financing the expansion.

- Construction on the Denmark expansion commenced later than anticipated, with its scope expanding to include a pipeline interconnection to the TransCanada network and off-site gas collection stations.

- Following initial delays and UCal amendments⁽¹⁾ extending deadlines and reducing first-year delivery requirements, the facility reached mechanical completion by late 2017.

- Senior Secured Financing: On September 28, 2017, the Debtor closed on approximately $75.8 million in long-term financing through the issuance of 6.25% Series A1 and 7.75% Series A2 Senior Secured Notes to institutional investors. These notes were secured by first-priority liens on all Denmark assets, with Douglas Blough providing a conditional personal guaranty.

- Iowa Acquisition: In October 2018, the JV acquired another biogas digestion facility in Riceville, IA, for $3.2 million.

1) On Sep. 28, 2017, following Amendment 2 of the UCal contract, the JV’s holding company (NEW Organic Digestion Holdings) pledged 100% of its equity in the Debtor’s parent (NEW Organic Digestion Investors) to UCal, giving UCal the right to assume control of the Debtor upon default, subject to conditions.

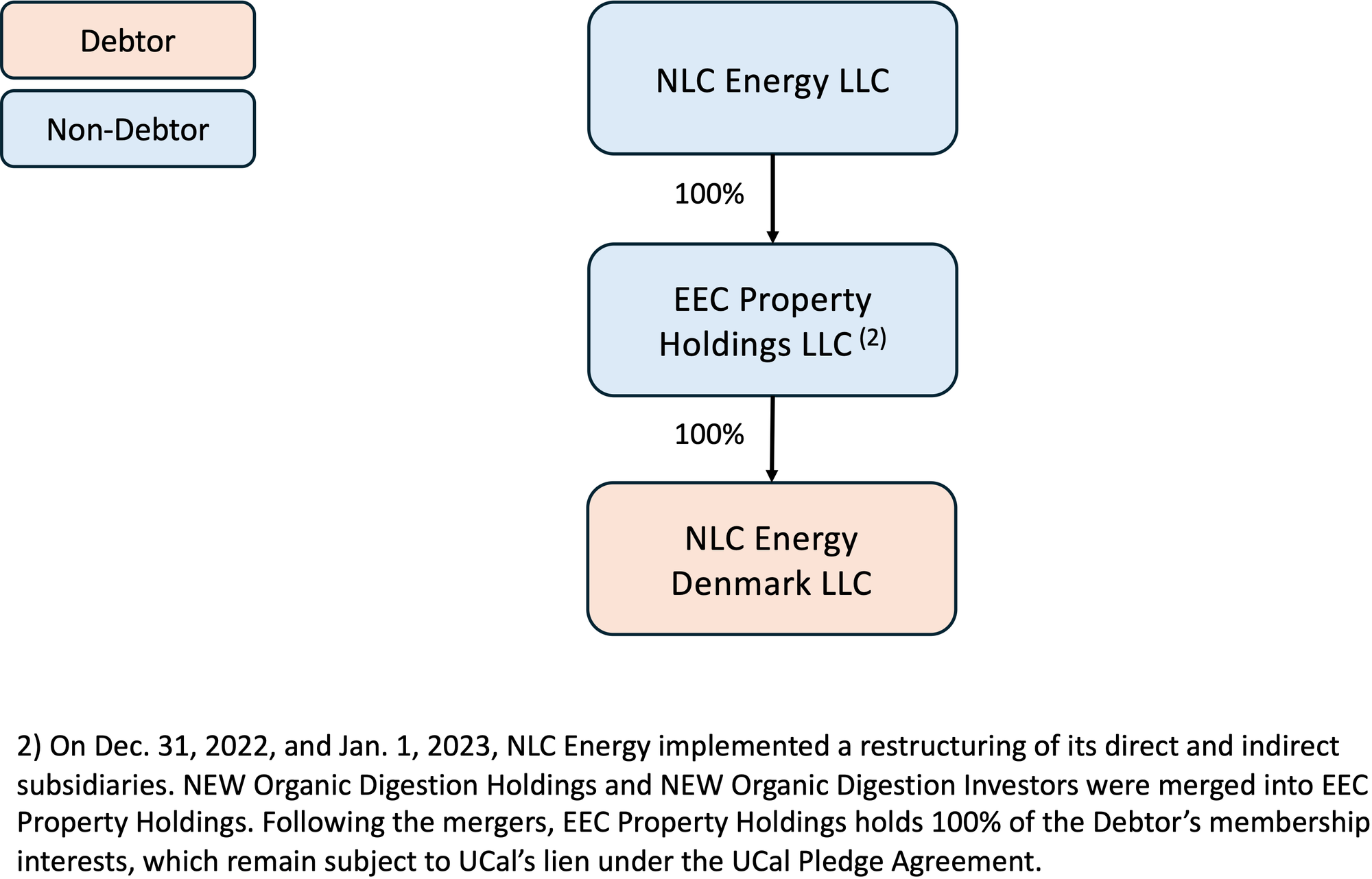

Corporate Organizational Structure

Operations Overview

NLC Energy Denmark LLC specializes in the conversion of organic waste into renewable natural gas (RNG) and valuable byproducts through anaerobic digestion at its flagship facility in Denmark, WI. This vertically-integrated operation processes both food waste (e.g., industrial food processing byproducts) and agricultural manure.

Key Products and Revenue Streams

- Biomethane (RNG): Pipeline-quality renewable natural gas, primarily sold under long-term contracts (historically with the University of California).

- Environmental Attributes: Monetization of carbon reduction credits, particularly high-value credits from manure-derived methane under California’s Low Carbon Fuel Standard.

- Co-products:

- Carbon Dioxide: Captured and sold as food-grade liquid CO2 or dry ice.

- Nutrient-rich Residuals: Usable as fertilizer.

- Tipping Fees: Revenue generated from accepting organic waste for disposal.

Facility Infrastructure and Capabilities

- The Denmark facility initially operated a single anaerobic digester, a wastewater storage tank, and a generator producing "green" electricity from biogas.

- A major expansion completed in 2017 added a second large digester, advanced feedstock mixing equipment, and gas upgrading systems essential for refining biogas into pipeline-quality RNG.

- This expansion included the construction of a dedicated pipeline connecting the plant to the TransCanada interstate pipeline network, alongside two off-site "decant" stations capable of accepting third-party biogas for injection.

- The facility's strategic location within Wisconsin’s dairy region and its established pipeline access provide significant advantages in the growing RNG sector.

Operational Dependencies and Management

- The success of NLC's operations is highly dependent on maintaining reliable waste input agreements with various regional partners, including food processors and farms. Feedstock quality management is critical, as demonstrated by a past incident at a sister facility involving high-fat waste.

- Wells Fargo Trust serves as the collateral trustee for NLC’s senior lenders, directly receiving all revenue from the UCal contract and applying it to debt service before any surplus is released to the Debtor. This cash management structure ensures lender control over cash flows.

- As of the Petition Date, the Denmark plant is staffed by approximately 32 employees.

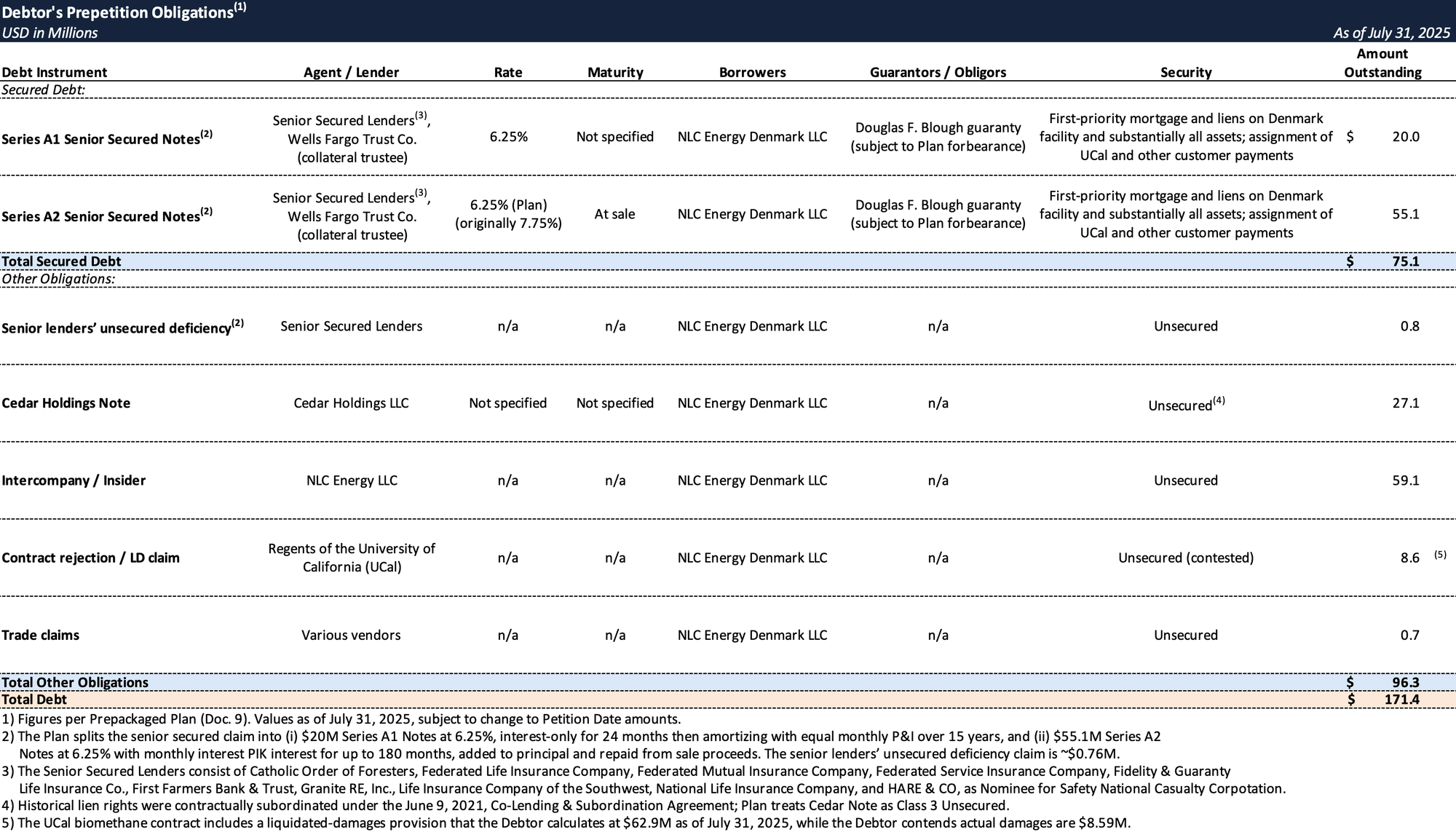

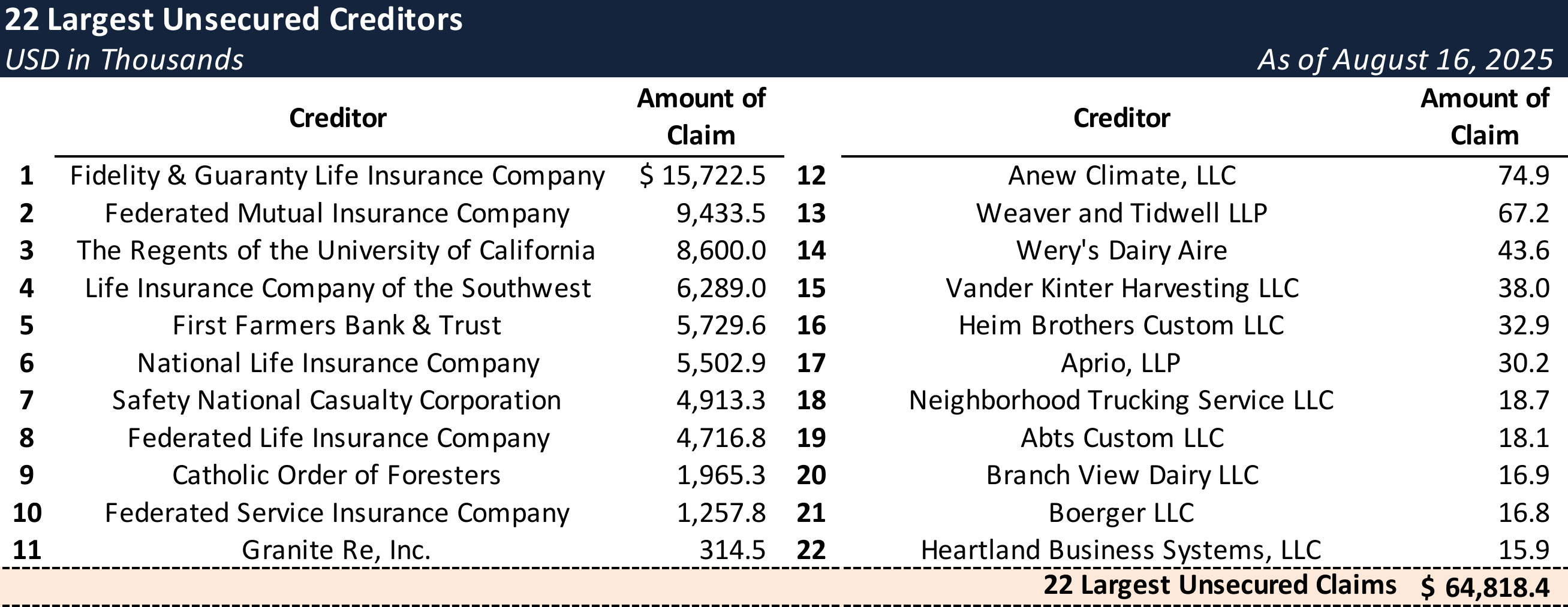

Prepetition Obligations

Top Unsecured Claims

Events Leading to Bankruptcy

Persistent Production Underperformance

- The Denmark facility expansion, completed in late 2017, failed to deliver projected biomethane volumes, with output "drastically underperforming projections." As a result, the facility was unable to meet minimum delivery obligations under its UCal contract or service the senior secured notes.

- To cover the shortfall, parent NLC Energy provided loans to sustain operations. Subsequent independent reviews concluded that the facility’s design capacity was structurally incapable of achieving the projected volumes.

Operational Strains & JV Dissolution

- By mid-2018, tensions between JV partners intensified, with Big Ox allegedly obstructing remediation efforts and restricting access to operating data. NLC Energy ceased funding operational deficits in September 2018, and the Denmark facility later shut down in 2019 after digestate storage reached capacity.

- NLC Energy resumed funding in July 2019, installing its own management by September. On July 31, 2020, the parties executed a Redemption Agreement, dissolving the JV and transferring 100% ownership of the Debtor and its assets to NLC Energy.

- The Debtor asserts Big Ox entities owe more than $8 million under reconciliation provisions, though recovery is unlikely.

Burdensome UCal Contract

- The UCal contract has long been priced below prevailing market rates, leaving the Debtor operating at a loss. In December 2020, the parties executed Transaction Confirmation #001A, which reduced required delivery volumes but also lowered price and imposed additional obligations:

- Operational Payment: Revenue-sharing on manure-based biomethane, though UCal purchases only food-waste gas.

- Annual True-Up: Payment of "lost Environmental Attribute Damages" for delivery shortfalls.

- Liquidated Damages: Six-year declining schedule tied to "Special Breach," beginning at $75 million. As of July 31, 2025, damages stood at $62.9 million. By comparison, Debtor’s biomethane advisor estimates actual damages at $8.6 million.

- The contract structure has driven continuing losses, with NLC Energy funding the Debtor at ~$1 million per month, or $59.1 million through the Petition Date. In 2022, the Debtor sought to raise contract pricing, but UCal rejected the request, citing the need for California State Legislature approval, which it described as nearly impossible.

Unsustainable Capital Structure

- The Debtor’s balance sheet is materially overlevered. In September 2017, it issued 6.25% Series A1 and 7.75% Series A2 Senior Secured Notes, secured by liens on the Denmark facility and substantially all assets. Approximately $75.8 million remains outstanding.

- In August 2020, the Debtor entered into a $12 million bridge note with Cedar Holdings to cure arrears on the Senior Secured Notes. No payments have been made, and the obligation has accreted to $24.4 million as of June 30, 2025.

- Cedar Holdings is controlled by insiders of the Debtor.

- An independent, lender-approved valuation conducted in 2025 pegged enterprise value at $10.3 million to $17.7 million, leaving the Senior Secured Lenders significantly undercollateralized.

Prepackaged Filing & Plan Terms

- Following lender discussions in February 2025, the Debtor pursued a prepackaged Chapter 11 filed on August 16, 2025. The Plan provides, in relevant part:

- Rejection of UCal Contract. The UCal agreement will be rejected; any rejection damages will be treated as general unsecured claims.

- Senior Secured Notes Restructuring. Class 1 secured claims will be bifurcated into:

- Series A1 ($20mm at 6.25%) — interest-only for 24 months, then equal monthly P&I amortized over 15 years; liens retained.

- Series A2 ($55mm at 6.25% PIK) — principal and accrued interest payable upon sale of the Denmark facility; liens retained.

- General Unsecured Treatment. $500,000 distribution pool for Class 3 unsecureds; ordinary trade claims < $250,000 are unimpaired.

- UCal Pledge Rights Preserved. UCal may exercise rights under the UCal Pledge Agreement to obtain all equity and control, subject to notice and conditions (including replacement guarantor); upon transfer, the case is dismissed.

- The plan requires active marketing of the Denmark facility within two months of the effective date, with Senior Secured Lenders involved in the process. Any sale remains subject to lender approval, but no deadline applies. Management may therefore continue operations until achieving a satisfactory price, avoiding a forced or "fire-sale" transaction.

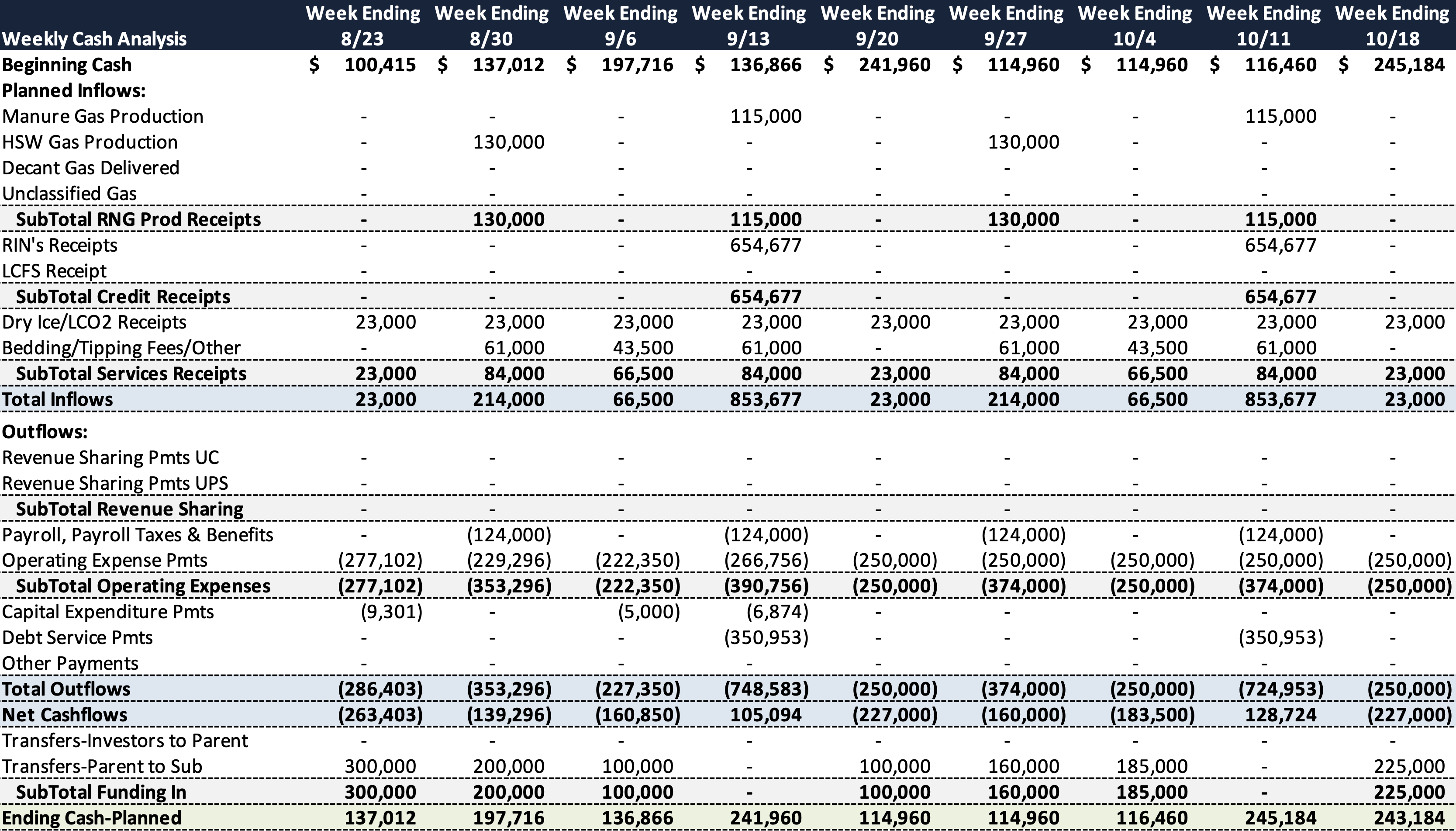

Cash Flow Projection (Aug. 23 – Oct. 18, 2025)

Supporting Materials

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.