Case Summary: The Container Store Chapter 11

The Container Store Group, Inc. has filed for Chapter 11 amid declining sales, securing $40 million in financing under a TSA backed by 90% of its term lenders.

Business Description

Headquartered in Coppell, TX, The Container Store Group, Inc. (“TCSG”), along with its Debtor and non-Debtor subsidiaries (collectively, the “Company”), operates as a specialty retailer offering organizing solutions, custom spaces, and in-home organizing services across the United States.

As of the Petition Date, the Company managed 104 retail stores across 34 states and the District of Columbia, with each store averaging approximately 24,000 square feet in size.

- These stores serve as key distribution points for its products and services.

In FY2023, TCSG reported total net sales of approximately $847.7 million.

- The TCS Segment and Elfa accounted for about 94.5% and 5.5% of such sales, respectively.

The Company was previously traded on the New York Stock Exchange (“NYSE”) under the ticker symbol “TCS”.

- On December 9, 2024, the NYSE suspended trading of TCSG's shares and initiated delisting proceedings as its average global market capitalization fell below the NYSE's minimum requirement of $15 million over a consecutive 30-day trading period.

As of the Petition Date, the Debtors reported $100-$500 million in assets and liabilities.

Corporate History

Founded in 1978 in Dallas, Texas, by Garrett Boone, Kip Tindell, and John Mullen, TCSG opened its first store to serve as a specialized provider of storage and organization solutions.

- In 1991, the Company expanded outside Texas with a store opening in Atlanta, GA.

Key Acquisitions and Digital Expansion

- In 1999, the Company acquired Elfa International, a leading manufacturer and distributor of drawer and shelving systems, expanding its capabilities as a retailer and manufacturer.

- The launch of containerstore.com in 2000 broadened the Company’s national reach, providing an e-commerce platform for its products.

Ownership and Public Offering

- In 2007, the Company was sold to TCSG (f/k/a TCS Holdings, Inc.), a majority-owned entity of Leonard Green & Partners, L.P. (“LGP”).

- The Company completed an initial public offering of its common stock in November 2013.

- At IPO, LGP held a majority controlling interest.

- LGP has since reduced its stake to below 50%.

Recent Milestones

- In 2019, a second distribution center was opened in Aberdeen, MD, to optimize logistical operations.

- The Company surpassed $1 billion in operational sales in FY2021.

- Its 100th retail store was opened in Princeton, NJ, in 2023.

Operations Overview

TCSG provides a range of merchandise and services centered on custom spaces, organizing solutions, and in-home services. Its operations are divided into two main product segments:

- TCS Segment:

- Custom Spaces: Branded product lines include Elfa Classic, Elfa Décor+, Elfa Garage+, and the Preston system. These offerings are complemented by in-home design and professional installation services.

- General Merchandise: Features over 10,000 storage and organization products designed to complement Custom Spaces solutions.

- Elfa Segment:

- Operates as a wholly owned Swedish subsidiary that designs and manufactures products for the TCS Segment and supplies other retailers globally.

Supply Chain and Manufacturing

- In FY2023, the Company sourced 47% of its products domestically and 53% internationally, with a significant proportion sourced from China.

- Distribution operations are supported by two facilities located in Coppell, TX, and Aberdeen, MD, while manufacturing is based in Elmhurst, IL.

Retail and E-Commerce

- Retail channels include both physical stores and online platforms, with options such as free shipping, curbside pickup, and same-day delivery available in select regions.

- For FY2023, ~28% of sales revenue was generated online.

Workforce

- TCSG employs approximately 3,800 individuals, with 2,900 working directly in retail store locations.

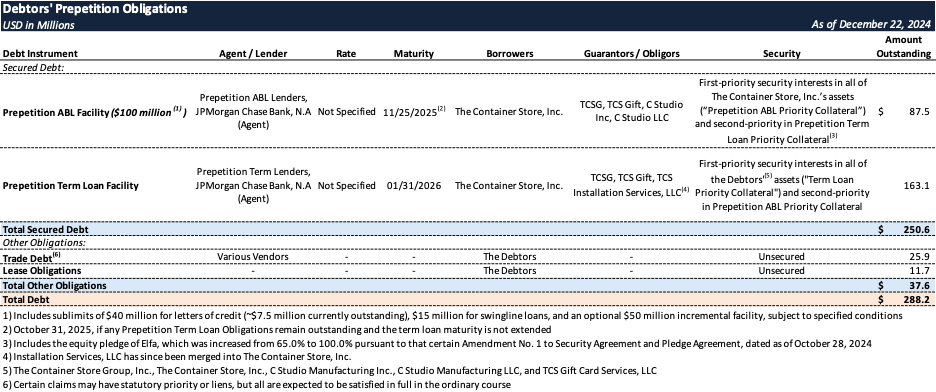

Prepetition Obligations

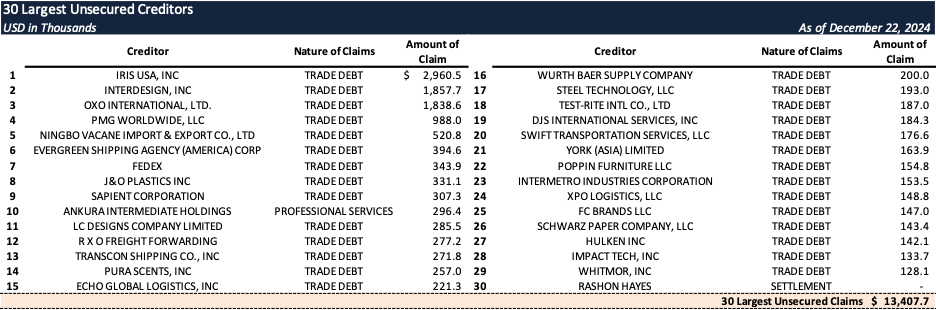

Top Unsecured Claims

Events Leading to Bankruptcy

Challenging Retail Environment and Operational Decline

- The persistently challenging retail environment, characterized by reduced consumer spending in the storage and organization category, increased price sensitivity, fewer home sales, and intensified competition, significantly impacted the Company’s performance from its peak in 2021.

- These challenges contributed to a 10.5% YoY decline in revenue and a 77.1% decline in adjusted EBITDA for the fiscal quarter ending September 28, 2024.

- Increased interest expenses and looming debt maturities further exacerbated financial strain.

Strategic Alternatives Review

- In response to declining performance, the Board initiated a formal Strategic Alternatives Review process, evaluating options such as the sale of the Company, new equity investments, or refinancing of its Prepetition Credit Facilities.

- As part of this effort, the Transaction Committee engaged JPMorgan Chase & Co. as a financial advisor. JPMorgan conducted an extensive marketing process, reaching out to approximately 40 strategic investors and 26 financial sponsors.

- Of the 20 parties that signed NDAs, five submitted non-binding proposals, but only one—Beyond, Inc.—offered to make a strategic investment through a preferred equity transaction.

- In October 2024, Beyond announced it would invest $40 million in the Company as part of the strategic partnership.

- Subsequently, the transaction did not materialize as TCSG was unable to secure financing on terms deemed commercially acceptable to Beyond.

- Simultaneously, an ad hoc group of Prepetition Term Lenders (the “Ad Hoc Group”) organized to address the Company’s deteriorating financial position and explore financing options when it became unlikely that the sale process would yield a sale of the entire Company and repay the Company’s debt in full.

- The Company also engaged Houlihan Lokey, Inc. in September 2024 to work with the Ad Hoc Group and explore standalone financing options.

Declining Performance and Liquidity Pressures

- The Company’s financial performance worsened during the Summer and Fall of 2024, marked by:

- A 10.5% YoY decline in consolidated net sales to $196.6 million for the quarter ending September 28, 2024.

- A $16.1 million consolidated net loss for the same period, compared to a $23.7 million net loss in the prior year.

- Adjusted EBITDA of $3.9 million—a 91.8% decrease from its peak of $47.7 million in FY 2021.

- Liquidity pressures mounted due to:

- Increased borrowings under the Prepetition ABL Facility in anticipation of the holiday season.

- A 15.4% YoY increase in consolidated net interest expenses, reaching $6.0 million in the Q2 FY2024.

- Vendor pressure caused by strained credit relationships and credit rating downgrades by S&P in March 2024 and Moody’s in November 2024, further constraining liquidity and inventory levels.

Efforts to Address Covenant Defaults and Maturing Obligations

- Unable to comply with the consolidated leverage ratio covenant under the Prepetition Term Loan Credit Agreement for Q2 FY2024, the Company negotiated Amendment No. 9 to the Prepetition Term Loan Facility on October 8, 2024:

- Waiving the leverage ratio covenant testing for Q2 FY2024.

- Introducing a requirement to secure qualified financing by November 15, 2024 (subsequently extended to December 31, 2024).

- Restricting the Company’s ability to incur additional debt or engage in certain non-ordinary course transactions.

Failed Financing and Liquidity Challenges

- Despite sustained efforts, negotiations with Beyond, Inc., and the Ad Hoc Group did not yield a financing proposal acceptable to all parties. Beyond ultimately declined to proceed with the proposed investment.

- The Company faced additional challenges:

- Imminent debt maturities, including the springing maturity of the Prepetition ABL Facility on October 31, 2025, and the Prepetition Term Loan Facility on January 31, 2026.

- The risk of defaulting on its obligations as early as June 2025 if it failed to secure an unqualified audit opinion for FY2024 financial statements.

Formation of the Restructuring Committee and Entry into Transaction Support Agreement

- On December 4, 2024, the Board established a Restructuring Committee to oversee negotiations related to potential restructuring transactions, including financing, sale, reorganization, and recapitalization efforts.

- Based on the Restructuring Committee’s guidance and advisor consultation, the Company concluded that:

- It lacked sufficient liquidity to operate beyond January 2025 without new capital and a restructured balance sheet.

- Iterative negotiations with stakeholders culminated in the execution of a Transaction Support Agreement (“TSA”) with 90% of its term lenders on December 21, 2024.

Key Provisions of the TSA

- Financing and Capital Structure Enhancements:

- $40 million in additional financing through a DIP-to-Exit Term Loan Facility, which will convert into committed exit financing upon plan confirmation.

- Refinancing of the Prepetition ABL Facility with a replacement DIP-to-Exit ABL Facility, providing incremental liquidity and borrowing capacity.

- Equitization of a significant portion of the Prepetition Term Loan Obligations.

- Treatment of Creditors:

- Full payment or satisfaction of general unsecured claims—including vendors, service providers, and employees—in the ordinary course of business.

- Equity Distribution and Participation:

- Prepetition Term Lenders to receive residual equity in the reorganized company, after accounting for the DIP Equity Premium and Management Incentive Plan.

- Lenders offered pro rata participation in the $40 million superpriority DIP-to-Exit Term Loan Facility, ensuring no lender is prejudiced by the terms.

Enjoyed this summary? Stay informed on new Chapter 11 filings over $10 million in liabilities—subscribe to Bondoro for free and get insights delivered directly to your inbox.

Plus, explore our full archive for all past summaries.