Case Summary: US Magnesium Chapter 11

US Magnesium has filed for Chapter 11 bankruptcy to facilitate a sale of its shuttered operations, after a catastrophic equipment failure and a lithium market collapse triggered a massive legal judgment and an existential lease dispute with the State of Utah.

Business Description

US Magnesium LLC ("USM" or the "Company") is the sole producer of primary magnesium metal in the United States and a nascent producer of lithium carbonate. Headquartered at its sprawling metallurgical and chemical facility in Rowley, UT, on the western shore of the Great Salt Lake, the Company has historically been North America’s largest supplier of primary magnesium, a critical material for the aerospace, automotive, and defense industries.

- The Company’s integrated operations leverage an approximately 80,000-acre network of solar evaporation ponds to extract and concentrate magnesium chloride-rich brine from the lake.

- In addition to high-purity magnesium, USM’s facility produces chemical co-products, including chlorine gas, hydrochloric acid, and other industrial salts.

- Seeking to diversify, USM developed a proprietary process to produce battery-grade lithium carbonate from its magnesium process byproducts, capitalizing on its existing infrastructure and waste streams.

Prior to idling its primary operations, USM had an annual production capacity of approximately 63,500 metric tons of magnesium and 9,000 metric tons of lithium carbonate. However, a catastrophic equipment failure halted magnesium output in late 2021, and a subsequent collapse in lithium market prices forced the suspension of its new lithium operations in late 2024.

As of the Petition Date, the Company employed 22 full-time and 2 part-time workers and was limited to selling dust suppressants, de-icing products, and sodium chloride from existing stocks.

US Magnesium LLC filed for Chapter 11 protection on September 10, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the District of Delaware, reporting $100 million to $500 million in both assets and liabilities.

Corporate History

The Company’s origins trace back to 1972, when the magnesium production facility was constructed by National Lead, Inc. The plant has since operated under several different owners and corporate structures.

- In 1979, the facility was acquired by AMAX Inc. and operated as AMAX Magnesium Corp.

- In 1989, an affiliate of The Renco Group, Inc. ("Renco") purchased the operation, renaming it Magnesium Corporation of America ("MagCorp"). Renco, a private holding company led by businessman Ira Rennert, gained 100% ownership of MagCorp by 1993.

Reorganization and Renco Ownership

- Amid financial and environmental challenges, MagCorp filed for Chapter 11 protection in 2001.

- In 2002, US Magnesium LLC was formed as a new Renco-backed entity to acquire substantially all of MagCorp’s assets out of bankruptcy and continue operations at the Rowley site. USM has since been wholly owned by Renco.

- Over the last decade, Renco has provided more than $400 million in financial support to USM through a combination of loans, equity infusions, and credit support to cover operating losses and capital expenditures.

Governance and Prepetition Restructuring

- USM is organized as a manager-managed Delaware LLC, led by President Ron Thayer since 2012.

- In August 2025, in anticipation of a restructuring, the Company appointed Shaun Martin as an independent manager to oversee potential transactions involving Renco and mitigate any conflicts of interest.

Operations Overview

USM’s operations are centered on two primary product lines: primary magnesium and, more recently, lithium carbonate. The Company leverages its strategic location on the Great Salt Lake, which provides a vast and effectively renewable source of mineral-rich brine.

Magnesium Production

- Process: The production cycle begins by pumping lake brine into a vast system of solar evaporation ponds, where the sun concentrates magnesium chloride levels. This concentrated brine undergoes chemical purification before being fed into electrolytic furnaces, where molten magnesium metal is separated from chlorine gas. The magnesium is then cast into high-purity ingots.

- Market & Competition: USM’s magnesium is used in aluminum alloys, titanium production, and steel manufacturing. However, the Company has faced intense and sustained pricing pressure from low-cost Chinese producers, which eroded its margins and market share over the last decade.

- Production Halt: Magnesium operations have been completely idle since late 2021 following a catastrophic failure of gas turbine generators essential to the production process. The shutdown was exacerbated by COVID-19-related supply chain disruptions that hindered repairs, ultimately leading USM to mothball the entire production line.

Lithium Initiative

- Development: In 2019, responding to rising demand for battery materials, USM launched a project to extract lithium from the waste tailings of its magnesium operations. The Company developed a proprietary process to convert this historical waste into high-purity, battery-grade lithium carbonate.

- Operations and Market Headwinds: While the technology proved viable, the lithium venture faced significant challenges:

- Market Volatility: A global supply glut caused lithium carbonate prices to crash by approximately 80% from their 2022 peak, rendering USM’s production uneconomical just as it came online.

- High Costs: As a first-of-its-kind process, production costs were high. Planned upgrades to implement more efficient Direct Lithium Extraction (DLE) technology were stalled by a lack of capital.

- Regulatory Uncertainty: The State of Utah raised questions regarding USM’s rights to extract lithium under its existing mineral lease, creating legal and operational risks.

- Suspension: Faced with a collapsing market and high costs, USM suspended lithium production and, in late 2024, laid off 186 employees (85% of its workforce) citing the dramatic downturn in lithium prices.

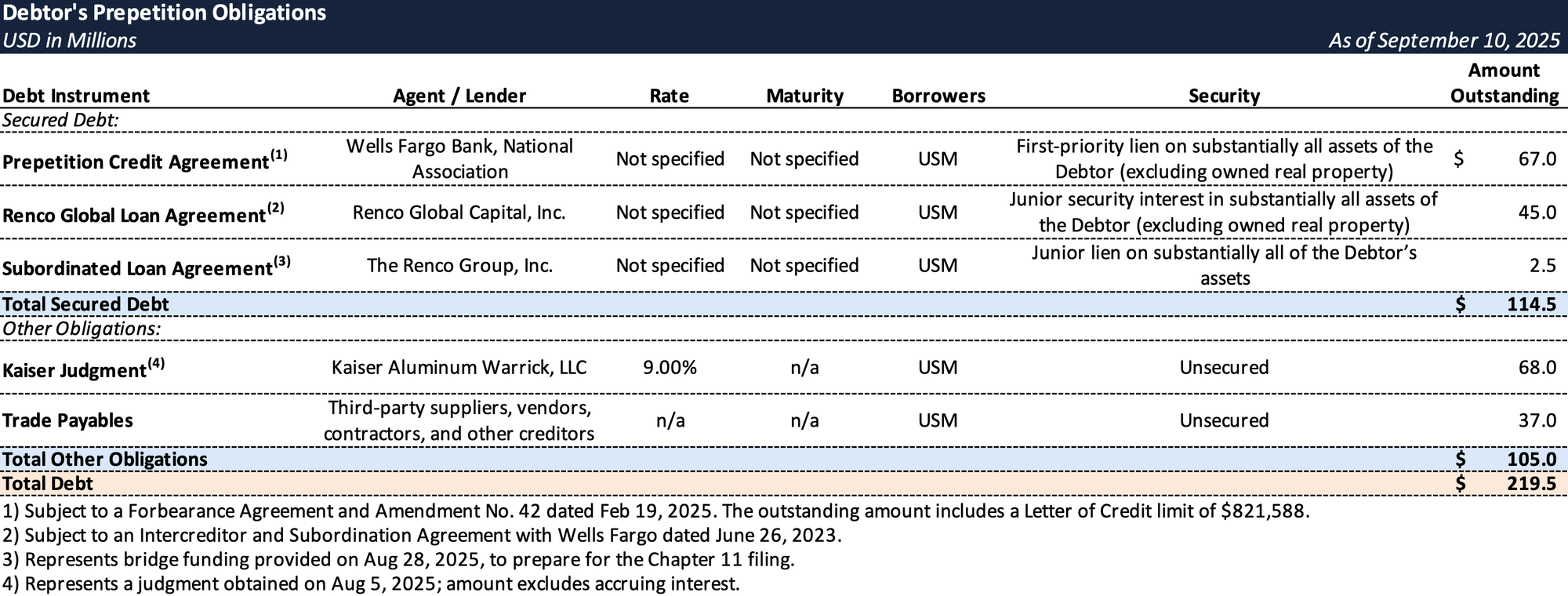

Prepetition Obligations

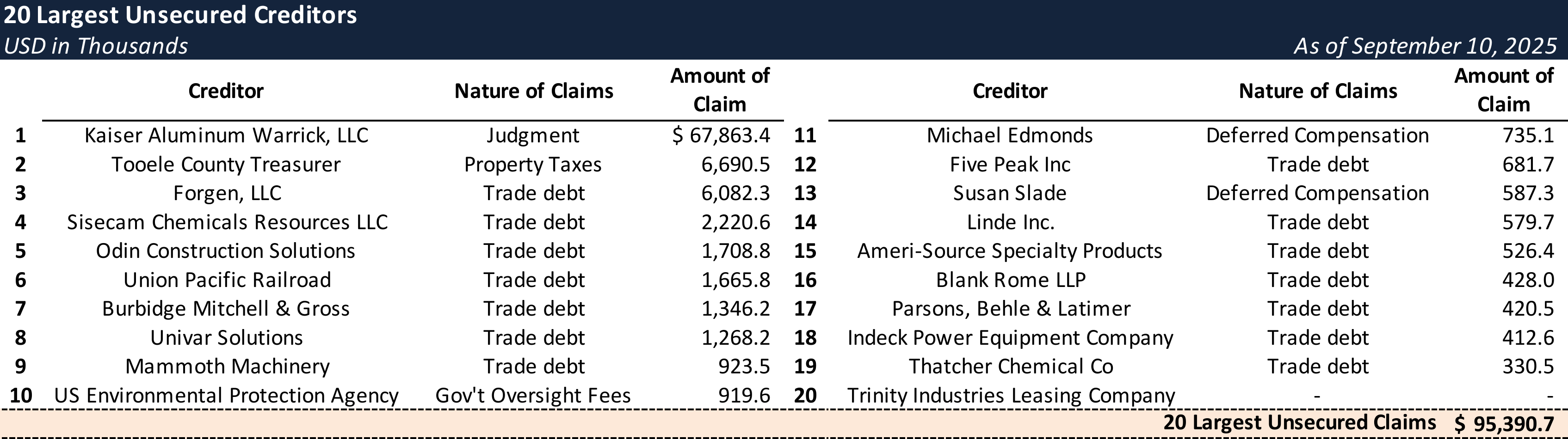

Top Unsecured Claims

Events Leading to Bankruptcy

USM's path to Chapter 11 was driven by a convergence of severe market pressures, a critical operational failure, mounting financial strain, and escalating regulatory conflicts that rendered its business untenable.

Market Downturn and Operational Crisis

- Sustained Market Pressures: For years, USM struggled with depressed magnesium prices due to low-cost Chinese imports and the 2016 loss of a key adjacent customer, Allegheny Technologies Inc. (ATI), which significantly reduced sales volumes.

- Failed Diversification: The Company's strategic pivot to lithium was ill-timed, as a market crash occurred just as its high-cost, initial-phase production began, turning a potential profit center into another source of significant losses.

- Catastrophic Equipment Failure: In September 2021, a critical equipment breakdown forced an immediate and complete halt to magnesium production. Unable to fulfill supply contracts, the Company declared a force majeure event.

- This shutdown led to a breach-of-contract lawsuit from a key customer, Kaiser Aluminum Warrick LLC, which culminated in a $68 million judgment against USM in August 2025.

Escalating Environmental and Regulatory Conflicts

- EPA Consent Decree: A 2021 consent decree with the U.S. Environmental Protection Agency (EPA) mandated costly environmental remediation projects. By 2024, USM’s liquidity crisis left it unable to fund the required work, leading the EPA to issue a Notice of Noncompliance.

- Utah State Lease Battle: The Company’s relationship with the State of Utah deteriorated significantly, leading to a high-stakes dispute over its foundational mineral lease.

- In December 2024, Utah’s Division of Forestry, Fire & State Lands (FFSL) moved to terminate USM’s lease, alleging multiple breaches, including unpaid royalties, unauthorized pledging of the lease as collateral, and other environmental violations.

- After a brief, court-ordered receivership was vacated, settlement talks between USM and the state collapsed in August 2025.

- According to The Salt Lake Tribune, Utah FFSL plans to hold an administrative hearing in late September 2025 to consider canceling US Magnesium’s lease.

Chapter 11 Filing and Restructuring Path

- USM filed for Chapter 11 protection on September 10, 2025 in the U.S. Bankruptcy Court for the District of Delaware

- On September 12, 2025, the court granted interim approval for the Company’s DIP financing facility from prepetition lender Wells Fargo. The facility provides for up to $10.8 million in new-money term loans and includes a dollar-for-dollar roll-up of up to $10 million of prepetition obligations. The new-money portion consists of:

- A $5 million Tranche A DIP Term Loan;

- A $5 million Tranche B DIP Term Loan, in which the Debtor’s sole equity owner, Renco Group, Inc., holds a 100% participation interest; and

- An approximately $821,588 letter of credit subfacility under Tranche A.

- The Company is pursuing the sale process with a stalking horse asset purchase agreement from LiMag Holdings, LLC, an affiliate of Renco. The bid consideration is structured as a credit bid and the assumption of key liabilities, including:

- A credit bid of Renco’s 100% participation interests in the prepetition Term Loan C and the new Tranche B DIP Term Loans.

- Assumption of all remaining obligations under the prepetition credit agreement and DIP agreement owed to Wells Fargo.

- Assumption of obligations under the Renco Global Credit Agreement and the Subordinated Loan Agreement.

- Assumption of obligations related to the Company’s defined benefit pension plan and the EPA Consent Decree.

- Pursuant to the proposed bidding procedures, the sale timeline includes a bid deadline of October 24, 2025, an auction, if necessary, on October 31, 2025, and a sale hearing on or before November 7, 2025.

Key Parties

- Gellert Seitz Busenkell & Brown, LLC (counsel); Carl Marks LLC (financial advisor / CRO, Ron Mayo); SSG Advisors, LLC (investment banker); Stretto, Inc. (claims agent).

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.